Traders Brief - Slight Rebound, But Upside Likely to be Limited

HLInvest

Publish date: Fri, 16 Aug 2019, 10:15 AM

MARKET REVIEW

Following the yield curve spread (10Y vs. 2Y) dipping briefly below the zero level, selling pressure intensified on Wall Street and spill over to Asia’s equities at the opening bell, but we noticed bargain hunting activities quickly emerged throughout the Asian trading hours. The Shanghai Composite Index (+0.25%) and Hang Seng Index (0.76%) reversed all their earlier losses and trended into the positive region for the session despite the ongoing protest in Hong Kong, while Nikkei 225 declined 1.21%.

Tracking the regional rebound, the FBM KLCI managed to regain momentum after opening near to 20 points down; the key index recouped most of the losses and closed flat near 1,600.29 pts (-0.02 pts). Market breadth was negative with decliners leading advancers by a ratio of 3-to-1, accompanied by 1.94bn shares traded, valued at RM1.85bn. Nevertheless, immigration stocks SCICOM and HTPADU are fairly focused for the day.

Wall Street ended mixed after a sharp decline on Wednesday amid a brief violation of the yield spread between the 10Y and 2Y bond yield below the zero level, forming an inverted yield curve (which market participants viewed it as a potential slowing economic indicator). The Dow and S&P500 rebounded 0.39% and 0.25%, respectively, but Nasdaq slipped 0.09%. Meanwhile, upbeat retail sales data has lifted the mood marginally for the day.

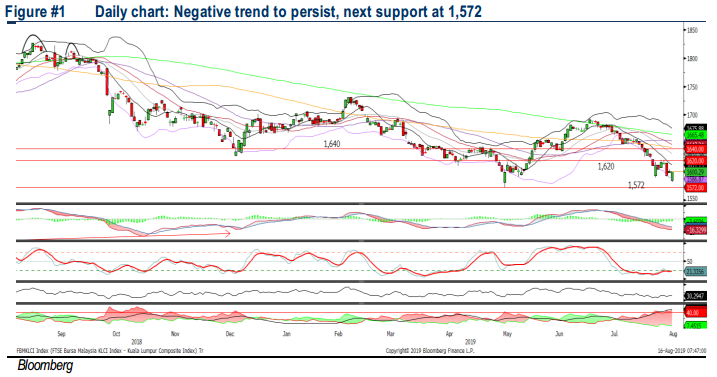

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded strongly throughout the day, recovering from an intraday low of 1,581.26 pts, forming a bullish green candle. However, the MACD indicator stayed flattish below zero. Meanwhile, both the RSI and Stochastic oscillators are recovering below 50. We believe the key index could be due for further technical rebound with a stiff resistance located around 1,620. The support is pegged around 1,572-1,580.

Given the strong bargain hunting activities on index heavyweights, which lifted the KLCI near to 20 points yesterday, this buying interest could sustain with the less -negative market environment today. We should expect more trading interest amongst bashed down stocks within the construction and technology stocks. The FBM KLCI’s range for today is set around 1,580-1,620 for today.

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded marginally above the SMA200 level after a sharp decline on Wednesday. The MACD Indicator however is still trending below the zero. Also, both the RSI and Stochastic oscillators are threading below 50; suggesting that the momentum is still weak at this juncture. Should there be any rebound on the Dow, the upside is likely to be capped around 26,000. Support is pegged at 25,000.

With the minor rebound on Wall Street and less negative news headlines, we expect the market to stabilise for this week and US equities may maintain its mild rebound momentum. However, the upside is likely to be capped at least until the resumption of the trade discussion between the US and China by early September. Hence, the trading range of the Dow is likely to be seen around 25,000-25,500.

TECHNICAL TRACKER: CLOSED POSITION

Yesterday, We Took Profit on SCICOM (9.7% Return).

TECHNICAL TRACKER: HSL

A strong proxy to Sarawak’s growth. In anticipation of higher project flows in Sarawak prior to the next state elections (must be held before Sep 2021), HSL is deemed as a major beneficiary of Sarawak’s robust infrastructure spending, as evident by its decent YTD new job wins of RM481m (FY18:RM142m). HSL is eyeing further contracts in the state as funding could be available from Sarawak’s solid state reserves (c.RM31bn). Valuations are not pricey at 10x FY20 P/E and 0.93 P/B, supported by its outstanding order book of ~RM2.5b (3 years visibility). Technically, the stock is ripe for a rebound towards RM1.39-1.55 zones, pending a decisive breakout above downtrend line at RM1.35.

Source: Hong Leong Investment Bank Research - 16 Aug 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024