Traders Brief - Bargain hunting activities to support the market

HLInvest

Publish date: Tue, 07 Jan 2020, 09:38 AM

Market Review

Asia’s stock markets ended mostly in the negative territory amid escalating trade tensions between the US and Iran after the latter’s top military commander was killed in a US airstrike in Baghdad and market participants rushed for safe haven assets such as gold and Japanese yen, while crude oil spiked after the incident. Hang Seng Index and Nikkei 225 declined sharply by 1.11% and 1.91%, respectively, while Shanghai Composite Index traded flat.

Similarly, stocks on the local front trended lower for the day, tracking the negative sentiment abroad as well as regional benchmark indices; the FBM KLCI lost 0.85% to 1,597.76 pts. Market breadth was negative with 646 decliners vs. 269 advancers, accompanied by 3.40bn shares traded (valued at RM1.64bn). Given the rally in crude oil prices, we observed that the O&G sector was traded actively higher for the session.

Wall Street started on a negative tone but managed to recoup earlier losses as bargain hunting emerged, marking the day in the positive territory investors brushed off US-Iran geopolitical tensions. The Dow and S&P500 gained 0.24% and 0.35%, respectively, while Nasdaq added 0.56%.

TECHNICAL OUTLOOK: KLCI

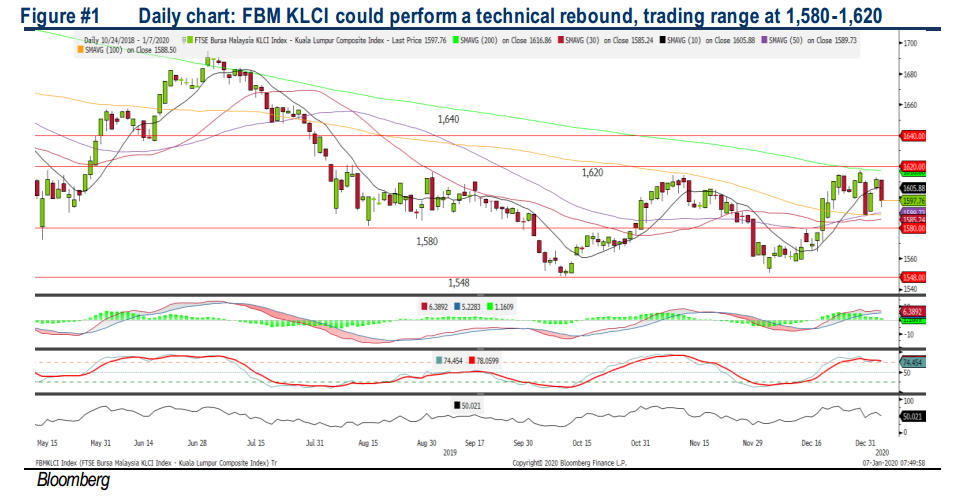

The FBM KLCI has pulled back after a two-day rebound and the MACD Line has declined mildly (but hovering above zero). Meanwhile, both the RSI and Stochastic oscillators are pointing lower (albeit threading above 50). With the mixed technical readings, we expect the FBM KLCI to remain sideways over the near term. Resistance is pegged around 1,620, while support stands at 1,580.

Given the rebound on Wall Street, we believe the FBM KLCI could perform a technical rebound amid bargain hunting activities. However, with the mixed technical readings on FBM KLCI, we opine that the key could stay range bound between 1,580-1,620. Meanwhile, with the recent firmer crude oil and gold prices, we think traders would look into O&G and safe-haven related stocks amid the on-going geopolitical tensions.

TECHNICAL OUTLOOK: DOW JONES

After performing a technical rebound on the Dow, it has formed a bullish engulfing bar. The MACD Indicator is still trending positively above zero. Also, both the RSI and Stochastic (still overbought) are hovering above 50. Based on the technical readings, upside target will be set around 29,000. Support is anchored along 28,000.

In the US, market participants will be focusing on trade front and putting aside the rising US Iran geopolitical tensions as investors may believe that the fresh tensions in the Middle East could be insufficient to derail the economy and the current solid positive rally in stocks on Wall Street. The Dow’s trading range will be located around 28,000-29,000.

Source: Hong Leong Investment Bank Research - 7 Jan 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024