Traders Brief - Recent Relief Rally Is Running Into Technical Resistance

HLInvest

Publish date: Mon, 27 Apr 2020, 12:27 PM

MARKET REVIEW

Global: Asian stock markets ended lower on Friday as the sentiment was zapped by new evidence of US economic damage after a string of economic indicators plummeted amid severe lockdowns crushed production, supply chains, and consumer spending. Meanwhile, the Dow jumped 1.1%, to 23775 (-1.9% WoW) last Friday amid the back-to-back crude oil rally from historic lows, coupled with the latest USD484bn SME economic aid package from Congress offsetting a grim March durable goods orders (-14.4% YoY). The sentiment was also helped by the gradual reopening of businesses and Reuters reported that a US government led trial of Remdesivir for potential coronavirus treatment was running ahead of schedule.

Malaysia: Tracking tepid regional markets and concerns of the long-term economic repercussions of the MCO Phase 4 extension to 12 May (a total 55 days since Phase 1 started on 18 Mar), KLCI tumbled 11.8 pts or 0.85% to 1369.9 (-37.4 pts WoW). Trading volume decreased to 4.69bn shares worth RM2.49bn as compared to Thursday’s 5.05bn shares worth RM2.58bn. Market breadth was positive with 445 gainers as compared to 400 losers (G/L ratio 1.11), but lower than Thursday (1.22x) and Wednesday (1.23x).

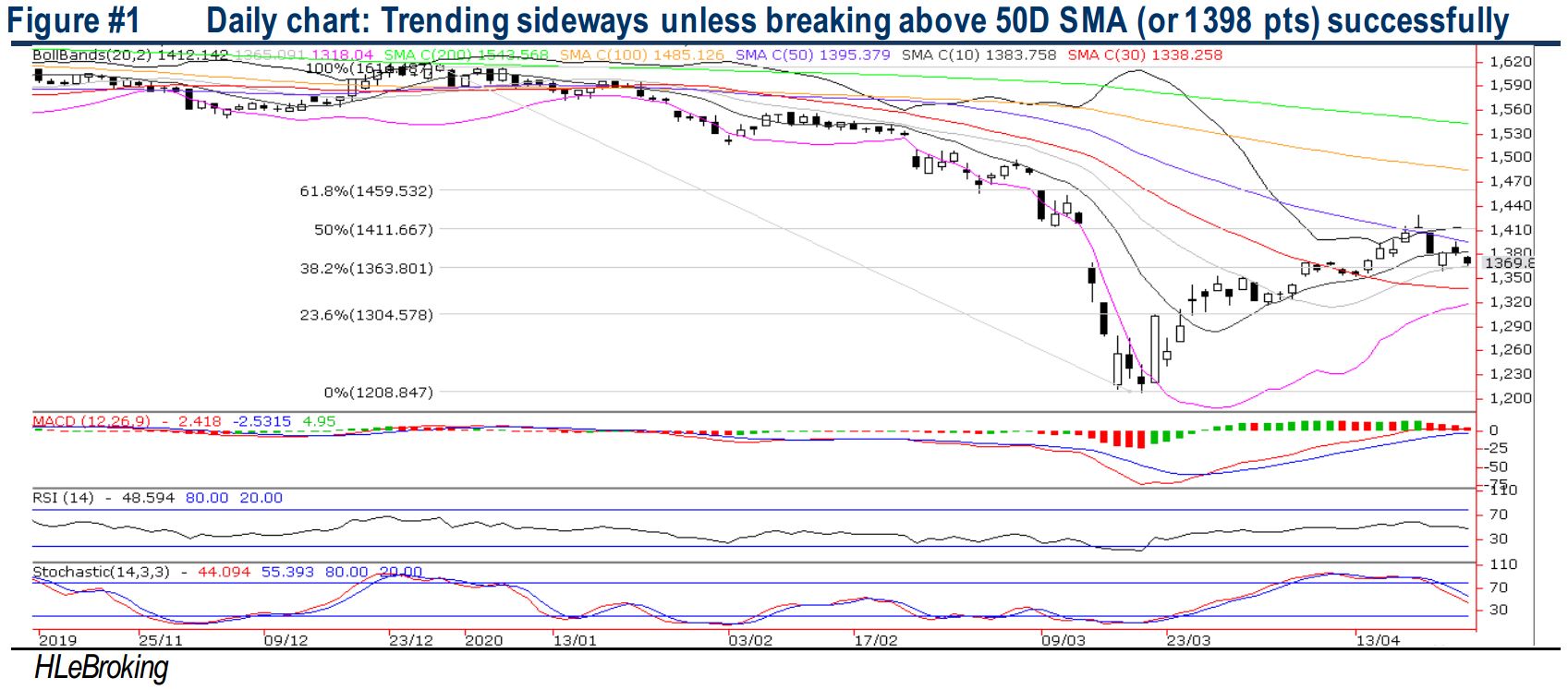

TECHNICAL OUTLOOK: KLCI

In wake of the bearish trend reversal Gravestone Doji formation after refilling the 1369-1419 gap on 20 Apr, KLCI fell 37.4 pts WoW at 1369.9 (+13.5% from 19 March low at 1208). As the MACD/RSI/Stochastic indicators are tapering off from their recent resistances, KLCI is likely to extend its consolidation mode, with key support at 1359 (22 Apr) and 1338 and 1304 (23.6% FR) zones. Conversely, a successful breakout above 50D SMA or 1395 pts will lift index from current consolidation mode to revisit 1412 (50% FR), 1429 (20 Apr) and 1460 (LT TP) levels.

MARKET OUTLOOK

Tracking a stunning recovery from the jaw-dropping collapse of oil prices and continuous drop in local active Covid-19 cases to 1820 (lowest since 27 Mar), KLCI may resume its upward momentum to retest the key 50D SMA or 1395 resistance this week. Breaking this hurdle would lift the index from a sideways consolidation mode towards 1412-1429 territory. Nevertheless, the 3rd MCO extension to 12 May could still pose downbeat ramifications to the economy and corporate earnings in 2020, crippling the bear-market rally.

CLOSED POSITION

Last Friday, we had squared off our positions on SUPERLN (Technical tracker 15.3% gain) after Hitting the R2 Resistance Target.

Source: Hong Leong Investment Bank Research - 27 Apr 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024