Technical Tracker - Cengild: Stomach for Growth

HLInvest

Publish date: Wed, 24 Aug 2022, 09:05 AM

Specialised healthcare service provider. Cengild Medical Berhad (CENGILD) is a healthcare service provider, providing tertiary care and specialising in diagnosing and treating gastrointestinal and liver diseases and obesity. It also provides other medical services, including the diagnosis and treatment of selected gynecology, urology, and oncology-related conditions, as well as general cardiology assessments. Majority of CENGILD’s patients are local patients, accounting for 95.3% of its revenue in FY20, while foreign patients contribute the remaining 4.7%

Riding on the growing prevalence of obesity. Obesity is among the factors that could raise the risk of a person developing gastrointestinal diseases and disorders, and the prevalence of obesity among Malaysians above the age of 18 has been on an increasing trend, from 15.2% in 2011 to 19.7% in 2019. According to the 2019 National Health and Morbidity Survey, Malaysia also has the highest prevalence of obesity among adults in Southeast Asia, with 50.1% of Malaysian adults reported to be overweight. This, in our view, allows CENGILD to capture and serve the growing market (c.4.3% market share in FY21).

Private healthcare, a growing pie. Generally, healthcare services in Malaysia is a two-tiered system, categorized as public and private healthcare service, with the former making up 46-49% market share while the latter making up 51-54% market share. On top of the growing population that serves as a baseline growth for private healthcare services, the better access and increasing availability of medical insurance packages in Malaysia can help to reduce reliance on out-of-pocket spending (73.6% of the source of financing in private healthcare) and encourage the transition from public to private healthcare services. Protégé projects the Malaysia private healthcare sector to grow at a 4-year CAGR of 9.5%.

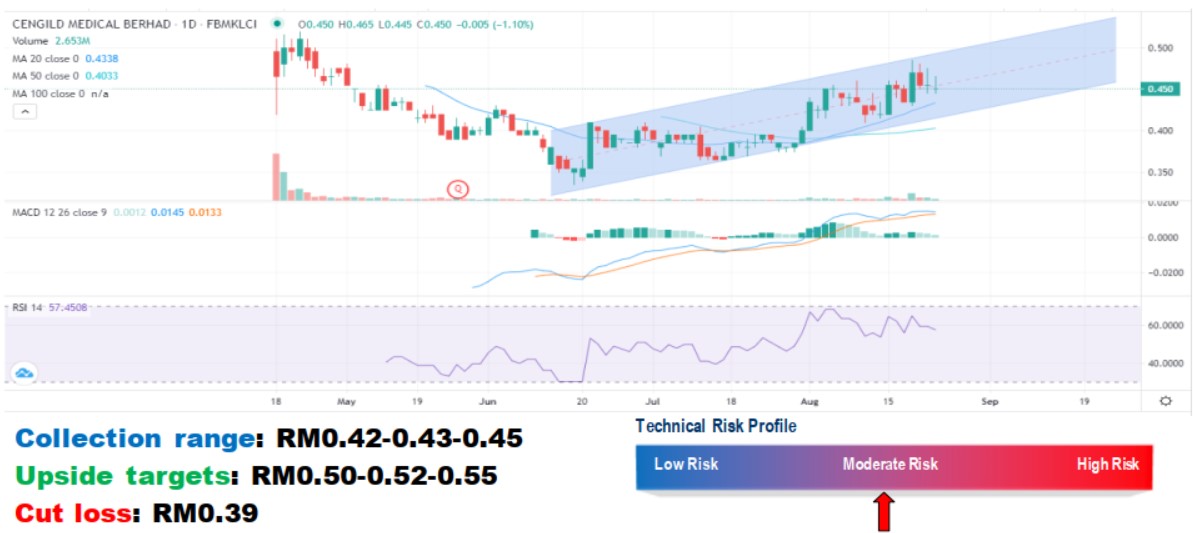

Trading near uptrend support. Technically, CENGILD is trading near its uptrend channel support of RM0.42-0.45. In the wake of the higher high pattern, a decisive breakout above RM0.48 will spur prices higher towards RM0.50-0.52-0.55 territory. Cut loss at RM0.39.

Source: Hong Leong Investment Bank Research - 24 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|