Automotive - Strong Rebound in March

HLInvest

Publish date: Thu, 22 Apr 2021, 09:09 AM

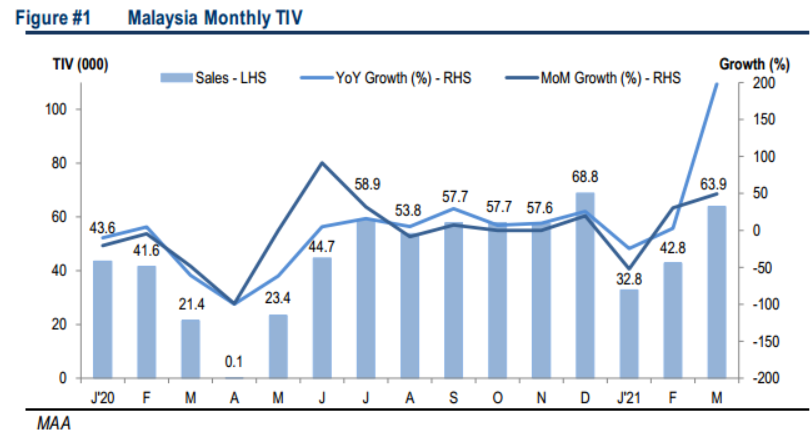

Mar 2021 TIV rebounded strongly +198.2% YoY and +49.3% MoM to 63.9k units, as productions and supplies normalised during the month with low base effect of MCO1.0 implementation in Mar 2020 and long holidays in Feb 2021. YTD TIV also improved +30.9% YoY. Note that Mar 2021 statistics lacks data from Mercedes, BMW, Mini, Peugeot and Scania. We maintain our 2021 TIV expectation at 585.4k units (+10.6% YoY), as we expect continued sales growth till Jun 2021 (driven by the extended SST exemption measures) prior to slowdown in 2H2021. We reaffirm our OVERWEIGHT call on the automotive sector with a stock selective approach (national marque bias) in view of the sales recovery in 2021. Top picks are MBMR (BUY; TP: RM5.70), DRB (BUY; TP: RM2.77) and Sime Darby (BUY; TP: RM2.68).

Malaysian Automotive Association (MAA) reported a strong rebound in Mar 2021 to 63.9k units (+198.2% YoY; +49.3% MoM), as the industry benefited from SST exemption measures and coupled with low base effect of MCO1.0 implementation in Mar 2020 and long holidays in Feb 2021. YTD TIV also improved +30.9% YoY, mainly due to low base effect from the implementation of MCO 1.0 in mid-March 2020. At current juncture, we are maintaining our TIV expectations of 585.4k units for 2021, a growth of +10.6% YoY, as we expect continued sales growth towards Jun 2021 driven by the extension of SST exemptions (car prices have reduced 2-7%; paultan.org) to 30 Jun 2021 before slowing down in 2H2021. National marques Proton and Perodua continued to perform strongly driven by attractive new launches. We expect both Proton and Perodua to continue outperforming non-national marques.

With the broader recovery in demand as consumer sentiment improves with the progress of vaccination program and transition to CMCO/RMCO, we maintain our OVERWEIGHT rating on the sector with a stock selective approach with 4 BUY and 3 HOLD recommendations. Our top picks include MBMR (BUY; TP: RM5.70), DRB (BUY; TP: RM2.77) and Sime Darby (BUY; TP: RM2.68). MBMR continues to leverage onto the strong performance of Perodua and benefits from strong cash flow and dividend yield, while DRB leverages onto Proton’s strong growth. We also like Sime Darby for its strong balance sheet and exposure to the China market rebound.

Source: Hong Leong Investment Bank Research - 22 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-12

DRBHCOM2024-11-12

DRBHCOM2024-11-12

SIME2024-11-12

SIME2024-11-12

SIME2024-11-11

DRBHCOM2024-11-11

SIME2024-11-08

DRBHCOM2024-11-08

DRBHCOM2024-11-08

SIME2024-11-08

SIME2024-11-08

SIME2024-11-07

SIME2024-11-07

SIME2024-11-07

SIME2024-11-06

DRBHCOM2024-11-06

SIME2024-11-06

SIME2024-11-06

SIME2024-11-05

DRBHCOM2024-11-05

DRBHCOM2024-11-04

DRBHCOM2024-11-04

SIME