Traders Brief - Bye-bye 1500 Support Amid Wall St's Rout

HLInvest

Publish date: Fri, 04 Sep 2020, 11:43 AM

Global. Tracking higher Wall St overnight, Asian markets rallied in the morning session but the gains were surrendered in the afternoon amid rising fears of a resurgence of Covid-19 cases following WHO’s warning of a possible new coronavirus wave this winter coupled with heightened US-China tension due to rising retaliations between the world's two biggest economies.

Despite lower weekly jobless claims and positive progress in vaccine development, technology, and other high-flying stock sectors suffered steep losses following an extraordinary rally since the Covid-19 bottom in March as investors have been encouraged by central bank infusions of credit into struggling economies and hopes for a vaccine to end the coronavirus pandemic. The Dow slid 808 pts at 28292 (still surged 55% from 18213 low) whilst both the S&P 500 slumped 126 pts at 3455 (+58% from 2192 low) and Nasdaq Composite stumbled 598 pts to 11458 (+73% from 6631 low).

Malaysia. In a seasonally weak September outing (KLCI tumbled ~1.7% from 2000 -2019) and domestic political uncertainty (ahead of the 26 Sep Sabah state election), KLCI plunged 22.1 pts to 1515.4, mainly led by selling spree in glove makers, utility and banking stocks. Trading volume reduced 2.2bn to 9.4bn shares worth RM5.4bn against Wednesday’s 11.6bn shares valued at RM5.4bn. Market breadth was bearish with losers 873 thumped 315 gainers.

Yesterday, local retailers were the sole buyers (RM298m) whilst foreigners and local institutional investors sold RM152m and RM146m equities, respectively. YTD, foreigners net sold RM20.86bn shares compared with net purchases by local institutional funds (RM10.0bn) and retailers (RM10.84bn).

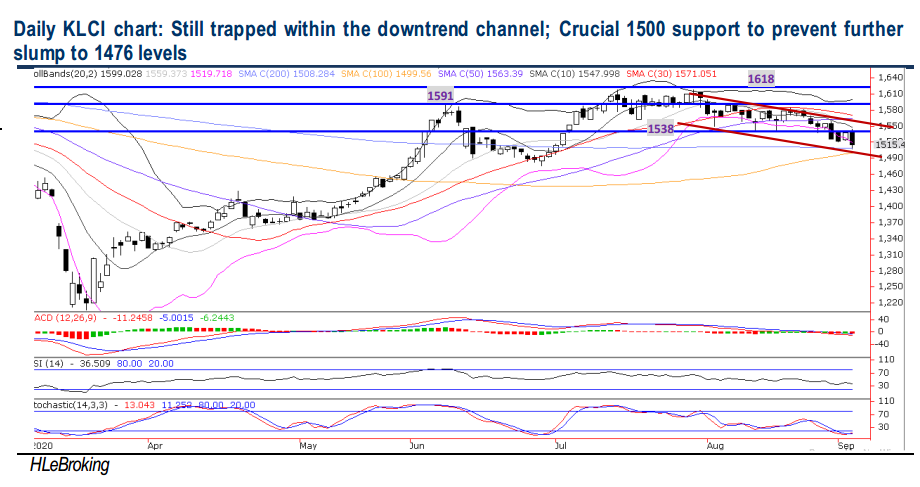

TECHNICAL OUTLOOK: KLCI

KLCI is currently trapped in a downtrend channel after sliding 103 pts from the YTD peak of 1618 (28 July) to 1515 yesterday. Tracking the overnight slump on Wall St and the bearish engulfing pattern, we expect KLCI to test the critical 1508 (200D SMA) and 1500 support territory. Failure to hold at 1500 would signal that the index is ready to head further southbound towards 1476 (29 June low) and 1460 levels. On the contrary, KLCI must overcome immediate 1538-1548-1564 (upper channel) resistance zones to resume upward momentum at 1591-1600 levels.

MARKET OUTLOOK

We reiterate KLCI to extend its range bound consolidation mode in a seasonally weak September outing, compounded by domestic political uncertainty (ahead of the 26 Sep Sabah state election), the resurgence of Covid-19 cases in global hotspots, escalating US China geopolitical tension coupled with a volatile Wall St amplified by worries about a Covid-19 resurgence in the fall and winter, the stalemate in Congress over additional pandemic aid coupled with heightened political uncertainty ahead of the US presidential election on 3 Nov. Key supports are situated at 1509-1500-1476 whilst resistances are pegged at 1538-1548-1564 levels.

VIRTUAL PORTFOLIO POSITION-FIG1

In the wake of the market uncertainty, we took profit on ARMADA (13% gain) yesterday.

Source: Hong Leong Investment Bank Research - 4 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024