Traders Brief - Potential Rebound Towards 1545-1556 Levels on Aggressive Vaccination Pace

HLInvest

Publish date: Fri, 16 Jul 2021, 09:48 AM

MARKET REVIEW

Global. Driven by better-than-expected China retail data and dovish comments by Powell, Asian markets ended mostly higher, offsetting the concern of a resurgence of Covid-19 cases due to the highly transmissible Delta variant. The Dow fell as much as 171 pts before staging a strong recovery to end +53 pts at 34987 as investors continued to mull on worries about high inflation and a recovery in the labour market (as US weekly jobless claims fall to 16M low) with ongoing upbeat 2Q21 upbeat earnings and reassuring comments from Powell that a recent jump in inflation as temporary.

Malaysia. KLCI jumped 8.5 pts to 1520.8, led by bargain hunting on the bashed-down glove and banking heavyweights. Sentiment was also boosted by the aggressive vaccination rollouts as another record high of 460k doses were administered yesterday (vs 7D average 385k), negating concern of another record high of 13215 new Covid-19 cases. Retail investors (-RM6m; 5D: -RM16m) joined local institutions (-RM64m; 5D: +RM96m) as major net sellers for the 3 rd day whilst foreign institutions were the net buyers (+RM70m; 5D: -RM324m) in equities.

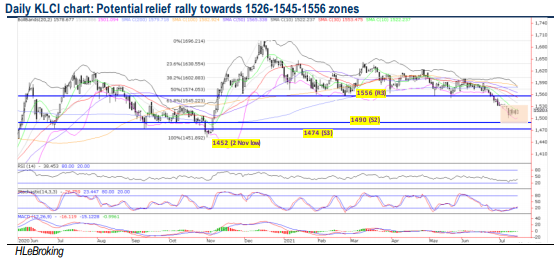

TECHNICAL OUTLOOK: KLCI

Following the slide on 8 July, the KLCI is still sitting within the 1501-1526 tight range and has failed to rebound despite being oversold. If a decisive breakout arises, it will open the door for further advance towards 1545-1556-1574 zones. Conversely, a decisive breakdown below 1500 will open the door for further selldown towards 1490-1474-1452 zones.

MARKET OUTLOOK

Despite the oversold relief rebound yesterday, the bears could still continue to control the market as long as the benchmark fails to clear above the key resistances situated at 1526- 1545-1556 levels successfully, in wake of the economic and corporate earnings risks amid the heightened Covid-19 situation. Nevertheless, significant fall is likely to be cushioned near 1490-1500 levels by the progressive vaccination rollouts, and about 12.8% of the nation's population were now fully inoculated with two doses (vs 4.4% a month ago). If the current pace persists, Malaysia is on track to achieve the herd immunity target at 80% of the population by end-2021.

On stocks selection, a successful breakout above downtrend line hurdle at RM4.13 will lift TOPGLOV (HLIB Research-BUY-TP RM6.66) share price higher towards the next barriers at RM4.26-4.58 levels (Supports: RM3.64-3.85), underpinned by bottoming up technicals. Likewise, the strong reclaim above 10d & 20d SMAs could spur SUPERMX (RM3.50, Notrated) share prices higher towards the next hurdles at RM3.65-3.95 levels. Strong supports are seen at RM3.20-3.33 zones.

Source: Hong Leong Investment Bank Research - 16 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-28

TOPGLOV2024-07-26

SUPERMX2024-07-26

TOPGLOV2024-07-25

SUPERMX2024-07-25

TOPGLOV2024-07-25

TOPGLOV2024-07-24

SUPERMX2024-07-23

SUPERMX2024-07-23

SUPERMX2024-07-23

TOPGLOV2024-07-22

SUPERMX2024-07-22

TOPGLOV2024-07-19

TOPGLOV2024-07-17

TOPGLOV2024-07-16

SUPERMX2024-07-16

TOPGLOVMore articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024