Traders Brief - Time for a Rebound

HLInvest

Publish date: Tue, 27 Aug 2019, 09:58 AM

MARKET REVIEW

Spooked by a series of trade war events, where Beijing unveiled new tariffs on USD75bn worth of US goods and tweets from Donald Trump last week, commenting that US will hike tariffs on USD250bn worth of Chinese goods to 30% (from 25%), trade tension intensified and Asia’s stock markets ended negatively. Shanghai Composite Index and Hang Seng Index declined 1.17% and 1.91%, respectively, while Nikkei 225 lost 2.17%.

Similarly, stocks on the local front were mostly in red and KLCI fell 0.55% to 1,600.53 pts . Market breadth was negative with decliners led advancers by a ratio of 3-to-1. Market volume stood at 2.21bn shares traded for the day, valued at RM1.81bn. Most of the Hang Seng Index warrants are traded actively for the session amid escalating trade tension.

Following a series of reciprocal actions from both the US and China, which caused the increase in market volatility, President Trump commented to reporters during the G7 meeting that China will be restarting trade talks very soon after a phone call on Sunday. The Dow and S&P500 rebounded 1.05% and 1.10%, respectively, while Nasdaq rose 1.32%.

TECHNICAL OUTLOOK: KLCI

Still, the FBM KLCI has been stabilising and building a base along the 1,572-1,580 levels. The MACD Line continues to recover above the Signal Line, despite hovering in the negative region. Both the RSI and Stochastic oscillators are trending towards 50 after recovering above the oversold region last week. Hence, with the improving technicals, we expect the FBM KLCI to rebound higher towards 1,620, while support will be anchored around 1,572-1,580.

Tracking the Wall Street overnight rebound following positive comments from President Trump, we may anticipate bargain hunting interest to emerge on the local bourse. The FBM KLCI that has briefly closed above the 1,600 psychological level may see further upside towards 1,620. Traders could focus on stocks within the technology sector for short term trading opportunity amid slight up tilt in the trade optimism.

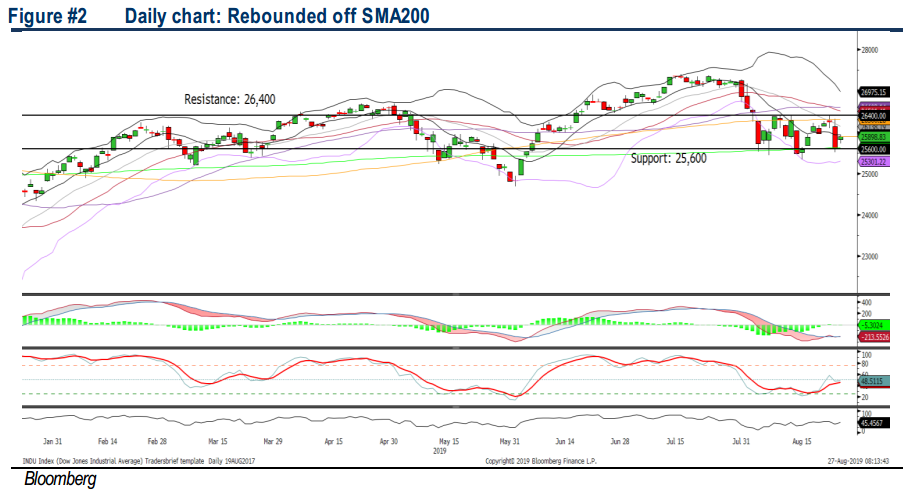

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded off the SMA200 level for the fourth time over the past 3 weeks. The MACD is recovering from the negative territory, while both the RSI and Stochastic are trending nearer to the 50 level. With the technical indicators pointing higher for the session, we believe the Dow may trend higher, retesting the 26,400 over the near term. Support will be set around 25,600.

On Wall Street, we opine it will be headlines-driven markets, focusing on President Trump’s tweets and China’s reply on the trade front. Hence, should there be any restart of trade talks in the near term, it may suggest further upside on the Dow at least hovering above the SMA200 for the near term. The Dow’s trading range will be within the 25,600-26,400.

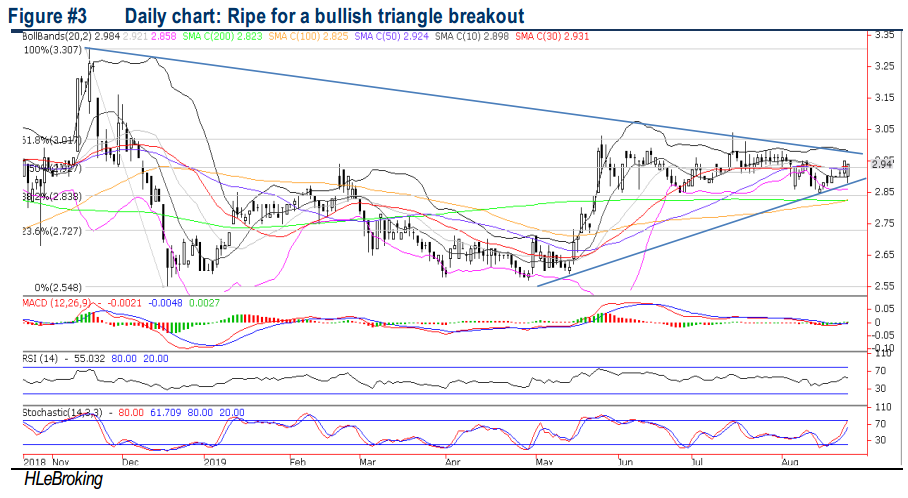

TECHNICAL TRACKER: LIIHEN

Solid fundamentals and balance sheet. Apart from the weak ringgit climate, we like LIIHEN for its healthy dividend yield (5.6% for FY19-21) and current net cash/share of 54.8 sen or 18.6% to share price as well as cheap valuation of 6.9x FY20 P/E (Ex-cash PE of 5.6x). Moreover, bright outlook in the global furniture market (Global Furniture industry expects a 5.2% CAGR for 2019-2023) and its fruitful diversification to upholstery products as well as growing trade diversion from unresolved US-China trade war should enhance stable earnings growth. Technically, the stock is ripe for a triangle breakout soon to lift prices higher towards RM3.13-3.31 levels.

Source: Hong Leong Investment Bank Research - 27 Aug 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024