Asia Poly Holdings - Positive Cast Acrylic Sheet Outlook; Bullish Triple Bottom Formation

HLInvest

Publish date: Wed, 24 Mar 2021, 10:08 AM

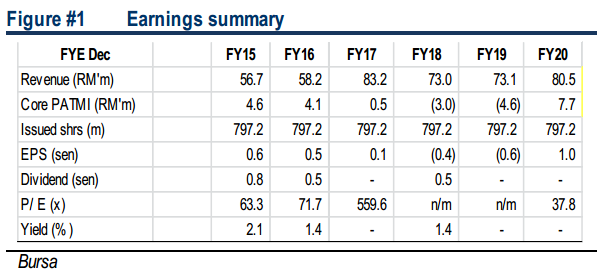

Being one of Asia’s largest cast acrylic producers, ASIAPLY is positive of its mid to long term prospects, underpinned by a 6.4% 2019-2024 CAGR to USD4.1bn (riding on the new application of the acrylic sheet as well as trade diversions amid a prolonged US-China trade war), sound balance sheet (with NCPS of 5.1sen or 14% to share price) and upbeat orders from the US (12% to FY20 sales) and Europe (9%) markets. Beyond Covid-19, ASIAPLY is eyeing another promising business opportunity in the booming automotive industry due to the unique characteristics cast acrylic products (e.g. versatility, flexibility, durability and optical clarity) as manufacturers aim to make cars as lightweight as possible. Also, its proposed diversification into renewable energy business offers a new stream of recurring income whilst the proposed acquisition of 30% in competitor GB Plas provides a strong synergistic growth in terms of market positioning, capacity allocations and R&D.

Bullish triple bottom formation. After tumbling 58.3% from RM0.60 (all-time high on 5 Aug) to a low of RM0.25 (12 Jan), ASIAPLY has formed a triple bottom pattern before staging a bullish neckline resistance breakout above RM0.345 on 15 March. With prices trading above all its SMAs and supported by heavy traded volume of 35m shares (vs 3M average 18m), we expect higher prices ahead to retest RM0.40 (16 March high). A successful breakout above this hurdle will spur share prices higher towards RM0.44 (triple bottom objective) and our LT target at RM0.51 (8 Oct 2020 high). Meanwhile, key supports are situated at RM0.345 and RM0.32 (100d SMA). Cut loss at RM0.31.

Source: Hong Leong Investment Bank Research - 24 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024