Traders Brief - Upside Limited Amid Grossly Overbought Position

HLInvest

Publish date: Fri, 10 Apr 2020, 09:08 AM

MARKET REVIEW

Global: Tracking Dow’s Wednesday 2% rally, Asian markets finished higher, boosted by hopes of the coronavirus pandemic is peaking and stimulus efforts by governments. Top gainers in regional benchmark indices were India (4.2%), Australia (3.5%) and Korea (1.6%). Overnight, the Dow soared 286 pts or 1.2% to 23719 (+30.2% from low of 18213 during Covid- 19 selloffs), ignoring an ugly report on another 6.6m jobless claims (ended 4 April) and a wild ride in the energy sector. Sentiment was buttressed by signs of a slowdown in the number of hospitalisations and ICU admissions in New York and Europe coupled with Fed’s USD2.3 trillion program to help funnel money to key parts of the economy that has been hard-hit by the NYSE will be closed tonight in observance of Good Friday.

Malaysia: Tracking higher regional markets and a rebound in oil prices during Asian trades amid optimism that OPEC+ would cut production output by 10-15m bpd, KLCI jumped 8.4 pts to 1369.8 (+13.5% from low of 1207 during Covid-19 selloffs). Trading volume decreased to 4.71bn shares worth RM2.25bn as compared to Wednesday’s 5.36bn shares worth RM2.67bn. Market breadth was positive with 634 gainers as compared to 252 losers.

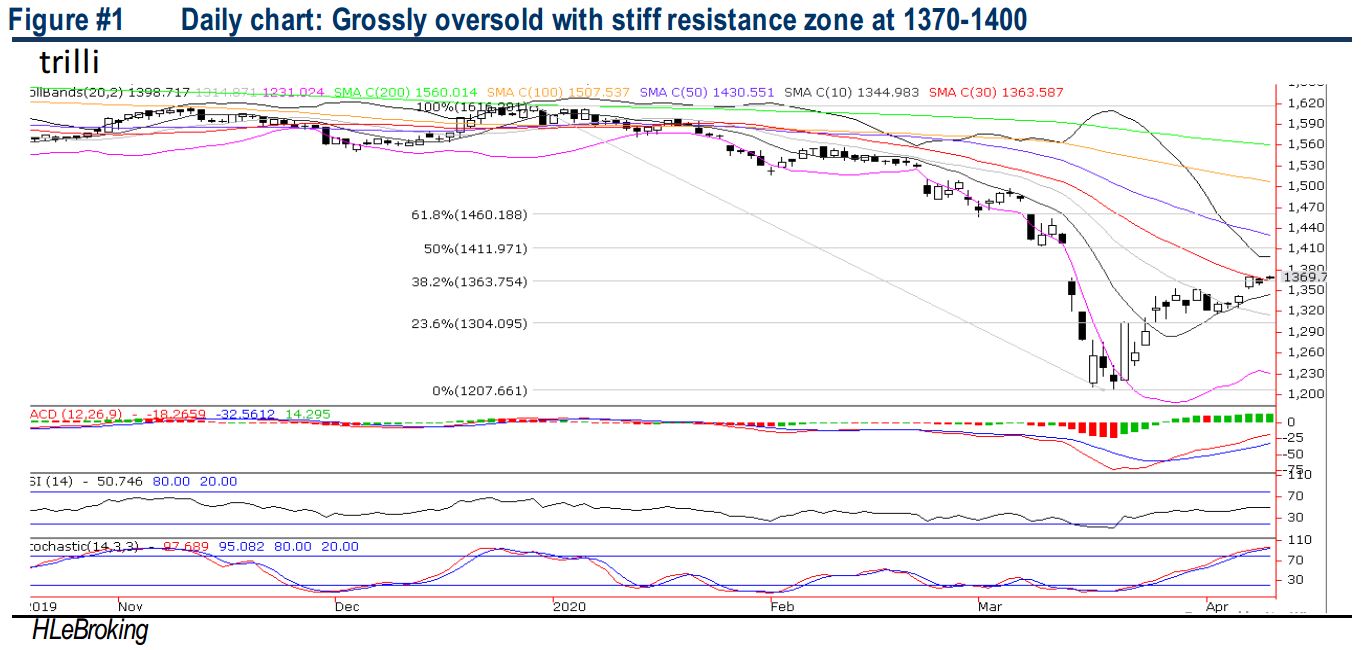

TECHNICAL OUTLOOK: KLCI

Following the sideways consolidation phase over the past 9 trading days, the key index has breached above the key neckline resitance of 1353 on 7 Apr to end at 1369.7 yesterday. While the MACD Indicator remains on a recovery mode but the RSI pattern is flattening and Stochastic oscillators are steeply overbought, indicating near term rally is easing. We believe the resistance will be located around 1370-1400 zones, while support is located around 1345/1315/1300 territory.

MARKET OUTLOOK

Tracking Dow’s 2nd straight gains and OPEC+ decision to slash 10m bpd or or c.10% of global supplies, with another 5m bpd from non-OPEC members coupled with early signs of flattening curve in global the pandemic-stricken hotspots, KLCI could advance further towards our envisaged 1370-1400 resistances. Nevertheless, we reiterate SELL INTO RALLY as we do not expect the hurdles to be broken in the near term in anticipation of potential MCO extension today as investors continue to assess the fallout from Covid-19, which is still wreaking havoc on domestic and global economies. Conversely, a decisive violation below immediate support near 1345 (10D SMA) could disrupt the ongoing rally and trigger a long overdue pullback to revisit 1300-1315 levels.

Source: Hong Leong Investment Bank Research - 10 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

OPENSYS2024-11-13

UNISEM2024-11-13

UNISEM2024-11-12

INARI2024-11-12

INARI2024-11-12

INARI2024-11-11

INARI2024-11-11

INARI2024-11-08

INARI2024-11-08

INARI2024-11-08

INARI2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

INARI2024-11-06

INARI2024-11-06

PHARMA2024-11-06

PHARMA2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-05

INARI2024-11-05

INARI2024-11-05

INARI2024-11-04

INARI2024-11-04

INARI