Traders Brief - Sell Into Rally With Formidable Hurdles at 1369-1419 Zones

HLInvest

Publish date: Tue, 31 Mar 2020, 09:16 AM

MARKET REVIEW

Global: Tracking Dow’s 915-pt slide last Friday, Asian markets ended lower as the benchmark MSCI Asia APEX 50 index tumbled 1.1% to 1143.3 amid surging Covid-19 cases globally, which may damage the economic growth amid the lockdown in various cities and concerns over a potential recession moving forward. Despite Trump’s coronavirus guidelines on social distancing to be extended to end April, the Dow soared 690 pts to 22327 (+22.5% from Covid- 19 rout low of 18213) overnight as investors view the measures as essential to prevent further death tolls and long-term damage to the economy. Sentiment was also aided by Fed’s no-limit QE and government’s mammoth USD2 trillion fiscal stimulus package coupled with positive Covid-19 vaccine news by J&J as the human testing of its experimental vaccine will begin by September and it could be available for emergency use authorization in early 2021.

Malaysia: Tracking sluggish regional markets, KLCI fell 14.2 pts to 1328.9 on profit taking after jumping 40 pts WoW. Trading volume decreased to 2.83bn shares worth RM1.86bn as compared to last Friday’s 4.23bn shares valued at RM2.74bn). Market breadth was negative with 305 gainers as compared to 511 losers. Nevertheless, SCGM gained 28% after commenting that it may venture into PPE industry following the Covid-19 outbreak.

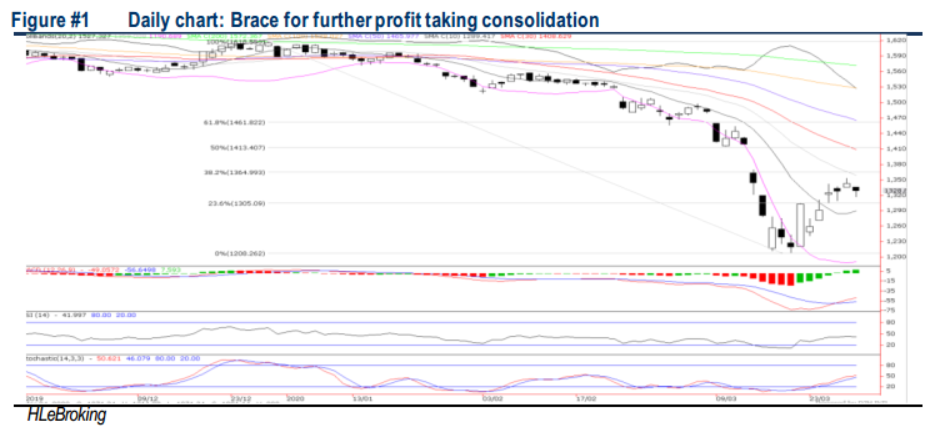

TECHNICAL OUTLOOK: KLCI

After a 25% or 404-pt rout from YTD high of 1612 (7 Jan) to a low of 1207 (19 Mar), KLCI rebounded as much as 146 pts to 1353 last Friday before narrowing the gains to 122 pts at 1329 yesterday. The MACD has staged a golden cross while the RSI and Stochastic oscillators are toning down, signalling potential sideways consolidation ahead. In wake of the shooting star pattern, the index is about to embark on further pullback should it fail to reclaim 1353 (26 March high) swiftly in the near term. Formidable resistances are located at 1369- 1419 (16 March gap). Key supports are at 1304/1285.

MARKET OUTLOOK

Taking cue from Dow’s 3.2% rally overnight, KLCI could advance further towards our envisaged 1353-1363 target due to expectations of 1Q2020 portfolios rebalancing by money managers and the RM250bn PRIHATIN package coupled with recent stock market friendly measures by SC/Bursa. Nonetheless, further upside could be capped by uncertainties lingering from the MCO extension, more countries going into lockdown and spiking Covid-19 cases worldwide. We reiterate a SELL INTO RALLY strategy and rebalance portfolio to sectors that are deemed to be more defensive as the Covid-19 is not only a public health crisis but also a global economic crisis as activities worldwide shutdown.

Source: Hong Leong Investment Bank Research - 31 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024