Traders Brief - Further Downside Amid Heightened Trade War and Geopolitical Risks

HLInvest

Publish date: Tue, 13 Aug 2019, 10:00 AM

MARKET REVIEW

After a tumultuous week driven by trade and currency wars fears, Asian bourses inched up in quiet trades as markets in Japan, India, Malaysia, Thailand and Singapore were closed for public holidays. Meanwhile, SHCOMP rebounded 1.45% after plunging 3.25% WoW amid news that Beijing will support its capital markets by relaxing margin financing due to lingering trade worries. Having said that, overall sentiment remained cautious amid persistent HK clashes and protracted trade war concern as Trump said on last Friday he was not ready to make a deal with China and even called a September round of trade talks into question.

Meanwhile, Bursa Malaysia was closed yesterday in conjunction with Hari Raya haji holiday. Last Friday, KLCI eased 1-pt to end 11.7 pts lower WoW at 1615.1 amid lingering trade war fears and expectations of a tepid Aug reporting season. Market breadth was positive with 447 gainers as compared to 354 losers but trading volume decreased to 1.97bn shares worth RM1.55bn as compared to Thursday’s 2.12bn shares worth RM1.52bn.

Wall Street slumped in a broad sell-off whilst bonds and gold prices rallied as simmering geopolitical tensions spooked investors and the protracted US-China trade war stoked fears of impending recession. Confidence was also dampened by mounting political confrontations in HK and warnings from China of a potential military response as well as plummeting Argentine’s Peso after President Mauricio Macri’s primary election defeat.

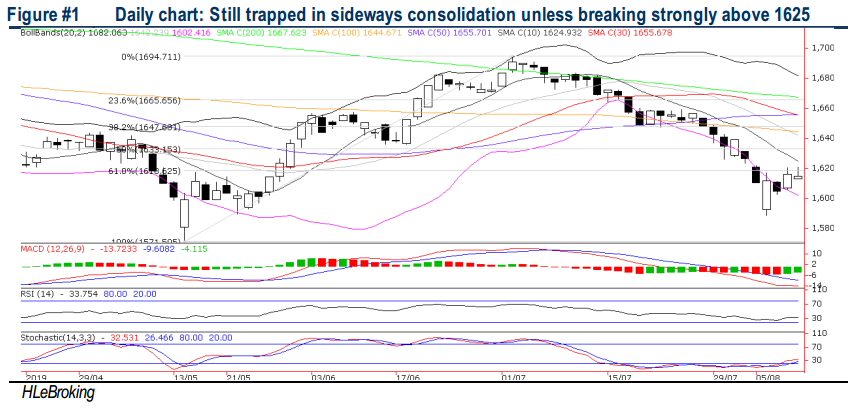

TECHNICAL OUTLOOK: KLCI

The KLCI managed to rebound higher to end at 1615 after hitting a weekly low of 1589 on 6 Aug amid sustained buying interest and the MACD Histogram recovered mildly. Meanwhile, both the RSI and Stochastic oscillators are recovering after threading along the oversold region over the past few weeks. We maintain that KLCI could still undergo an extended consolidation unless it is able to overcome strongly above immediate 10D SMA resistance at 1625, and subsequently 1633 (50% FR). Conversely, should the index further below 1600, the outlook could turn bearish with potential slide towards 1589, followed by 1572 (14 May low).

Given the lingering external headwinds such as heightened US-China trade tension, rising geopolitical tensions in India/Pakistan, Japan/South Korea and US/Iran, coupled with expectations of a tepid Aug reporting season, KLCI is expected to trend sideways within 1600- 1633 band in the short term. Meanwhile, local sentiment would also be dampened by key concerns e.g. policy reforms, leadership transition in Malaysia, and potential outcomes from the review on Malaysia’s position in the World Government Bond Index (WGBI) in early Sep.

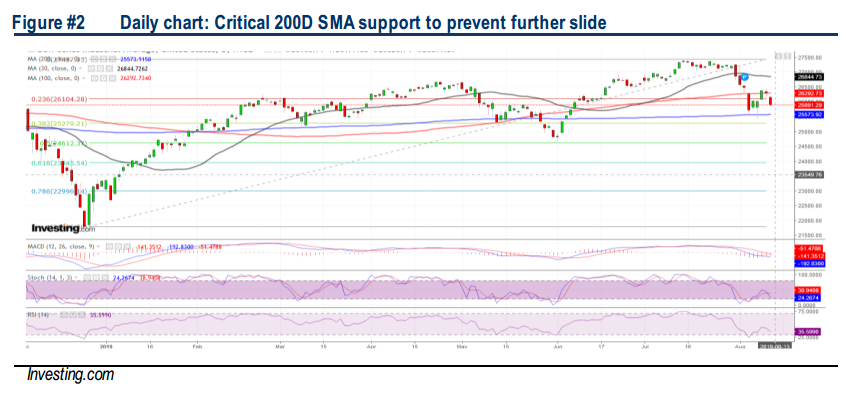

TECHNICAL OUTLOOK: DOW JONES

The Dow continued to trade lower after violating the 30D/100D SMAs supports. The MACD indicator trended lower and both the RSI and Stochastic oscillators are signalling further weakening momentum. A decisive violation below immediate SMA200 support around 25570 will accelerate further downside risks towards 25200/25000 levels. Formidable resistances are situated at 26100/26300/26800 zones.

In the US, Wall Street sentiment is likely to remain sluggish following recessionary fears warnings by Goldman Sachs and Morgan Stanley as investors are watching closely on the trade war and currency developments following Yuan weakened above CNY7.00/USD threshold and the plummeting Argentine Peso. Meanwhile, the escalating HK tension, which could lead to greater intervention by mainland Chinese authorities, poses a risk to the Asian region due to its major financial status and could have spill over implications to Europe and the US.

TECHNICAL TRACKER: CLOSED POSITION

We took profit on HSSEB (10.8% return) on 9 Aug after hitting RM1.03 (R2). On the other hand, we also decided to square off our newly recommended GENM following the unexpected Chapter 11 bankruptcy filing by Empire Resorts (0.3% loss).

Source: Hong Leong Investment Bank Research - 13 Aug 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024