Traders Brief - Rotational Buying Interests in Technology, Covid-19 Winners and GLC-linked Stocks to Sustain Market Momentum

HLInvest

Publish date: Tue, 28 Jul 2020, 09:43 AM

MARKET REVIEW

Global: Boosted by an improvement in China’s June industrial profits, Asian markets rose in the early sessions. However, lingering concerns on heightened the Sino -US tensions and Covid-19 pandemic woes kept gains in check. Overnight, the Dow jumped 115 pts to 26585 amid speculation the Federal Reserve will reinforce its dovish message during the 29-30 July FOMC meeting and lawmakers continued coronavirus stimulus negotiations. So far, over 130 S&P 500 companies had reported earnings, with 80% beating analyst expectations and investors are bracing for the the busiest of the corporate earnings season this week as McDonald’s, Pfizer, Alphabet, Apple and AMD are among the companies slated to release their latest 2Q20 results.

Malaysia. KLCI inched up 1.9 pts to 1591.5, thanks to a rush for Top Glove and Hartalega in the final minutes of trading. The index fell as much as 4.4 pts intraday amid falling banking stocks due to worries that Malaysia will re-introduce CMCO should the covid-19 cases return to triple digits and news that the banking sector is estimated to see losses of RM6.4bn during the loan moratorium period, and whether the six-month moratorium will be extended beyond September.

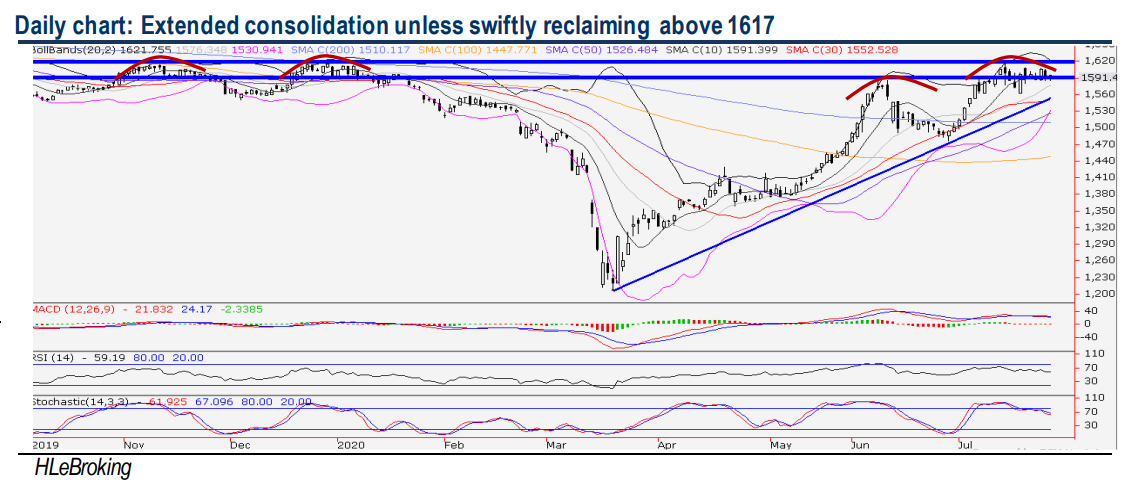

TECHNICAL OUTLOOK: KLCI

After hitting a 6M high at 1617 (14 July), KLCI was locked in a 46-pt range bound consolidation within 1563 (17 July low) and 1609 (20 July) levels before ending at 1591 yesterday. Unless a successful breakout above 1617 neckline resistance, current consolidation mode would prevail to neutralize overbought technical momentum for a more sustained uptrend going forward. Breaking this hurdle would open the door for higher targets at 1641 (weekly upper BB) and 1679 (200W SMA) zones. On the flip side, a sharp fall below 1563 would witness the index to revisit 1552 (30D SMA) and 1526 (50d SMA) territory.

MARKET OUTLOOK

In the short term, rotational buying interests in the technology, covid-19 winners and GLClinked stocks are expected to sustain the trading activities and strong volume in the local equity market (average RM5.2bn value in July vs YTD RM3.4bn), thanks to the choppy markets triggered by the Covid-19 news, tit-for-tat actions between the US and China, domestic political uncertainty, expectations of a bleak Aug reporting season valuation and growing speculation about GE15 by end 2020. Unless a successful breakout above 1617 neckline resistance, current consolidation mode would prevail to neutralize overbought technical momentum for a more sustained uptrend going forward. Breaking this hurdle would open the door for higher targets at 1641 (weekly upper BB) and 1679 (200W SMA) zones. On the flip side, a sharp fall below 1563 would witness the index to revisit 1552 (30D SMA) and 1526 (50d SMA) territory.

Source: Hong Leong Investment Bank Research - 28 Jul 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024