Technical Tracker - Unique Fire: Get Ready for the Second Wave

HLInvest

Publish date: Thu, 19 Jan 2023, 10:13 AM

A fire protection systems provider. Listed on the ACE market in Aug-22, UNIQUE is mainly involved in assembly, manufacturing and distributing fire protection systems, equipment and accessories. Having its in-house brand names (Unique, Unique 227, Unique 5112, Commander and Yama), as well as being an authorised distributor of well-known brands such as Keddie and Orient, UNIQUE has established a solid track record in supplying fire protection systems to public (MRT 1&2) and private sectors. The domestic market is UNIQUE’s bread and butter (98% of FY21 sales), with bulk of it derived from in-house brands (80.5% of the FY21 sales).

Recovering demand outlook. Recall that UNIQUE reported a two-year consecutive YoY earnings decline in FY21-22 due to the halt of construction activities following the Covid-19 outbreak. Given the sales to M&E and FPS contractors and FPS maintenance service providers accounted for 93.6% of UNIQUE’s FY21 sales, we understand that UNIQUE is dependent on the building construction and property development industries. Nonetheless, we believe the demand outlook is improving owing to increased construction activity amid the dissipating foreign labour shortage. According to the MOF's FY23 forecast, real GDP from the construction sector will grow by 4.7% YoY, aided by increased development expenditure allocation. We reckon the increased construction activity will drive the demand for UNIQUE’s products, as fire protection systems are critical products mandated by various bodies prior to the CCC.

Penetrating into Johor and Penang market. In anticipation of the new sales offices and warehouses to be commenced by 1H23 in Johor and Penang, UNIQUE would be able to deliver customers’ orders promptly and efficiently to penetrate into the said markets further. UNIQUE sees significant growth opportunities in Johor and Penang market (currently ranked about 3rd to 4th after Selangor and Kuala Lumpur) given the influx of FDI (predominantly in the semiconductor and data centre) to these two states.

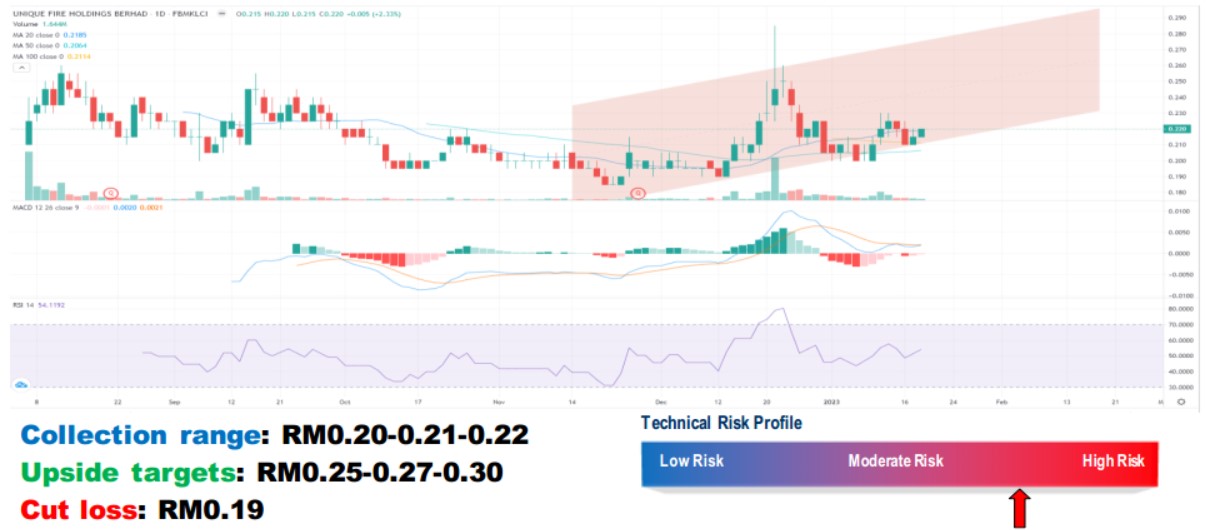

New wave on the making. With indicators on the mend, we anticipate UNIQUE to stage an imminent breakout above RM0.23 and advance further toward RM0.25-0.27- 0.30 levels, creating a higher high formation. Cut lost at RM0.19.

Source: Hong Leong Investment Bank Research - 19 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|