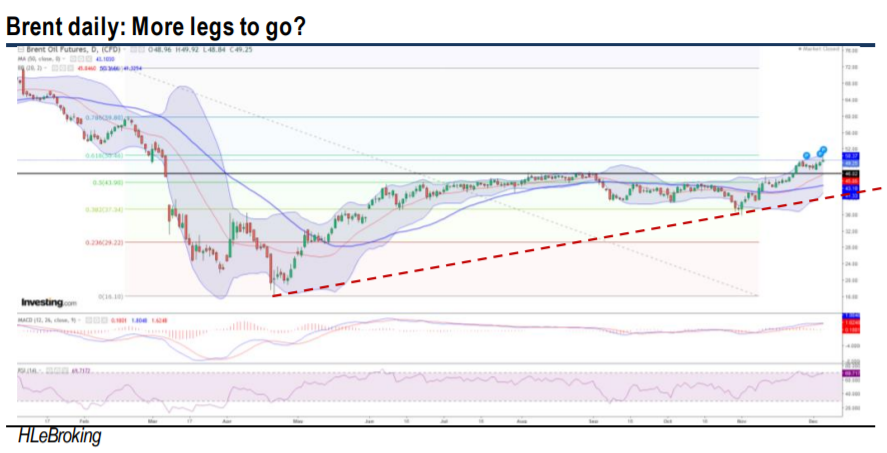

Technical Tracker - Brent Crude Oil - Upside bias towards USD50-56 zones following bullish neckline breakout

HLInvest

Publish date: Mon, 07 Dec 2020, 09:09 AM

In anticipation of healthy demand outlook, Brent continued to grow USD0.9 or 2% in 1-4 Dec on top of a whopping 26.7% rally in Nov (4QTD: +15%, YTD: - 24.2%). The surge was mainly driven by: (i) OPEC’s commitment to stabilise oil prices after slashing output by 500k bpd last week to 7.2m effective Jan 2021 (vs 2m originally planned), (ii) recent Covid-19 vaccines’ optimism, (iii) buoyant crude oil demand from China, (iv) decreasing US crude oil inventories and (v) more Covid-19 fiscal stimulus (may weaken the greenback and bode well for USD-denominated crude oil). Barring a breakdown below the crucial USD46 neckline, we expect oil prices to gain further strength to USD50-56 territory in the coming weeks. HLIB Research top picks for the sector are Armada (HLIB Research TP RM0.65) and Serbadk (HLIB Research TP RM2.50) which are more insulated from the volatility in oil prices and less-dependent on Petronas’ capex spending.

LT uptrend toward USD50-56 levels remains intact. After nose-diving 77.7% from YTD high of USD71.75 (8 Jan) to USD 15.98 (22 Apr), Brent oil prices have been steadily firming up to refill the USD38.3-45.2 gap (9 Mar) and break the critical neckline resistance near USD46 before closing at USD49.2 last Friday. Barring any breakdown below the immediate USD48 and USD46 supports, Brent is likely to advance further towards USD50.5 (61.8% FR) and USD53.8 (100W SMA) levels before hitting our LT target at USD56.5 levels (120W SMA), helped by improving sector landscape and bullish technical readings.

Ripe for a pullback. After rallying 73.8% from RM0.21 (2 Nov) to RM0.365, Armada’s share prices may face some imminent pullback amid the Doji star patterns and steeply overbought indicators. Stiff resistances are RM0.385 (4 Dec high), RM0.40 and RM0.48 (200W SMA). Key supports are pegged at RM0.34 (upper BB), RM0.30 and RM0.28 (mid BB).

Bullish breakouts. Following the bullish 200D SMA (RM1.70) and RM1.78 neckline resistance breakouts last Friday, the stock is likely to advance further towards RM2.00, RM2.16 (76.4%v FR) and RM2.32 (monthly upper BB) resistances. Key supports are situated at RM1.78, RM1.70 and RM1.59 (38.2% FR).

Source: Hong Leong Investment Bank Research - 7 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024