Traders Brief - Yield Curve Worries May Send Stocks Lower

HLInvest

Publish date: Thu, 15 Aug 2019, 09:47 AM

MARKET REVIEW

Asia’s stock market gained momentum especially amongst Apple’s suppliers, which traded higher following the US President Trump’s administration announced tariffs on selected electronics products from China will be delayed till December. The Shanghai Composite Index and Hang Seng Index rose 0.42% and 0.08%, while Nikkei 225 advanced 0.98%.

Similarly, on the local front, the FBM KLCI was support and closing marginally higher above the 1,600 psychological level at 1,600.31 pts (+0.47%) led by rebound in most of the index heavyweights. Market breadth was positive with 450 gainers vs. 319 losers, accompanied by 2.41bn (worth RM1.65bn) shares traded for the day. Also, we noticed immigration related stocks such as HTPADU, SCICOM and DSONIC trended positively throughout the session.

Wall Street declined sharply after the yield spread between the 10Y and 2Y bond yield dipped below the zero level briefly, forming the inverted yield curve phenomenon with investors taking this signal as a potential slowing global economy warning. In addition, the Germany 2Q19 GDP slipped into the negative region and weaker-than-expected China industrial output data (4.8% YoY, slowest in 17-years) contributing to the bearish trading tone. The Dow and S&P500 plunged 3.05% and 2.93%, respectively, while Nasdaq dived 3.02%.

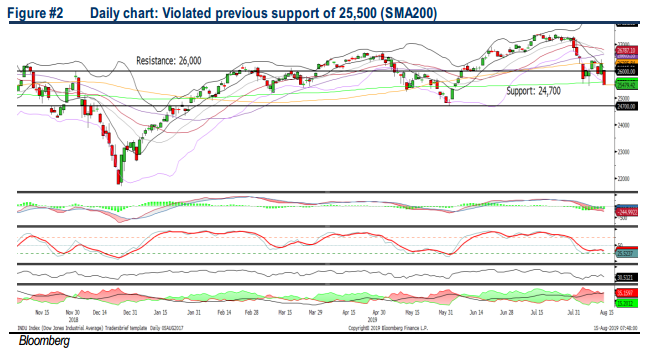

TECHNICAL OUTLOOK: KLCI

After the sharp plunge on the KLCI on Tuesday, the key index rebounded to close above 1,600 and the MACD indicator recovered mildly (albeit hovering below zero). The RSI and Stochastic oscillators are recovering above the oversold region. With the mildly improving indicators, we expect KLCI to perform a short term technical rebound, with the resistance located around 1,620-1,640. Support will be set along 1,572.

Given the inverted yield curve signal, which led to a sharp decline on Wall Street, we opine that the selling pressure is likely to spillover towards stocks on the local front especially the banking stocks and the FBM KLCI could revisit the immediate support around 1,572. Nevertheless, traders may look into short term opportunities within internal catalyst such as ECRL or immigration tenders over the near term.

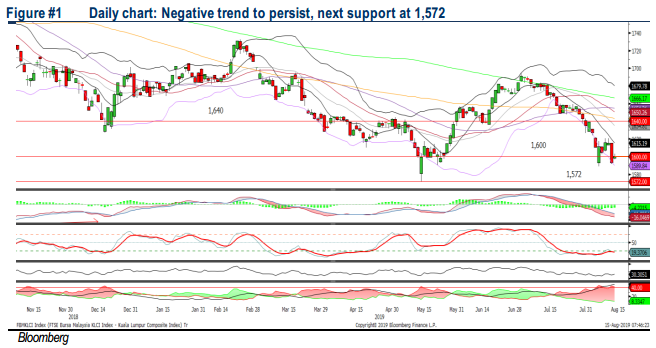

TECHNICAL OUTLOOK: DOW JONES

The Dow has violated below the previous SMA200 support near the 25,500 level. The MACD indicator expanded negatively below zero, while both the RSI and Stochastic oscillators trended lower after recovering from the oversold region. Hence, with the negative bias amongst the indicators, we think the Dow may continue in its current pullback trend towards 24,700-25,000. Meanwhile, resistance will be set along 25,500-26,000.

With the ongoing unresolved trade tensions between the US and China, sentiment has worsened with recession warnings from the inverted yield curve and investors are further reducing their exposure on equities and rushing for safe haven assets (gold, USD and Japanese yen). Hence, Wall Street is likely to undergo further selling pressure if the trade tensions and inversion of yield curve persist over the near term; the Dow could trend lower towards 24,700-25,000.

TECHNICAL OUTLOOK: DOW JONES

Yesterday, We Took Profit on HTPADU (20.9% Return) and DSONIC (15.2% Return).

Source: Hong Leong Investment Bank Research - 15 Aug 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024