Traders Brief - Lukewarm sentiment amid Wuhan coronavirus outbreak and long CNY holidays

HLInvest

Publish date: Wed, 22 Jan 2020, 09:16 AM

MARKET REVIEW

Led by a 1.4% plunge in SHCOMP, Asian markets tumbled on mounting worries about the new deadly virus, which authorities confirmed spreads through human contact, broke out just ahead of the tremendous human flow CNY holidays in Wuhan and has spread to Beijing, Shanghai and other cities, with more than 200 cases reported so far. Sentiment was also dampened by a 2% slide on HSI following Moody’s cut HK rating to Aa3 from Aa2.

Tracking sluggish regional markets and ahead of the long CNY holidays, KLCI fell 1.5 pts to 1587.3, with focus on the winners of coronavirus outbreak such as gloves and healthcare stocks, offsetting selling pressures on tourism-related companies such as GENM, GENTING and AIRASIA coupled with profit taking pullback on telco stocks after recent run-up. Trading volume increased to 2.66bn shares worth RM1.93bn as compared to Monday’s 2.53bn shares worth RM1.79bn. Market breadth was negative with 383 gainers as compared to 509 losers.

Following record-setting rallies on Dow in recent weeks, the benchmark tumbled 152 pts to 29196 on reports that a deadly respiratory viral outbreak in China had migrated to the US, spurring concern about the potential economic repercussion. On Monday, the IMF had downgraded its global economic growth forecast from original Oct’s 3.4% to 3.3% for 2020 and the US economy to grow by 2.0% this year (Oct: 2.1%). Sentiment was also dampened by the start of a presidential Senate impeachment trial of President Trump.

TECHNICAL OUTLOOK: KLCI

Following a mild rebound from a low of 1551 (24 Dec) to a high of 1617 (30 Dec), KLCI had retreated 30 pts to close at 1587 yesterday, below the 20D/30D/50D SMAs. Unless a decisive fall below 1575 (uptrend line support from 1551), KLCI’s near term upward momentum remains intact. Key resistances are 1600-1613 (200D SMA) whilst supports fall on 1584 (50% FR)/1575. Failure to hold at 1575 may induce more selling spree towards 1566 (76.4% FR)/1550 levels.

Following another tepid performance on Bursa Malaysia and overnight profit taking pullback on Dow, KLCI is envisaged to extend its sideways consolidation mode ahead of the long CNY holidays (half day trading on 24 Jan and reopens on 28 Jan). Technically, unless a decisive fall below 1575 (uptrend line support from 1551), KLCI’s near term upward momentum remains intact. Key resistances are 1600/1613 whilst supports fall on 1584/1575/1566 levels. Nevertheless, traders may continue to focus on gloves/healthcare companies amid rising cases of coronavirus, as well as plantation counters as FCPO is slated for a technical rebound, given a positive hammer candles stick formation yesterday.

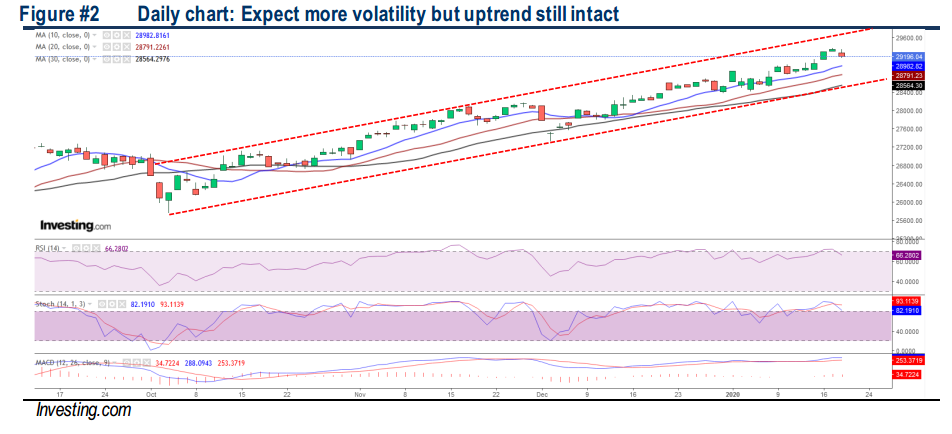

TECHNICAL OUTLOOK: DOW JONES

From an all-time high of 29374 on 17 Jan, the Dow had retraced 178 pts to 29197. Given the weakness in the MACD/RSI/stochastic readings, the Dow is likely to experience choppy sessions ahead with key supports situated at breakdown below 28790 (20D SMA) and 28563 (30D SMA) and zones. Formidable hurdles are 29500-30000 levels.

Despite the fear of deadly Wuhan coronavirus reported in the US, we believe the Dow’s uptrend is fairly intact amid fading US -Iran geopolitical tensions and de-escalation of US-China trade disputes coupled with the expectation of low Fed’s interest outlook ahead of the 28-29 Jan meeting (US time). In wake of the ongoing positive 4Q19 reporting season, we remain optimistic the Dow could advance towards 29500-30000 territory in the next few weeks albeit interim profit taking pullback, with support set around 28500-28800 levels.

CLOSED POSITION

Yesterday, we had squared off our positions on JAKS (Technical tracker: 18.1% return) and APB (1Q2020 Picks: 23.2% Gains).

Source: Hong Leong Investment Bank Research - 22 Jan 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024