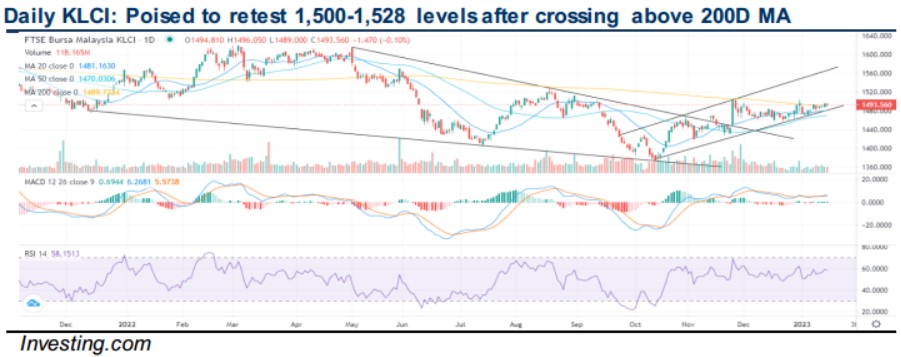

Traders Brief - Poised to Retest the 1,500-1,512 Zones After Crossing Above Key 200D MA Hurdle

HLInvest

Publish date: Tue, 17 Jan 2023, 09:32 AM

MARKET REVIEW

Asia/US. Asian markets extended their new year rallies as optimism over peak inflation and interest rates coupled with China’s reopening effect overshadowed the risk that the Bank of Japan might temper its super-sized stimulus policy at a pivotal meeting this week. Sentiment continued to be supported by the People’s Bank of China's move on injecting more liquidity into the banking sector, spurring hope for more stimulus plans to roll out going forward. Overnight, the Dow was closed due to the Martin Luther King holiday. After surging 672 pts or 2% WoW, investors will weigh whether the rally has gone too far given the outlook for inflation, growth, and earnings. This week, the spotlight will be on the World Economic Forum at Davos (16-20 Jan), PPI and retail sales (18 Jan), housing starts (19 Jan) and earnings reports for several major corporations (e.g. Goldman Sachs, Morgan Stanley, P&G, American Airlines, Netflix).

Malaysia. Bucking the regional trend, KLCI ended its three-day wining strike to close -1.4 pts at 1493.5, driven by persistent profit-taking activities against selected banking and plantation counters. Market breadth (gainers/losers ratio) deteriorated to 0.85 from 1.36 last Friday. Local institutions turned net buyers for a 6th consecutive session (RM122m, Jan: +RM336m) while local retailers (-RM61m, Jan: -RM303m) increased their net outflows for the 6th straight day ahead of the upcoming CNY. Meanwhile, after net buying RM44m from 12-13 Jan, foreigners (-RM61m, Jan: -RM33m) emerged as net sellers again.

TECHNICAL OUTLOOK: KLCI

As long as KLCI hold up above the support trend line (near 1,480) and 200D MA (1,489 now), we reckon the bulls would have the upper hand to retest 1,512-1,528 in the short term. Conversely, a decisive break down below the support trend line would trigger a selloff towards 1,454-1,468 zones.

MARKET OUTLOOK

We continue to see uptick bias in KLCI, supported by (1) improving technical outlook following a successful closing above 200D MA last Friday, (2) undemanding KLCI CY2023 valuation (12.5x P/E vs 10Y mean 16.9x), (3) low foreign shareholding (Dec 2022: 20.6% vs all-time low of 20.1% in Aug), and (4) hopes that OPR will peak at 3.25% as BNM is likely to raise rates by another 25 bps each during its Monetary Policy Committee (MPC) meetings on 19 Jan and 9 Mar. This, coupled with bets for the Fed for a rate-hike downshift on cooling inflation and China’s borders reopening momentum, we reiterate our view that KLCI will post back-to-back gains in January (resistance: 1,500-1,512-1,528).

VIRTUAL PORTFOLIO (FIG1)

Ahead of the upcoming CNY holidays (22-24 Jan), we took profit on ITMAX (7.6% gain), MYEG (5.9% gain) and KGB (5.4% gain) yesterday.

Source: Hong Leong Investment Bank Research - 17 Jan 2023