Technical Tracker - TENAGA: Set to Rebound Soon

HLInvest

Publish date: Thu, 21 Oct 2021, 09:24 AM

In line with China power crunch, TENAGA share prices had fallen 5.7% from a high of RM10.33 to RM9.76 yesterday. We continue to like TENAGA on the back of better utilities demand prospect that is driven by Malaysia’s transition into Phase 3 and 4 of National Recovery Plan.

We believe the risk-reward profile had turned attractive after recent weakness, underpinned by stable FY20-23 EPS CAGR of 5%, undemanding valuations of 11.3x FY22E (-28% vs 5Y mean 15.7x) and 1.01x P/B (-22% vs 5Y mean 1.3x) coupled with attractive DY of 5.1% for FY21-22. As such, we reckon the current sell down is mainly driven by the sentiment, and recent weakness in share prices provides a great opportunity to accumulate the stock as a recovery proxy.

Despite lingering fear that the recent surge in power energy would impact TENAGA in terms of electricity generation cost and demand for the utilities, we nonetheless are not overly concerned as the Imbalance Cost Pass-Through (ICPT) mechanism will allow TENAGA to transfer the fluctuation risk of fuel energy cost to end-users or be compensated by the government. With the hike in energy cost, we expect a potential surcharge of RM7.6bn in 1H22 to be pass-through. Hence, TENAGA is deemed to be neutral from the hike in energy cost. Going forward, TENAGA will continue to leverage into its power business through focusing its RE investment and will not undertake any new coal-fired power plant development, this is in line with the government pledge.

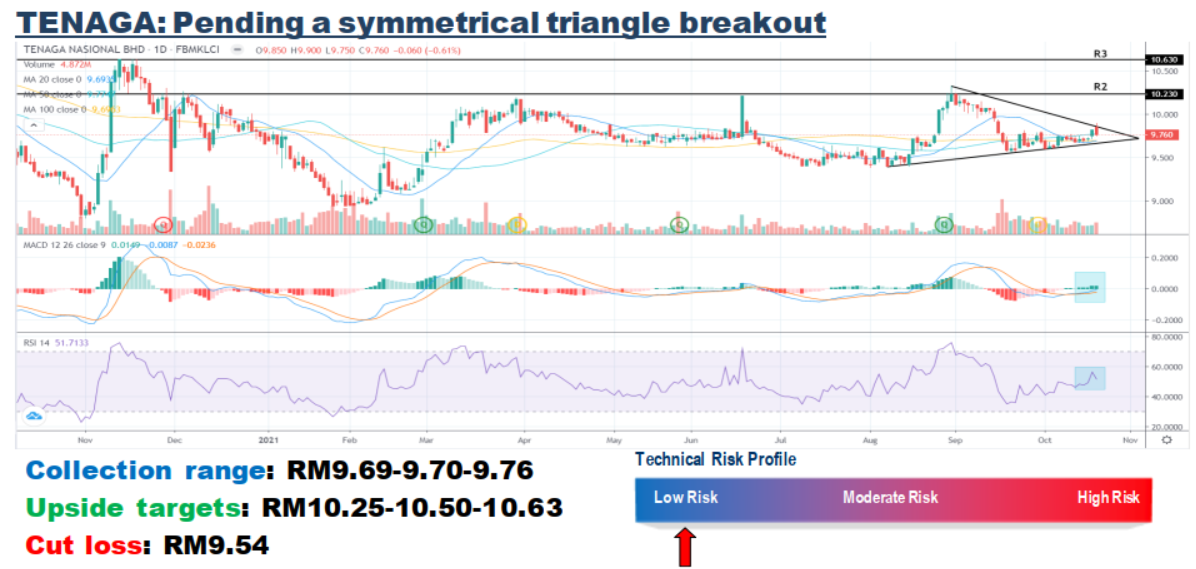

Technically, TENAGA is poised for symmetrical triangle breakout (RM9.85). A successful breakout will spur the prices toward RM10.23 before reaching our LT targets of RM 10.63. Cut lost at RM9.54.

Source: Hong Leong Investment Bank Research - 21 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA