Traders Brief - KLCI Approaching Overbought Region

HLInvest

Publish date: Mon, 20 Apr 2020, 09:04 AM

MARKET REVIEW

Global: Asian markets finished mixed last Friday in lacklustre mode with major markets across the region closed for the Good Friday holiday. Investors appeared to shrug off another 6.6 m US jobless claims and a wild ride in the energy sector, boosted Fed’s additional USD2.3 trillion measures to cushion the fallout from the Covid-19 pandemic. On Wall Street, the Dow soared 286 pts or 1.2% to 23719 (+30.2% from Covid-19 carnage low of 18,213) last Thursday to end the Easter holiday-week 2,667 pts or 12.7% higher, as sentiment was buttressed by signs of a slowdown in the number of hospitalizations and ICU admissions in New York coupled with Fed’s additional USD2.3 trillion program to help funnel money to key parts of the coronavirus hit economy. Malaysia: Prior to the MCO announcement at 4pm last Friday coupled with lower oil prices after Mexico refused to sign up a historic multilateral deal to lower global oil production and stabilize prices from a debilitating coronavirus-induced slump, KLCI slid 12.3 pts or 0.9% at 1357.5 last Friday (but still ended +26.9 pts WoW). Trading volume decreased to 3.72bn shares worth RM1.68bn as compared to Thursday’s 4.71bn shares worth RM2.25bn. Market breadth was negative with 207 gainers as compared to 689 losers.

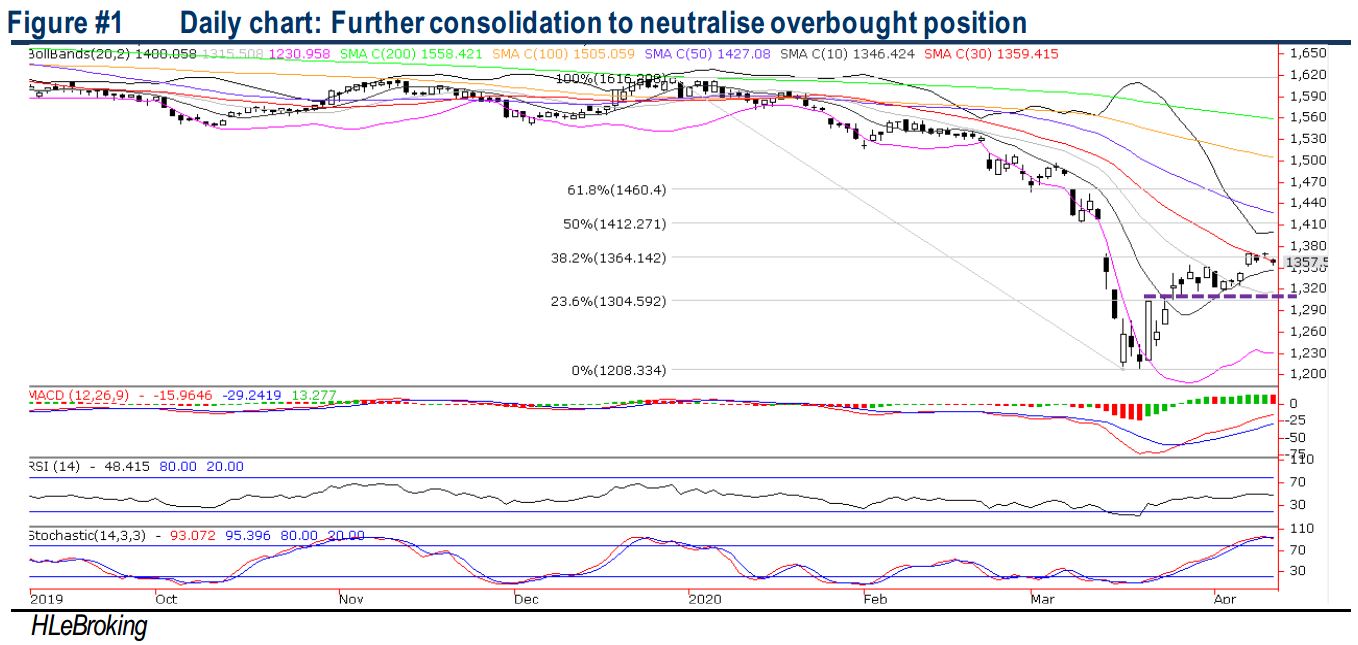

TECHNICAL OUTLOOK: KLCI

Since staging a neckline breakout above 1311.2 (24 Mar), KLCI has steadily inched higher to a high 1371.4 (9 Aprf) before closing lower to 1357.5 last Friday (+26.9 pts WoW). Both its MACD and RSI indicators appear stretched and flattening whilst the Stochastic oscillator is grossly overbought, indicating more sideways pattern ahead. We believe the resistance will be located around 1371-1400 zones, while support is located around 1346/1315/1311 territory.

MARKET OUTLOOK

Tracking OPEC+ decision’s on Sunday to broker a deal after days of discussion to slash 9.7m bpd for May-June (8m bpd from July- Dec 2020) or c.10% of global supplies to curb Covid-19 induced selling coupled with early signs of flattening Covid-19 curve in Malaysia, KLCI could still advance further towards our envisaged 1,370-1,400 resistances after undergoing a mild profit taking pullback. Nevertheless, we reiterate SELL INTO RALLY as we do not expect the hurdles to be broken in the near term and the risk to reward perspective is getting more risky compared with 1-2 weeks ago. Conversely, a decisive breakdown below immediate support near 1,346 (10D SMA) could disrupt the ongoing rally and trigger a long overdue pullback to revisit 1,300-1,315 levels.

Source: Hong Leong Investment Bank Research - 20 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

INARI2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

MHB2024-11-14

OPENSYS2024-11-13

UNISEM2024-11-13

UNISEM2024-11-12

INARI2024-11-12

INARI2024-11-12

INARI2024-11-11

INARI2024-11-11

INARI2024-11-08

INARI2024-11-08

INARI2024-11-08

INARI2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

PHARMA2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

INARI2024-11-06

INARI2024-11-06

PHARMA2024-11-06

PHARMA2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-05

INARI2024-11-05

INARI2024-11-05

INARI2024-11-04

INARI2024-11-04

INARI