Traders Brief - Cautiously Optimistic Ahead of Reporting Season

HLInvest

Publish date: Wed, 21 Aug 2019, 09:18 AM

MARKET REVIEW

Regional benchmark equities ended mixed as the PBOC started its new mechanism for the new loan prime rates which would result in cheaper borrowing costs for companies under the protracted trade war environment. Also, Reserve Bank of Australia's July meeting minutes indicated that the central bank would consider on further easing measures if needed to support sustainable growth in the economy. The Shanghai Composite Index and Hang Seng Index fell 0.11% and 0.23%, respectively, but Nikkei rose 0.55%.

Meanwhile, the FBM KLCI (+0.39% to 1,602.75 pts) managed to surpass the 1,600 level as buying interest emerged on banking heavyweights especially in CIMB, which rose 2.8% to RM5.18. However, market breadth was negative with 400 losers as compared to 369 gainers, accompanied by 2.06bn, valued at RM1.73bn for the session. Nevertheless, we observed that power- and utilities-related stocks such as JAKS and MFCB traded actively higher.

Wall Street closed in the negative territory amid profit taking activities following the slight drop in 10Y Treasury yield (-3.2% to 1.555%), where reignited the recession worries and snapping the gains of the recent technical rebound. The Dow and S&P500 declined 0.66% and 0.79%, respectively, while Nasdaq down 0.68%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has surged above 1,600 psychological level and the MACD indicator has formed a rounding bottom, recovering mildly below the zero level. Both the RSI and Stochastic oscillators are rebounding from the oversold position. Hence, we expect further rebound on the key index towards 1,620. Meanwhile, support will be pegged around 1,572-1,580.

On the local bourse, we believe the technical rebound may still sustain given the KLCI is grossly oversold suggested by the momentum indicators. Also, investors could be looking out for opportunities within the bashed down technology stocks ahead of its respective financial results by end-Aug. The KLCI is likely higher towards 1,620 over the near term.

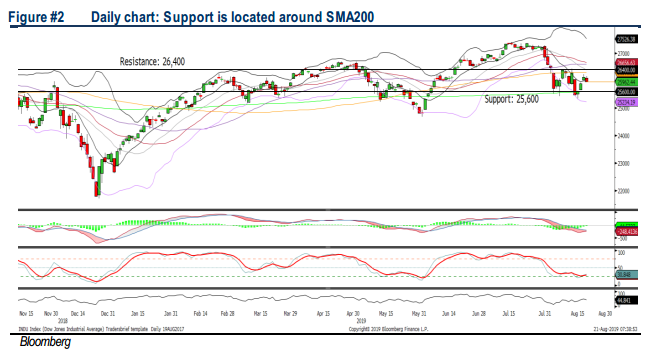

TECHNICAL OUTLOOK: DOW JONES

The Dow experienced a slight pullback after claiming above 26,000 level. The MACD Indicator is improving, while both the RSI and Stochastic oscillators are trending higher (out from the oversold region earlier). With the improving technicals, the Dow’s near term downside risk is likely to be limited. Meanwhile, the resistance will be pegged around 26,400.

The unresolved trade tensions between the US and China, coupled with the emergence of recession fears following the declining move in Treasury yields recently are likely to dampen the market sentiment, limiting the upside potential of the markets eventually. Also, investors are focusing on the upcoming FOMC meeting minutes to gauge the future interest rate outlook for the rest of the year.

TECHNICAL TRACKER: AWC

Solid order book and balance sheet to cushion adversity. We like AWC’s asset management business model for its: (i) substantial order book c.RM1.1bn (providing about four years earnings visibility), (ii) healthy balance sheet (net cash of 13.8sen), (iii) positive growth in the Total Building Solutions industry, (iv) reputable clientele (mainly from Malaysia, Singapore and Middle East) with a high chance of securing future tenders. Valuations are undemanding at 6.7x FY20 P/E (46% below its peers and 35% below its 10Y mean of 10.3x), supported by strong earning CAGR of 17% from FY18-21. Ex-cash, valuation is even more compelling at 5.4x. Although share prices could see mild pullback following yesterday 9.2% rally, a decisive LT downtrend line breakout above RM0.72 could see a potential downtrend reversal, targeting higher upsides at RM0.74-0.85 zones.

Source: Hong Leong Investment Bank Research - 21 Aug 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024