Traders Brief - KLCI May be Supported Along Support (1572-1580)

HLInvest

Publish date: Thu, 26 Sep 2019, 09:32 AM

MARKET REVIEW

Asia’s stock markets ended broadly lower after some negative developments in the US political scene, where the House Speaker Nancy Pelosi announced a formal impeachment inquiry into President Donald Trump. Also, investors were trading cautiously ahead of the trade discussion that will take place in the next few weeks; the Shanghai Composite Index and Hang Seng Index lost 1.00% and 1.28%, respectively, while Nikkei 225 fell 0.36%.

Similarly, stocks on the local front suffered another round of selling pressure in line with the regional markets amid uncertainties in the US politics and trade front; the FBM KLCI traded lower by 0.17% to 1,588.58 pts. Market breadth was negative with 528 losers vs. 278 gainers, accompanied by 2.20bn shares traded worth RM1.62bn. Nevertheless, selected construction related stocks such as Gamuda and CMSB were traded actively higher for the day.

Wall Street closed higher following a comment from President Trump, stating that a US-China trade deal could arrive earlier than expected. Market tone also rebounded after a rough transcript of President Trump’s call with Ukrainian President Volodymyr Zelensky was released by the White House. The Dow and S&P500 gained 0.61% and 0.62%, respectively, while Nasdaq increased 1.05%.

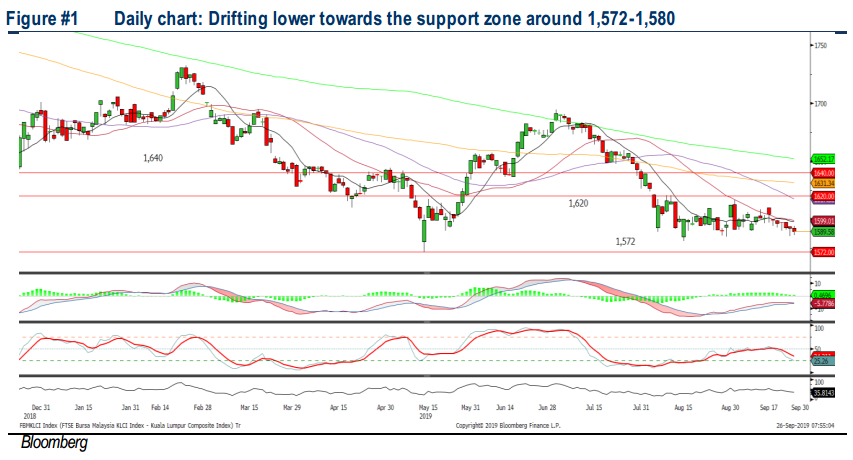

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has drifted lower for the fourth day and the MACD Histogram has contracted over the past few sessions. Both the RSI and Stochastic oscillators are still hovering below 50. With the negative technical readings, we expect the KLCI’s upside to be limited (if any technical rebound). The resistance is pegged around 1,600, followed by 1,620. Support is located around 1,572-1,580.

Given that Wall Street has formed a technical rebound, we think it may spillover towards stocks on the local front in the near term, supporting the KLCI slightly above the 1,572-1,580 levels. Nevertheless, should there be any strong rebound, we think the upside may be limited as investors will trade on a cautious tone ahead of the WGBI review later today and the upcoming Budget 2020 that will be held on 11 Oct. KLCI’s trading range will be located around 1,580-1,600 for today.

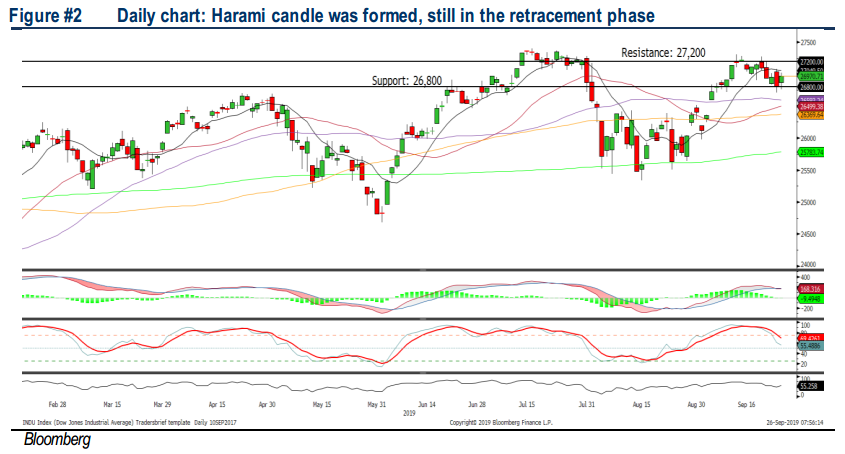

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded off the 26,800 level forming a ‘harami’ candle, but still hovering within the retracement phase. The MACD Line is below the Signal Line, while both the RSI (above 50) and Stochastic (below 50) are having mixed signals. Hence, we opine that the Dow may extend its consolidation phase within the 26,800-27,200 for now.

On Wall Street, the political uncertainty may cloud the trading tone for the near term amid the impeachment process on President Trump, which we believe it will increase the market volatility. At the same time, investors will be looking forward and trade on a cautious tone ahead of the upcoming trade talks between the US and China in October. Hence, we think the Dow may trade range bound within the 26,800-27,200 levels.

Source: Hong Leong Investment Bank Research - 26 Sept 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024