Traders Brief - Negative Sentiment May Spillover on KLCI

HLInvest

Publish date: Thu, 01 Aug 2019, 09:38 AM

MARKET REVIEW

Asia’s equities ended lower as investors were trading cautiously prior to the FOMC meeting outcome, where market participants were expecting that the Fed to cut a quarter points. In addition, China’s official manufacturing PMI came in at 49.7 in July (contracted for the third straight month) has weighed on the stock markets. The Shanghai Composite Index and Nikkei 225 dropped 0.67% and 0.86%, respectively, while Hang Seng Index declined 1.31% (ended early for the session due to issuance of Typhoon Signal No. 8).

Similarly, stocks on the local front traded mostly in the negative territory; the FBM KLCI closed 0.48% lower to 1,634.87 pts. Market breadth was negative with 603 decliners vs. 259 advancers, accompanied by 2.75bn shares traded for the session worth RM2.75bn. Nevertheless, selected stocks related to technology and automation such as ISTONE and GREATEC traded actively higher.

Despite having a 25 basis-point cut in the FOMC meeting, Wall Street ended lower as the Fed dampened hopes for further rate cut potential this year with Jerome Powell commenting in a news conference that central bank’s interest rate cut move was just a “mid-cycle adjustment”, indicating that further rate cuts this year are not a sure thing, providing less aggressive stance on the interest rate cut. The Dow and S&P500 declined 1.23% and 1.09%, respectively.

TECHNICAL OUTLOOK: KLCI

The KLCI extended its pullback phase and the MACD Line is hovering below zero. Despite both the RSI and Stochastic oscillators are in the oversold region, we expect the upside for today will be limited, given the negative performance on overnight Wall Street. The KLCI’s resistance is envisaged around 1,658, while support is pegged around 1,620.

Following the negative tone in the US, we expect the soft market sentiment may spillover towards stocks on the local front. Market participants will be focusing on the developments from the resumption of US-China trade talks this week. Also, traders may look out for trading opportunities within the O&G as crude oil prices steadied above USD65. For the KLCI, it may extend its pullback phase below the immediate resistance of 1,658.

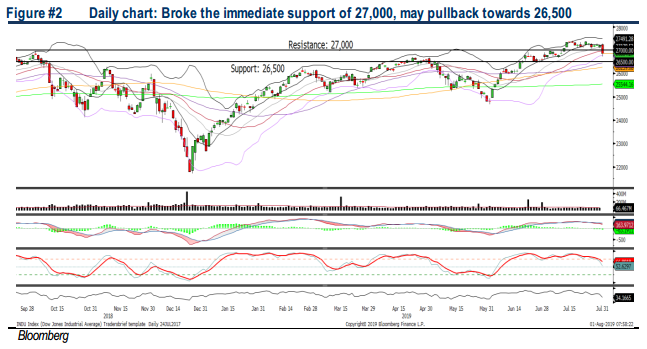

TECHNICAL OUTLOOK: DOW JONES

The Dow has violated below the immediate support of 27,000 after the FOMC meeting and the MACD indicator continues to trend lower. Meanwhile, both the RSI and Stochastic oscillators are on the declining mode as well. Hence, with the weaker technical readings, we expect further downside to be seen on the Dow towards support of 26,500. On the flip side, the resistance will be located around 27,000.

With the expectation of further interest rate cut later this year has faded, we believe the recent rally that has been driven by the rate cut expectation may take a breather and upside of the Dow will be capped along 27,400. Hence, all eyes will be on the developments of the trade talks between the US and China as well as the ongoing US reporting season for now. The Dow’s trading range will be located around 26,500-27,000

Source: Hong Leong Investment Bank Research - 1 Aug 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024