Kronologi Asia - May See More Enquiries Under Covid-19

HLInvest

Publish date: Thu, 16 Apr 2020, 08:57 AM

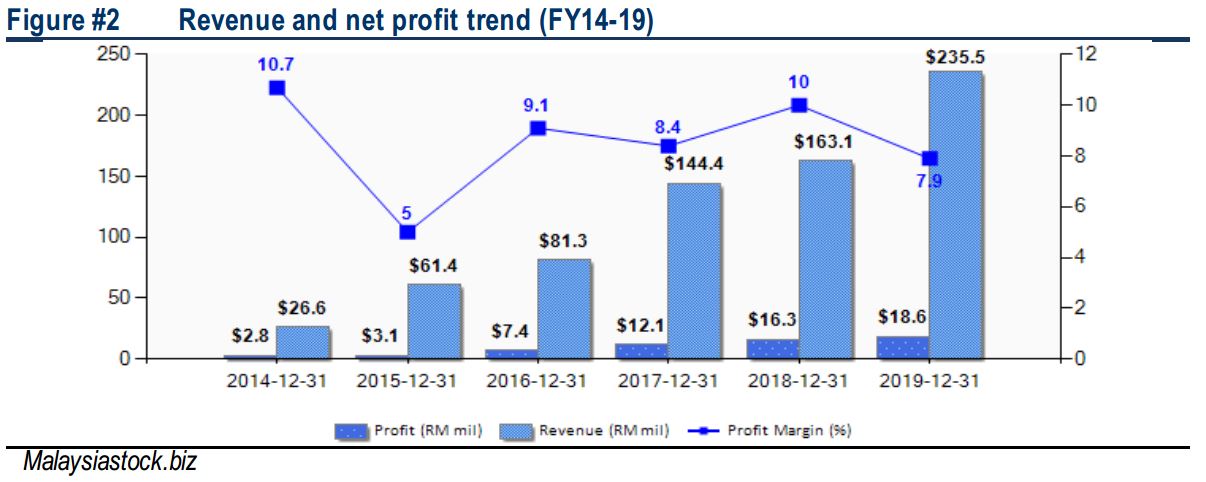

FY19 is a record year for KRONO following the acquisition of Sandz Solutions with a profit warrant of USD1.5m. Currently, KRONO has 3.5sen net cash per share and we believe it may anticipate more enquiries of their online/ EDM solutions under this Covid-19 pandemic. Technically, it has experienced a flag formation breakout above RM0.495. Next resistance at RM0.54-0.58, with LT target at RM0.66, support is at RM0.46-0.47, with a cut loss below RM0.45.

Record year for KRONO. From the Sandz Solution acquisition, it has brought KRONO towards record year with the profit warrant of USD1.5m for FY19. Although management is cautious on the Covid-19 pandemic, we believe its RM18.4m (7% of current market cap) net cash should be decent for them under these trying times.

Value of cloud services/ EDM solutions in times of Covid-19. Moreover, we opine under the Covid-19 outbreak, more corporates would look for with online/ cloud solutions, this may translate to more business opportunities for KRONO.

Flag formation breakout. KRONO has experienced a flag formation breakout above RM0.495 with higher volumes. Momentum and trend oscillators are pointing on a recovery towards resistance of RM0.54-0.58, followed by LT target of RM0.66. Meanwhile, support is pegged around RM0.46-0.47, with a cut loss below RM0.45.

Source: Hong Leong Investment Bank Research - 16 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024