Traders Brief - Still Upside Bias to Refill the 1558-1568 Gap

HLInvest

Publish date: Fri, 07 Feb 2020, 09:01 AM

MARKET REVIEW

Tracking the bullish tone on Wall Street, Asia’s stock markets gained further traction following the unconfirmed reports of breakthroughs in the development of a drug for 2019-nCoV. Also, China has announced that it would halve tariffs on USD75bn worth of US goods from 14 Feb onwards. The Shanghai Composite Index advanced 1.72%, while Hang Seng Index and Nikkei 225 soared 2.64% and 2.38%, respectively.

Similarly, bullish tone spilt over towards stocks on the local front and the FBM KLCI rose 1.04% to 1,552.77 pts. Market breadth was positive with 673 gainers as compared to 292 decliners, accompanied by 3.08bn (worth RM2.48bn) shares traded for the session. Also, we noticed solar-related stocks such as Solarvest and Greatech trended higher for the session.

The Dow rose 89 pts to end at record high of 29380 (its 4th consecutive gains) amid ebbing concerns over the economic fallout from the coronavirus outbreak after China said effective 14 Feb it would halve its tariffs on some USD75bn of US imports, as part of the US-China Phase 1 trade resolution. Sentiment was also boosted by ongoing upbeat 4Q19 reports with over 60% of S&P 500 companies have reported earnings thus far, 71% of them beating analyst expectations and the overall earnings decline rate has revised lower at -0.2%, better than the more-than 4% contraction before the start of the 4Q earnings season.

TECHNICAL OUTLOOK: KLCI

Following the double top patterns, KLCI dived 6.2% from 1617 (30 Dec) to 1517 (3 Feb), violating the neckline support of 1548. However, the index swiftly staged a 2.3% relief rally to end at 1552 yesterday, a tad above the 1548 support -turned resistance levels. In wake of the strong recovery and bottoming up indicators, the KLCI is set to retest the 1558/1568 gap resistance (28 Jan). Only a successful refill will lift the index higher towards 1582 (100D SMA) and 1600 levels. On the flip side, failure to defend the 1548 levels will trigger another round of selloff towards 1517 and 1500 zones.

Taking cues from the overnight record-setting on the Dow, KLCI is expected to hold onto moderate gains today, on optimism of China's recent stimulus measures and the easing pressures on US-China trade tension after China announced to cut in half tariffs on some USD75bn of US imports. Technically, a decisive breakout above the 1558-1568 gap (28 Jan) will lift index higher towards 1580-1600 zones.

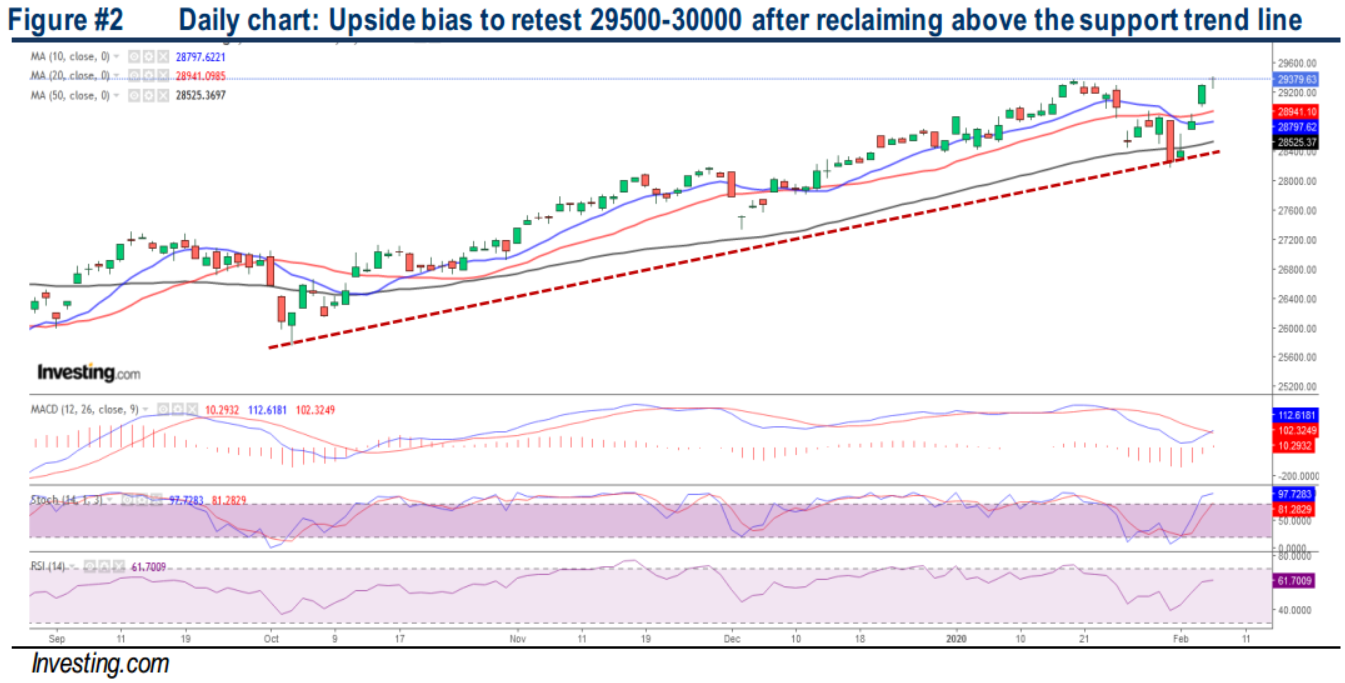

TECHNICAL OUTLOOK: DOW JONES

The Dow jumped 89 pts at 29380, comfortably above the uptrend line support from a low of 25743 (3 Oct) and the multiple key SMAs. The MACD Indicator remains positive (MACD Histogram recovering, while MACD Line is hovering above zero). Meanwhile, both the RSI and Stochastic oscillators have hooked upwards; indicating that the positive momentum is returning. The resistances are located around 29500-30000, while the support is pegged around 28500-28900.

In the near term, the Dow is expected to remain in choppy as investors remained wary of the virus outbreak and its impact on global growth. As at Thursday, the coronavirus epidemic has sickened more than 30,000 people (mostly in China) and death toll has risen to 635, with 28 countries affected. Nevertheless, downside risks are likely to be well -cushioned by the Fed’s positive US economic outlook and accommodative monetary policy coupled with the ongoing positive 4Q19 results. Sentiment is also likely to be buoyed by the China's latest stimulus measures and the easing US-China trade tension after China announced to cut in half tariffs on some USD75bn of US imports. Crucial supports are situated at 28500-28900 whilst resistances are at 29500-30000 levels.

TECHNICAL TRACKER: CHINHIN

Cheaper proxy to solar theme? We like CHINHIN for its (i) recovering net profit over the past 3 quarters, (ii) attractive valuation of 13.3x PE (26.5% below its 2Y historical average of 18.1x), (iii) solid FY18-20f net profit CAGR of 30.7%. Also, its 34% shareholdings in Solarvest may translate to a potential earnings boost moving forward. Technically, it is oversold after the recent selldown and our indicator is suggesting that CHINHIN is warrant for a technical rebound in the near term. Resistance is set around RM0.64-0.66, followed by a LT TP of RM0.69. Support is pegged around RM0.54-0.555, while stop loss is set around RM0.53.

Source: Hong Leong Investment Bank Research - 7 Feb 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024