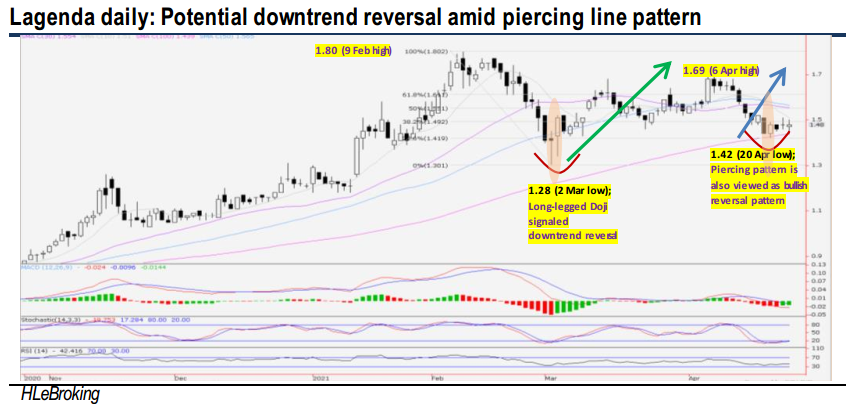

Lagenda Properties - A Hidden Gem in the Affordable Home Segment; Bullish Piercing Line Pattern

HLInvest

Publish date: Mon, 26 Apr 2021, 08:53 AM

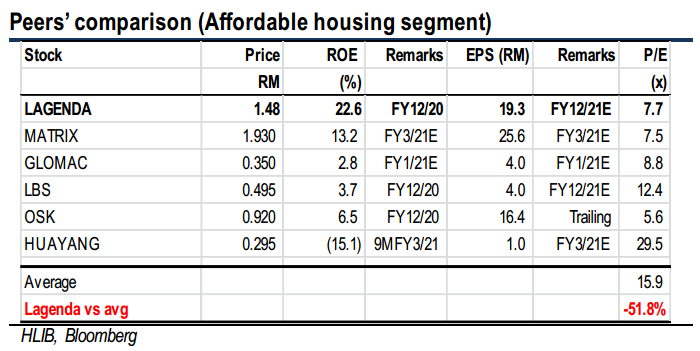

Lagenda is a Perak-based property developer that focuses on affordable housing in self-sustaining townships in Sitiawan, Teluk Intan and Tapah. It is also seeking to venture outside of Perak via townships in Sungai Petani, Kedah as well as Pahang in the near future. While other property developers have been struggling with inventories overhangs and increasing demand for affordable housings, Lagenda is thriving in the current climate amid its affordable houses at ~RM200K/unit targeting at the B40 and M40 income groups, and has a defensive customer profile of public servants who are less susceptible to economic cycles. We like Lagenda for its strong take-up, fast project turnaround, and superior net margins (averaging 24% from FY21-23) given the low land cost (well below 10% of GDV). Currently, the stock is trading at FY21 FD P/E of 7.7x (7.3x if ex-NCPS 6sen; vs peers 15.9x), supported by FY21 dividend yields of 3.9% and superior ROE of 25.2% coupled with a remaining GDV of RM4.1bn to be developed for the next 5 years.

Potential downtrend reversal amid the piercing line pattern. After tumbling 16% from RM1.69 (6 Apr high) to a low of RM1.42, Lagenda has formed a piercing line candlestick pattern near the 100D SMA uptrend line. A close above the RM1.51 (10D SMA) will be positive for the stock to retest RM1.55 (50% FR) and RM1.69 levels before advancing further to our LT target at RM1.80. Key supports are pegged at RM1.42 and RM1.38 (2 Mar closing). Cut loss at RM1.34.

Source: Hong Leong Investment Bank Research - 26 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024