Traders Brief - Sentiment to turn cautious, waiting for fresh leads

HLInvest

Publish date: Wed, 15 Jan 2020, 09:09 AM

MARKET REVIEW

Most Asian markets gained, underpinned by optimism on the imminent signing of a Phase 1 US-China trade deal in Washington on 15 Jan (US time) coupled news that the US Treasury Department on Monday dropped its designation of China as a currency manipulator. Aiding the sentiment further, exports from the region's largest trading partner, China, rose for the first time in five months in December.

Bucking higher regional markets and overnight Wall Street, KLCI lost 4.1 pts (from as much as -12.8 pts) to 1580.6, recovering from a low of 1571.9 in the absence of fresh market leads as sentiment remains cautious amid lingering domestic concerns over weak earnings delivery and political noises coupled with pullback in crude oil and FCPO prices. Trading volume increased to 2.65bn shares worth RM1.77bn as compared to Monday’s 2.61bn shares worth RM1.65bn. Market breadth was negative with 336 gainers as compared to 541 losers.

The Dow rallied as much as 147 pts to 29054 following upbeat earnings from JP Morgan and Citigroup. However, the gains was reduced to 33-pt at 28940 after a Bloomberg report said existing tariffs on Chinese imports would likely stay in place until after the US elections in Nov and any reduction would depend on Chinese compliance with the terms of the accord.

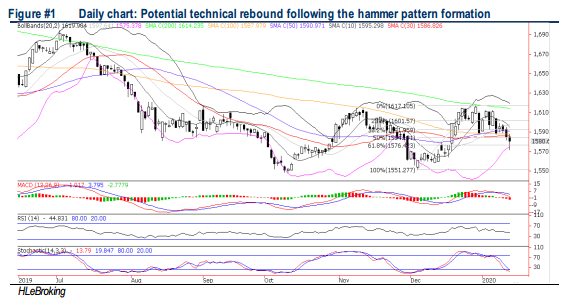

TECHNICAL OUTLOOK: KLCI

After hitting 1M high at 1617 (30 Dec) on year-end window dressing from a low of 1551 (4 Dec), persistent profit taking activities saw KLCI plunging to a low of 1571.9 yesterday before recovering to end at 1580.6 yesterday. Following the violation of multiple key SMA supports together with bearish MACD and hook-down in RSI, KLCI’s immediate term outlook has turned uglier. Nevertheless, further strong selldown is likely to be cushioned by the grossly oversold stochastic indicator and a hammer pattern candlestick. Stiff resistances are at 1600-1614 (200D SMA) whilst key supports are situated at 1572 and 1566 (76.4% FR) levels.

We see an extended KLCI consolidation as investors await more clarity on the US-China phase 1 trade pact outcome, apart from the long CNY holidays next week and expectation of another unexciting Feb reporting season. Key resistances fall at 1600-1614 whilst supports are near 1566-1572 levels.

TECHNICAL OUTLOOK: DOW JONES

In wake of ongoing volatility the Dow is still able to close above multiple key SMAs supports. As indicators are gradually on the mend with a flattish MACD while both the RSI and Stochastic oscillators are ticking up, the Dow could still break the all-time high of 29054 (14 Jan high) and advance towards 29500-30000 zones in the next few weeks, barring any decisive violation below 28300 support

In the US, we believe the Dow’s uptrend is fairly intact amid fading US-Iran geopolitical tensions and the impending US-China Phase 1 trade deal signing, coupled with the news that China’s removal from a list of currency manipulating countries. Barring any negative surprises from the trade deal details and the start of Jan reporting season (for 4Q19 results) this week, we remain optimistic the Dow to advance towards 29500-30000 territory in the next few weeks, with support set around 28000-28300 levels.

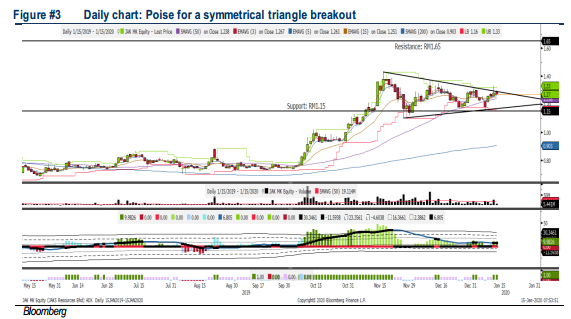

TECHNICAL TRACKER: JAKS

Power operations may boost earnings in the long run. The Hai Duong Vietnam EPC contract has been progressing well and the power plant is reaching the completion stage (2Q19: c.82% vs. 1Q19: 70%) and likely to be commencing by mid-2020. Although its construction orderbook is declining and the property segment is slowing down, should the Hai Duong Vietnam power start operation by 2H2020, it should be able to support its earnings in the long run. Technically, JAKS could poise for a symmetrical triangle breakout, targeting RM1.43-1.50, with a LT TP of RM1.65, while support is located around RM1.15-1.18, with a cut loss set around RM1.12

Source: Hong Leong Investment Bank Research - 15 Jan 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024