Telekom Malaysia - A Prime Beneficiary of 5G Rollout

HLInvest

Publish date: Tue, 28 Jul 2020, 09:44 AM

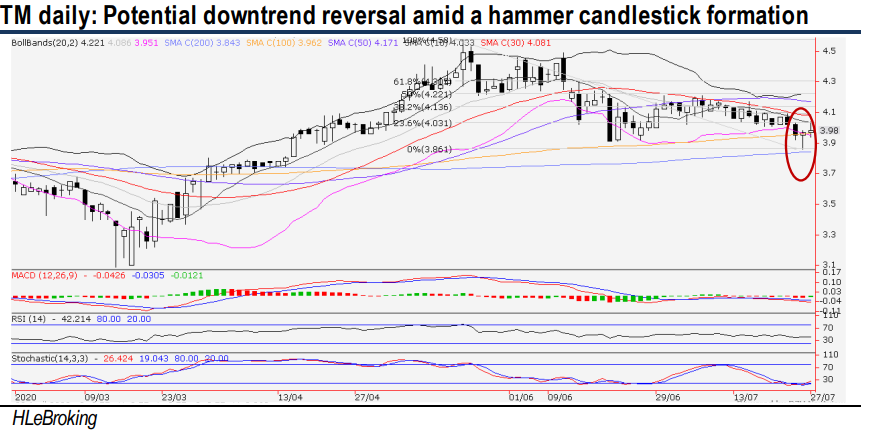

Anticipate a steady 9% EPS CAGR growth for FY20-22. HLIB Research maintains a BUY rating with a DCF-derived fair value of RM5.17 (+29.9% upside), supported by an undemanding 17.5x FY21 PE (31.5% lower than peers) and a steady 9% EPS CAGR for FY20-22. In the long run, we are upbeat on its cost optimization measures and expect TM to be a prime beneficiary of 5G rollout. Technically, the stock is poised for a downtrend reversal to retest RM4.09-4.58 upside targets, after tumbling 13% from a 52-week high of RM4.58, while downside risk is cushioned near RM3.80-3.86 zones. Cut loss at RM3.75.

Potential downtrend reversal amid hammer pattern. After falling 15.7% from the 52-week high of RM4.58 to RM3.86 (24 July), TM staged a technical rebound to end at RM3.98 yesterday. In the wake of a hammer candlestick formation and bottoming up indicators, we expect the stock to recapture above the key 20D SMA resistance at RM4.09 soon. A successful breakout will send share price higher towards RM4.22 (50% FR) before reaching our LT objective at RM4.58. Supports are pegged at RM3.86 and RM3.80. Cut loss at RM3.75.

Source: Hong Leong Investment Bank Research - 28 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-24

TM2024-07-24

TM2024-07-24

TM2024-07-23

TM2024-07-23

TM2024-07-23

TM2024-07-22

TM2024-07-22

TM2024-07-22

TM2024-07-19

TM2024-07-19

TM2024-07-19

TM2024-07-19

TM2024-07-19

TM2024-07-19

TM2024-07-18

TM2024-07-18

TM2024-07-18

TM2024-07-18

TM2024-07-17

TM2024-07-17

TM2024-07-17

TM2024-07-17

TM2024-07-17

TM2024-07-16

TM2024-07-16

TM2024-07-16

TM2024-07-16

TM2024-07-16

TM2024-07-16

TM2024-07-16

TMMore articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024