LII Hen Industries - Solid Fundamentals and Balance Sheet

HLInvest

Publish date: Tue, 27 Aug 2019, 09:59 AM

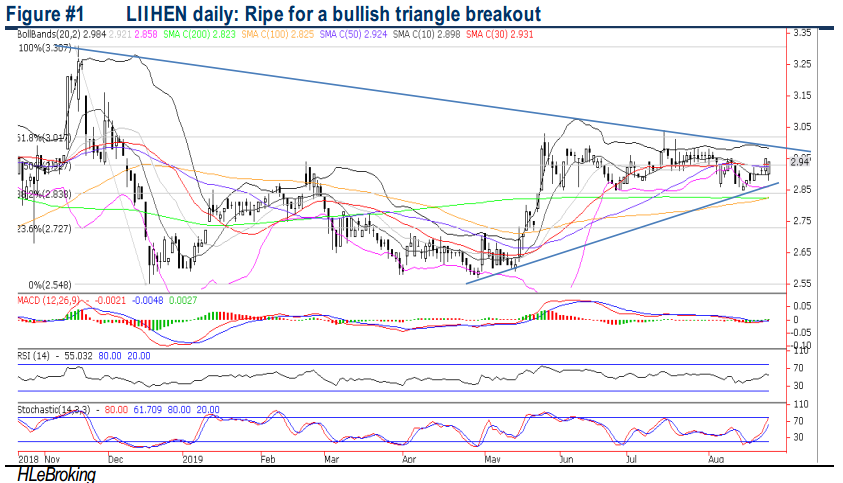

Apart from the weak ringgit climate, we like LIIHEN for its healthy dividend yield (5.6% for FY19-21) and current net cash/share of 54.8 sen or 18.6% to share price as well as cheap valuation of 6.9x FY20 P/E (Ex-cash PE of 5.6x). Moreover, bright outlook in the global furniture market (Global Furniture industry expects a 5.2% CAGR for 2019-2023) and its fruitful diversification to upholstery products as well as growing trade diversion from unresolved US China trade war should enhance stable earnings growth. Technically, the stock is ripe for a triangle breakout soon to lift prices higher towards RM3.13-3.31 levels.

Ripe for a bullish triangle breakout. LIIHEN has been trading in range bound mode within 3.04 (15 July high) and RM2.85 (26 June low) band in the last three months. In our view, the stock is poised for a triangle breakout soon, with share prices closed above key SMAs and supported by upticks in technical indicators. A successful breakout above RM2.96 (downtrend line) will push share prices towards RM3.04 and RM3.13 (76.4% FR) barriers before reaching our LT objective of 52W high at RM3.31 (21 Nov 2018). Key supports are RM2.85 and RM2.80. Cut loss at RM2.78.RM2.99.

Source: Hong Leong Investment Bank Research - 27 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024