Alliance Bank - Ripe for a Technical Rebound Amid Compelling Valuations and Attractive Dividend Yields

HLInvest

Publish date: Thu, 10 Oct 2019, 08:54 AM

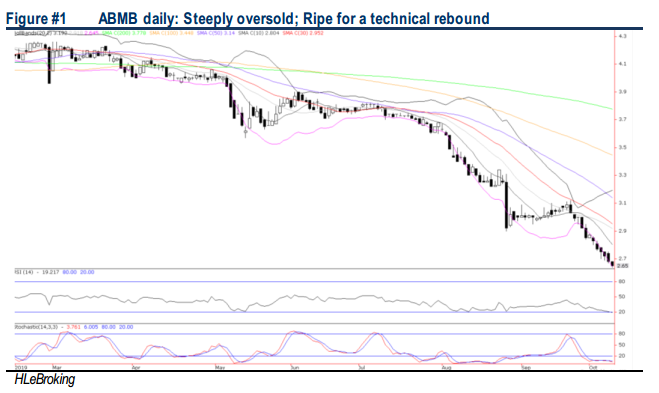

With share price corrected 34% YTD (the worst performer amongst peers) and 39% from 52W high, we are cautiously positive on ABMB, viewing this as an opportune time to accumulate on weakness amid recent selloff primarily due to the concern of 3 problematic loan accounts (which management shared that those were fully provided for and recovery plans are ongoing). Overall, the selling was overdone, reflected by its undemanding valuations at 7.7x FY21 P/E (33% below peers and 13% below 5Y historical mean) and 0.72x P/B (39% below peers and 13% below 5Y historical average), supported by an attractive DY of 6.2% (16% higher than peers). Technically, the stock is ripe for a relief rebound towards RM2.80-3.07 in the mid to long term, as it is at the tail-end of current downcycle from all-time high of RM5.50.

Ripe for a techical rebound. ABMB technical readings are steeply oversold after plunging 39% to RM2.65 from a 52W high at RM4.35 (4 Feb). On a long term monthly chart, the stock is likely at the tail-end of current down cycle (from all-time high of RM5.50 in July 2013), supported by the steeply oversold techncial readings (lower than the global financial crisis). In our view, the stock could trend sideways in the near term to build a base with key supports at RM2.50-2.60 levels before staging a long overdue technical rebound. A decisive breakout above RM2.80 (10D SMA) will spur prices higher towards RM2.95 (30D SMA) before reaching our LT objective at RM3.07 (21 Jan 2016 low). Cut loss at RM2.46.

Source: Hong Leong Investment Bank Research - 10 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024