Traders Brief - Optimism over US-China trade talks to cushion downside

HLInvest

Publish date: Tue, 22 Oct 2019, 09:12 AM

Asian markets ended mixed as investors braced for another week of Brexit headlines as Boris Johnson was forced by opponents again to seek for an extension on 31 Oct Brexit deadline, as Britain’s political class argue over whether to leave with a deal, exit without a deal or hold another referendum. Nevertheless, further downside was cushioned on hopes that US and China could sign a trade deal next month in Chile (16-17 Nov) following positive remarks by President Trump and Premier Liu He last week.

Tracking a mixed regional market, KLCI eased 0.22-pt at 1570.9 after traded within intra-day high of 1572.1 and a low of 1565.1. Trading volume decreased to 2.58bn shares worth RM1.48bn as compared to Friday’s 2.96bn shares worth RM2.23bn. Market breadth was cautious with 380 gainers as compared to 438 losers as market awaited more fresh impetus.

The Dow rose 57 pts to 26828 after sliding 256 pts last Friday, boosted by optimism around US-China trade talks as well as the corporate earnings season. However, the gains were capped by the further decline in Boeing (-3.76% to US$331) following a report that the company may have misled federal aviation authorities about the safety of the 737 Max jet.

TECHNICAL OUTLOOK: KLCI

After rebounding to a high of 1577 (17 Oct) from a low of 1548 (10 Oct), KLCI experienced a mild pullback to a low of 1565.1 yesterday before recovering to end at 1570.9 (below the key 1572 support on 14 May low). Technically, unless KLCI could stage a meaningful rebound above 1572 this week, it is expected to resume an extended downward consolidaiotn, reflected by the lower lows and lower highs sequence since hitting YTD high of 1732 (22 Feb) and closing below key multiple SMAs. Stiff resistance levels are 1581 (30D SMA)/1589 (50D SMA)/1600 whilst supports fall on 1564 (10D SMA)/1548/1539 (weekly lower BB) levels.

Taking cues from external volatility driven by the US-China trade talks as well as Brexit jitters, Bursa Malaysia should extend its sideways trade this week, with focus primariry on the small caps (FBMSCAP rallied 4.6% in Oct) and ACE counters (FBMACE surged 7.4% in Oct) whilst index-linked heavyweight lost 0.8% October to date. We see stiff resistances at 1581-1600 territory in anticipation of another lacklustre Nov reporting season. Key supports are pegged at 1563/1548/1539 territory.

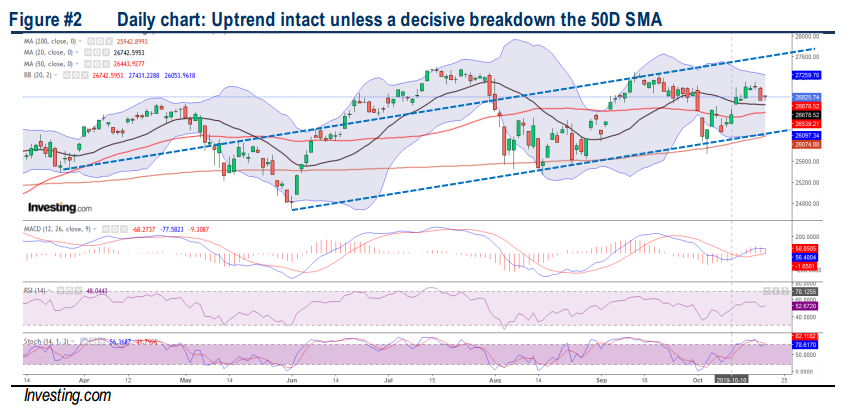

TECHNICAL OUTLOOK: DOW JONES

Following last Friday’s bearish Marubozu candlestick and sideways pattern in technical indicators, the Dow is likely to face more choppiness ahead. Nevertheless, the Dow’s uptrend from Oct low at 25743 (3 Oct) should remain intact unless there is a decisive break down below 50D SMA support at 26443 in the coming days. Key resistances are 27000/27400/27600 while supports fall on 26700/26400 levels.

Despite Dow’s 256-pt plunge last Friday, we remain hopeful that further significant correction is limited (with sound support near 200D SMA at 25942), cushioned by expectations of another round of Fed rate cut during the 30-31 Oct FOMC meeting coupled with positive remarks by President Trump and Liu He that both countries have made substantial progress in many aspects and laid an important foundation for a phase one agreement. Moreover, the US 3Q19 reporting season has made a good start as the S&P 500 earnings (over 80% reported results so far beat earnings estimates) is expected to fall only at ~4% YoY from -4.9% before the start of the earnings season. For the Dow, the trading range this week is set around 26400-27000 zones.

Source: Hong Leong Investment Bank Research - 22 Oct 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024