Technical Tracker - UMC: Rosy Outlook

HLInvest

Publish date: Thu, 03 Nov 2022, 09:32 AM

A medical devices distributor and manufacturer. Debuting on the ACE Market in July 2022, UMediC (UMC) is principally involved in the marketing and distribution of branded medical and consumable devices. UMC is the authorized distributor for well known medical device companies like Philips, GE, Merit, etc. UMC also ventured into the R&D and manufacturing of its own-branded medical consumables in 2011, with product series such as HydroX and Airdrox, which were commercialized in 2021 and June 2022. Bulk of the group revenue is generated from the marketing and distribution segment (82.8% in FY21), while manufacturing segment accounted for the rest.

Healthy demand outlook. UMC has indicated that there has been an increase in demand for automated external defibrillator (AED) after the government made it mandatory for all public facilities to have an AED installed on-site. With this, together with some newly launched products under UMC’s portfolio, we believe the group’s c.30% market share (limited to the existing category of medical devices that UMC supplies) for its distribution business will grow further. As at 4Q22, UMC’s current order book stood at c.RM10m (29% of FY21 revenue), evenly split between both the manufacturing segment and distribution and marketing segment.

AirdroX sales to grow further. In just one month after the Airdrox spacer (a type of Oxygen Therapy & Suction Solution) commercialized, the group’s 2nd own-branded product has generated RM360k worth of revenue in 4Q22 (reported till 31 July), with an estimated sales volume of c.30k units. The AirdroX spacer is supplied to hospitals and local pharmacies with an ASP of RM30 per unit. Given the different app roach applied for the production of AirdroX spacer (manufacturing of components outsourced to third party contract manufacturers while the assembly is done in-house), we believe it would be easier to ramp up the production of AirdroX. As own-branded products yield a better margin, we expect margin expansion once more own-branded products are presented.

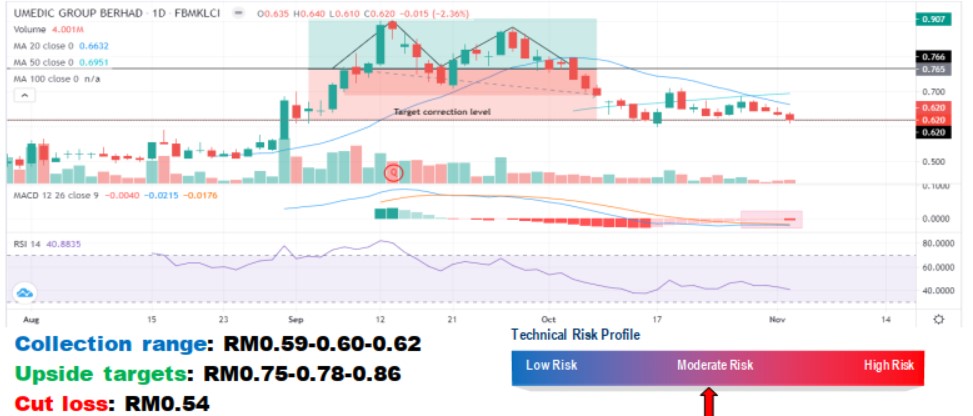

Time to rebound. After forming a double top formation and corrected to our envisaged RM0.62 support, UMC is slated for a technical rebound as indicators are on the mend. A successful breakout above RM0.70 immediate resistance will spur share prices toward RM0.75-0.78-0.86. Cut lost at RM0.54

Source: Hong Leong Investment Bank Research - 3 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|