Technical Tracker - Lagenda Properties - Sustainable business model to overcome challenges

HLInvest

Publish date: Wed, 07 Jul 2021, 09:55 AM

Lagenda Offers Economical & Affordable Landed Homes (equipped With Community Facilities & Public Amenities) for the Underserved Housing Markets to Cater to the Mass B40 and M40 Income Groups. This Sustainable and Scalable Business Model Has Transformed the Perak-based Property Developer (with Self-sustaining Townships in Sitiawan, Teluk Intan and Tapah) to Expand Its Foray Into Sungai Petani (Kedah), Kuantan (Pahang) and Mersing (Johor).

We like Lagenda for its exposure to the underserved affordable housing segment, defensive customer profile (public sector workers with government financing access), low land cost, high booking conversion rate and superior margins.

All in all, Lagenda has over the years displayed a remarkable track record, underpinned by solid FY20-23 EPS CAGR of 31%, attractive 5.4% FY22 dividend yield, superior FY22 ROE of 25.7%, and remaining GDV over RM6bn to be developed for the next 5-6 years. The stock is also trading at an undemanding 5.6x FY22 FD P/E (5.1x if ex-NCPS 12sen estimated for FY22), which is a steep 39% discount vs peers’ P/E of 9.2x.

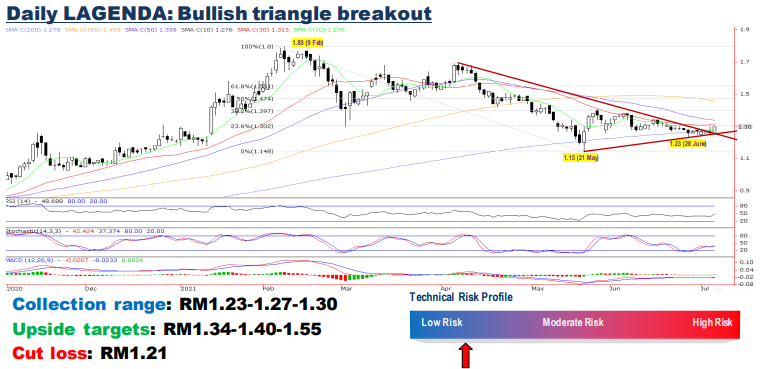

The bullish triangle breakout and a close above 200D SMA (RM1.27) with high volume (1.57m shares vs 20D average 0.7m) will spur the stock higher towards RM1.34-1.40- 1.55 levels, supported by bottoming up indicators.

Source: Hong Leong Investment Bank Research - 7 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|