Traders Brief - Mixed Trading Tone Prior to US-China Talks

HLInvest

Publish date: Fri, 20 Sep 2019, 09:35 AM

MARKET REVIEW

Asian markets edged higher after Fed cut rates by 25 bps to 1.75-2.00%, a move that was widely expected. Although the Fed appeared divided on further actions for the year, the risk is skewed to another rate cut before end 2019, as part of the “insurance cut” amid sluggish global economy. Meanwhile, China stocks closed higher on Thursday amid rising speculation that Beijing will lower a key domestic rate today to help bolster the economy.

In view of an overnight Wall Street mixed performance and rotational selling pressures from index-linked stocks such as IHH, GENM, SIME, SIMEPLT and HLFG, KLCI was traded within a tight range at intraday high of 1599.17 and a low of 1592.65 before easing 3.2 pts to 1596.3. Trading volume rose to 2.3bn shares worth RM1.5bn as compared to Wednesday’s 1.98bn shares worth RM1.6bn. Market breadth was negative with 362 gainers against 464 losers.

The Dow gave up a 125-pt rally as investors checked their optimism on renewed U.S.-China trade talks. The benchmark index lost 52 pts at 27095 amid uncertainty over whether the Fed will cut rates again in coming Oct 29-30 and Dec 10-11 meetings and after Trump advisor Michael Pillsbury warned that US is ready to escalate the trade war if a deal is not struck soon. Chinese and American officials began face-to-face meeting yesterday, in preparing for high level talks in early October.

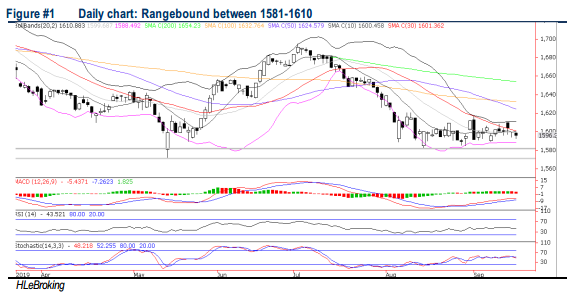

TECHNICAL OUTLOOK: KLCI

In the near term, KLCI is expected to trade in range bound mode between the 1571-1610 levels. The MACD indicator is hovering below zero, while both RSI and Stochastic oscillators are hooking down below 50, we believe the KLCI may trade sideways to downward bias tone. The support will be set around 1581 (15 Aug low) and 1572 (14 May low), while the resistance is pegged at 1610 (upper BB) and 1624 (SMA 50).

Range bound trade within 1571-1610 should persist given volatility in global oil prices due to increased geopolitical risks in the Middle East and upcoming US-China trade talks in October. On the local front, sentiment would stay cautious ahead of the FTSE Russell’s World Government Bond Index (WGBI) review of Malaysia bonds on 26 Sep and the tabling on Budget 2020 on 11 Oct.

TECHNICAL OUTLOOK: DOW JONES

The Dow jumped as much as 125 pts yesterday to 27272 but surrendered the gains and ended 52 pts lower at 27095. The MACD, RSI and Stochastic indicators are showing signs of lethargy. Hence, the uptrend move on the Dow could be limited around 27400-27500. Meanwhile, key supports are anchored around 27000 and 26800 zones.

In the short term, the Dow is likely to move in range bound mode (26800-27400 zones) as investors digest the divided views on the next course of actions by the Fed in the Oct 30-31 and Dec 10-11 FOMC meetings. In addition, traders will be shifting their attention towards the crucial US-China trade negotiation in early October as well as the upcoming US 3Q19 reporting season in mid Oct (consensus is predicting the S&P 500 earnings to decline 4.8% yoy from a flat performance in Q1 and Q2).

Source: Hong Leong Investment Bank Research - 20 Sept 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024