Traders Brief - Rebound in Store Amid Partial Tariffs Delay

HLInvest

Publish date: Wed, 14 Aug 2019, 09:29 AM

MARKET REVIEW

Asia’s stock markets ended on a negative pulled out of risky assets such as equities into safe haven assets amid the potential slowing global economic outlook, the US and China trade war as well as growing worries over protest in Hong Kong. Shanghai Composite Index and Hang Seng Index dropped 0.63% and 2.10%, respectively, while Nikkei 225 lost 1.11%. Meanwhile, the Chinese yuan is trading above the 7 yuan psychological level.

Similarly, stocks on the local front traded mostly in the negative region, contributing to the negative broader market (744 decliners vs. 173 advancers); the FBM KLCI was dragged below the 1,600 psychological at 1,592.88 pts led by Genting related stocks and banking heavyweights. Nevertheless, most of the Hang Seng Index put warrants topped the gainers list as investors were speculating further downside move in the equities markets.

Wall Street rallied strongly as US decided to delay tariffs on a wide variety of the Chinese goods, splitting the USD300bn worth of goods from China into two stages. While some products from the list will still continue to be imposed with the 10% tariffs on 1st Sept, about USD160bn goods including smartphone, laptop, children toys’ and etc will be subjected to tariffs from 15th Dec onwards. The Dow and S&P500 soared 1.44% and 1.48%, respectively, while Nasdaq advanced 1.95%.

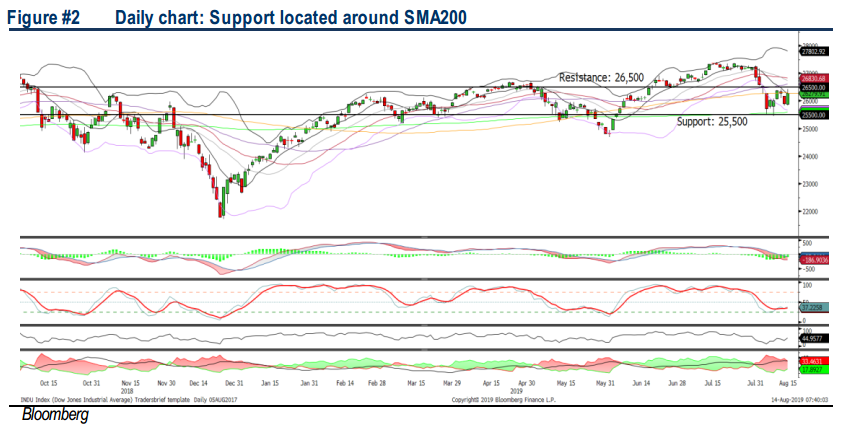

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has retested below the 1,600 level for another session within the span of 5 trading days. The MACD indicator has expanded negatively below the zero level. Nevertheless, the RSI and Stochastic oscillator are oversold and the DMI- in the ADX indicator is extremely negative and suggests that the KLCI could be due for a technical rebound. Resistance will be set around 1,620-1,640, while support will be located around 1,580.

With the relief rebound on Wall Street after the US Trade Representative’s (USTR) Office announced the decision of delaying tariffs on selected Chinese products, we expect the feel good sentiment could spillover towards stocks on the local front and the FBM KLCI may reclaim above the 1,600 psychological level. Also, technology sector is likely to anticipate an increase in trading activities on the back of this announcement. However, the upside could be limited with the unresolved geopolitical tensions in Hong Kong.

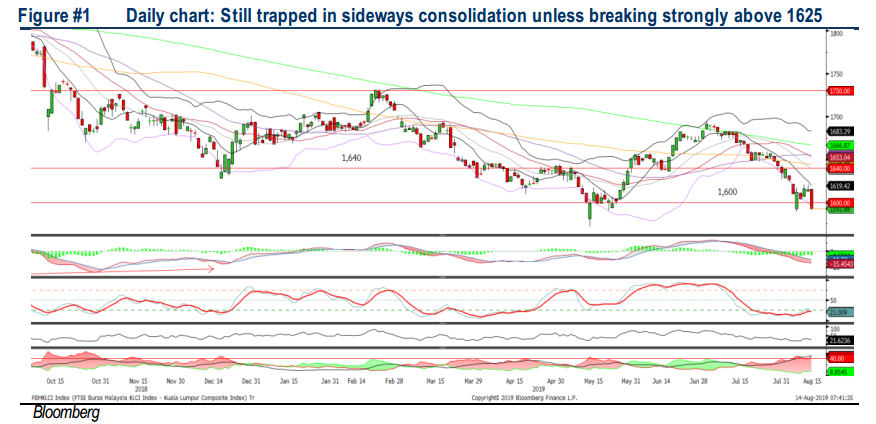

TECHNICAL OUTLOOK: DOW JONES

The Dow revisited above the 26,000 level amid the trade optimism and tariffs delay on selected products. The MACD indicator is still in the negative region. The RSI and Stochastic oscillators are recovering from the oversold region. With the improving technicals we expect the Dow to sustain its technical rebound towards the resistance of 26,500, with the support located around 25,500 (SMA200).

Given the delay of tariffs on selected Christmas season products such as the electronic gadgets, buying interest could sustain over the near term on Wall Street. Also, optimism on the trade discussion has reignited as Vice Premier Liu He agreed with USTR Robert Lighthizer and Treasury Secretary Steven Mnuchin to speak again by phone within the next two weeks and both the US and Chinese officials may still meet in early September as scheduled.

Source: Hong Leong Investment Bank Research - 14 Aug 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024