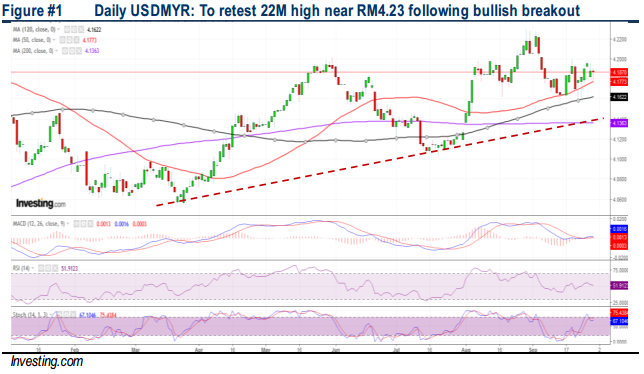

USDMYR - RM Softness May Persist Towards RM4.23-4.28 Levels

HLInvest

Publish date: Tue, 01 Oct 2019, 11:13 AM

In wake of the prevailing risk-off sentiment, the appetite on dollar assets has strengthened, as worries that negotiations between the US-China on 10-11 Oct will not lead to a “complete” trade deal, possibility of a no-deal Brexit, excessive financial market volatility and lingering geopolitical tensions, coupled with deepening political turmoil in the US after the start of an impeachment inquiry into Trump. On RM outlook, despite abating risk of WGBI exclusion for now (pending further review in March 2020), the greenback strength and BNM’s easing bias (HLIB forecast a 25bps OPR cut within the next 6 months and keeps a 4.15-4.20 range/USD), USDMYR is expected to move alongside USDCNY (also on weakening tone) towards RM4.23-4.28 territory in the next 3-6 months (technical view). Given the weak ringgit undertone, we reckon that export plays could return. HLIB top picks are Top Glove (BUY: TP RM5.31, DY: 2.3%) and Lii Hen (BUY: TP RM4.22, DY: 5.3%).

Still weakening bias towards RM4.23-4.28 zones. After strengthening 1.5% briefly from 22M high of RM4.23 (29 Aug) to RM4.167 (13 Sep low), ringgit (vs USD) eased 0.5% again to close at RM4.189 yesterday to hold firmly above 120D/200D SMAs. This together with the with a bullish weekly symmetric triangle formation bode well for further ringgit depreciation towards RM4.21 (daily high BB) and RM4.23 zones before heading towards LT objective at RM4.28 (monthly high BB). On a flip side, a decisive violation below RM4.162 (120D SMA) and RM4.136 (200D SMA) levels would augur well for the currency to recover at RM4.104 (19 July low) territory.

Source: Hong Leong Investment Bank Research - 1 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024