Asia Poly Holdings - Bullish Downtrend Line Breakout

HLInvest

Publish date: Wed, 24 Feb 2021, 06:11 PM

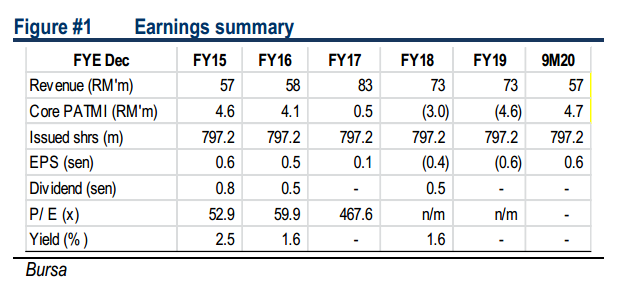

Being one of Asia’s largest cast acrylic producers, ASIAPLY is positive of its 4Q20 results and long term prospects (we note its 9M2020 results was the best in the last 5 years), supported by sound balance sheet (with netcash of RM32m or NCPS of 4sen) and upbeat orders from the new American and European customers (the two largest in the world) as it rides on growth opportunities presented by the US-China trade war and the Covid-19 pandemic. Beyond Covid-19, ASIAPLY is eyeing another promising business opportunity in the booming automotive industry due to the unique characteristics cast acrylic products (eg versatility, flexibility, durability and optical clarity) as manufacturers aim to make cars as lightweight as possible. Also, its proposed diversification in into renewable energy business (via 80% stake in Dolphin Biogas) offers a new stream of recurring income whilst the proposed acquisition of 30% in competitor GB Plas provides a strong synergistic growth in terms of market positioning, capacity allocations and R&D.

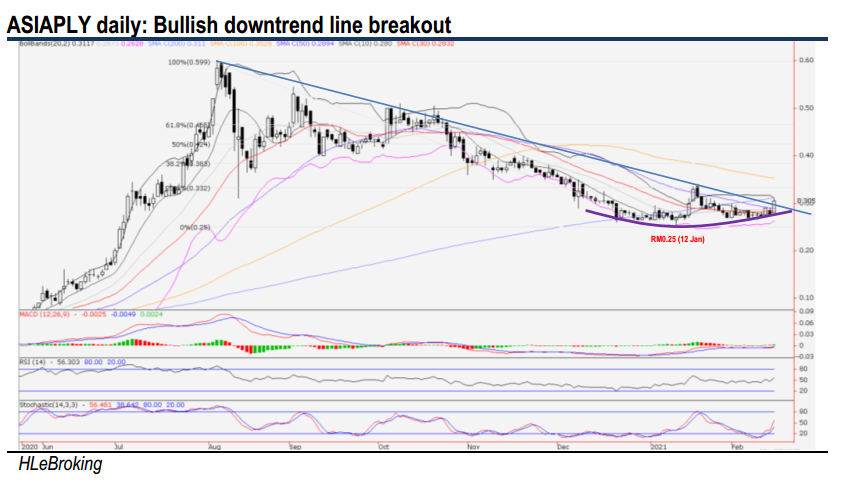

Bullish downtrend line breakout. After tumbling 58.3% from RM0.60 (all-time high on 5 Aug) to a low of RM0.25 (12 Jan), ASIAPLY has formed a saucer bottom before staging a bullish downtrend line breakout (near RM0.295) to close at RM0.305 yesterday. We believe this crossover may have enhanced the near term bullish bias, underpinned by robust volume of 22m shares traded (vs 90D avg of 16.3m) and bullish technical indicators. A successful breakout above RM0.33 (23.6% FR) barrier will lift share prices higher towards RM0.38 (38.2% FR) and our LT target at RM0.42 (50% FR). Meanwhile, key supports are situated at RM0.29 (50% FR) and RM0.28 (10M SMA). Cut loss at RM0.265.

Source: Hong Leong Investment Bank Research - 24 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|