Traders Brief - More cautious tone pending US-China trade talks and Brexit progress

HLInvest

Publish date: Mon, 21 Oct 2019, 09:18 AM

Asian markets slipped following China’s worse-than-expected 3Q19 GDP amid Beijing’s protracted trade conflict with the U.S, which grew 6.0% YoY (vs consensus 6.1%), the slowest pace since the early 1990s. Sentiment was also cautious prior to the “Super Saturday” vote by British MPs on Boris Johnson’s Brexit deal, which was approved by EU last Thursday. Tracking sluggish regional markets, KLCI fell 3.4 pts to 1571.2 (+14.3 pts WoW) after traded within a range of 9.2 points between an intra-day high of 1576.9 and a low of 1567.7. Trading volume increased to 2.96bn shares worth RM2.23bn as compared to Thursday’s 2.33bn shares worth RM1.88bn. Market breadth was negative with 401 gainers against 432 losers. The Dow tumbled 0.95% or 256 pts to 26770 (-47 pts WoW), weighed down by steep losses in Boeing and Johnson & Johnson, uncertainty over Brexit vote on Saturday coupled with the negative China’s 3Q19 GDP. Boeing plunged 6.8%, its biggest one-day drop since Feb 2016 on news that the aerospace giant misled regulators over the safety systems of the 737 Max whilst Johnson & Johnson slid 6.2% after the company recalled some baby powder upon finding traces of asbestos.

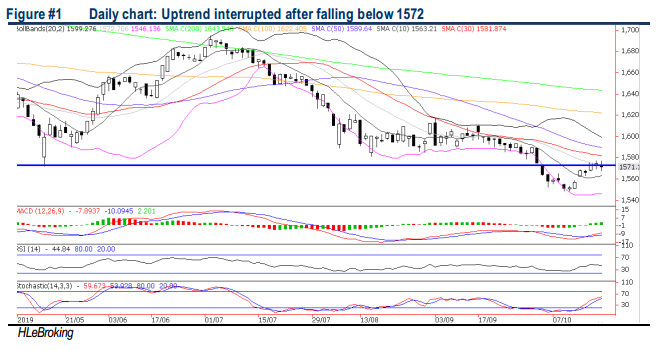

TECHNICAL OUTLOOK: KLCI

After rebounding to a high of 1577 (17 Oct) from a low of 1548 (10 Oct), KLCI experienced a mild pullback last Friday to end at 1571.2 (below the key 1572 support on 14 May low) following a sluggish China’s 3Q19 GDP. Technically, the rebound from 1548 remains intact unless the index witnesses a meaningful breakdown below 1572 this week. Immediate resistance is 1577/1582 (30D SMA)/1590 (50D SMA) zones. Key supports are 1563 (10D SMA) and 1548 levels.

Following last Friday’s slide on the Dow, Bursa Malaysia should extend its sideways trade this week amid caution over the progression of US-China trade talks coupled with the Brexit uncertainty after UK parliamentary rejection on Boris Johnson’s deal last Saturday. We see stiff resistances at 1582/1591/1600 territory in anticipation of another lacklustre Nov reporting season. Key supports are pegged at 1563/1548 territory.

TECHNICAL OUTLOOK: DOW JONES

Following last Friday’s bearish Marubozu candlestick and hook-down in technical indicators, the Dow is likely to face more volatility ahead. Nevertheless, the Dow’s uptrend from Oct low at 25743 (3 Oct) should remain intact unless there is a decisive break down below 50D SMA support at 26528 in the coming days. Key resistances are 27000-27400 while supports fall on 26500/26200 levels.

Despite Dow’s 256-pt plunge last Friday, we remain hopeful that further significant correction is limited (with sound support near 200D SMA at 26058), cushioned by expectations of another round of Fed rate cut during the 30-31 Oct FOMC meeting coupled with Chinese Vice Premier Liu He positive remark last Saturday that the US and China made ‘substantial progress’ at trade talks and China will work with the US to address each other’s core concerns on the basis of equality and mutual respect. Moreover, the US 3Q19 reporting season has made a good start as the S&P 500 earnings (over 80% reported results so far beat earnings estimates) is expected to fall only at 2.9% YoY from -5% before the start of the earnings season. For the Dow, the trading range this week is set around 26200-27000 zones.

TECHNICAL TRACKER: CLOSED POSITION

We Had Squared Off Our Position on ABMB (10.9% Gains) Last Friday.

Source: Hong Leong Investment Bank Research - 21 Oct 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024