Public Packages Holdings - Consistently Growing Over the Past 10 Years

HLInvest

Publish date: Fri, 17 Apr 2020, 08:57 AM

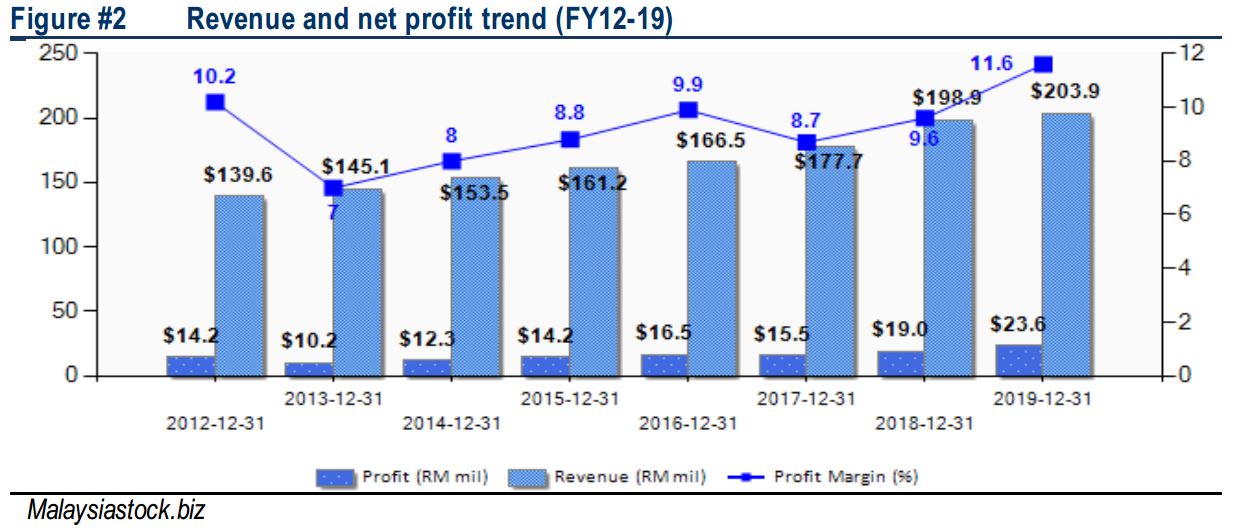

PPHB has plunged 77% throughout the recent Covid-19 pandemic towards the low of RM0.325. We believe this is overdone and we reckon its rebound could sustain over the near term, supported by its (i) 6Y revenue and net profit CAGR of 5.8% and 15.0%, respectively, (ii) 6.3sen (c.10% of share price) net cash per share as well as (iii) the restart of paying dividends (0.25sen) in FY19 after stopping for 8 years. Technically, it is poised for a consolidation breakout above RM0.63, targeting RM0.68-0.725-1.00, support at RM0.58-0.605, while cut loss is set around RM0.57.

Stable revenue and earnings growth. PPHB staged a 6Y revenue and net profit CAGR of 5.8% and 15.0%, respectively. Also, PPHB has net cash per share of 6.3sen (c.10% of share price), which provide some cushion during these trying times. Moreover, PPHB has restarted paying dividends (0.25sen) for FY19 after 2.5sen paid in FY10 (stopped for 8 years).

Sideways consolidation breakout. PPHB has consolidated sideways between the range of RM0.57-0.67 levels over the past 11 days. We have noticed price action and technical indicator has turned slightly positive and may experience a breakout in the near term towards resistance along RM0.68-0.725, followed by a LT target around RM1.00. Support is set around RM0.58-0.605, and cut loss is anchored at RM0.57.

Source: Hong Leong Investment Bank Research - 17 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024