Homeritz Corporation - Value resurfaces

HLInvest

Publish date: Wed, 20 Jan 2021, 11:02 AM

HOMERIZ risk-reward profile is attractive after sliding 28% from an all-time high of RM0.89 to RM0.64 yesterday, supported by undemanding valuations of 7.9x (ex NCPS of 19sen) FY21E P/E and 1.08x P/B (22% below peers). The group is expected to ride on the promising industry outlook, boosted by: 1) structural demand shift on the US-China trade tension; 2) pent-up demand for furniture amid the work-from-home (WFH) trend; and 3) sustainable margins on price reviews and improved utlisation despite growing pressures from stronger RM and higher raw material prices. Meanwhile, as an ODM manufacturer, it provides HOMERIZ with a better competitive advantage due to superior cost control from its integrated manufacturing operations and its in-house R&D team.

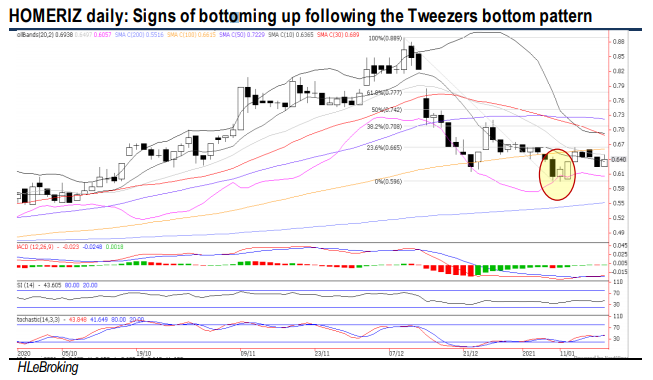

Signs of bottoming up following the Tweezers bottom formation. After hitting an all-time high of RM0.89 (9 Dec), HOMERIZ share prices slipped 28% to close at RM0.64 yesterday. Following the formation of the Tweezers bottom, the stock is poised for a potential downtrend reversal as technical indicators are on the mend. A decisive breakout above RM0.665 (23.6% FR) will spur prices higher towards RM0.71 (38.2% FR) before advancing further to our LT objective at RM0.78. Key supports are situated near RM0.595 (Tweezers bottom on 8 &11 Jan) and RM0.58 (200W SMA). Cut loss at RM0.57.

Source: Hong Leong Investment Bank Research - 20 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|