(IBanker) Masteel - The Big U-Turn From Now

IBanker

Publish date: Sun, 11 Mar 2018, 11:09 AM

Take a look at Masteel's price chart above, it has dropped rapidly in the last few days and finally being supported at RM0.955. I would conclude the three main reasons which led to the plunge of the share price, down to the far South, as follows:-

1. Trump Announces Tariffs on Steel & Aluminum Imports

2. Hidden Threat of the Emerging of Alliance Steel

3. Panic Selling - Heavy Margin Calls & Subscription Group Members Selling

Here are the reasons why the above would not cause a significant impact to MASTEEL and why a strong U-Turn should be expected:-

1. Malaysia's Exports to the US only took up 0.28%

According to the President of Malaysia Iron and Steel Industry Federation, Datuk Soh Thian Lai, the impact of the planned tariff on steel would be minimal because Malaysia only exported 96,000 tonnes to the US out of 34 million tonnnes in 2017. A consensus view on this - minimal impact to Malaysian steel companies can be found on local press release and research reports - google it.

2. Local Steel Market's Demand is Large Enough to Absorb this New Capacity

Domestic Steel demand is circa 10 tonnes per annum while the capacities of all rebar manufacturers locally are at 8.3mt per annum. Also, with the additional demand from the mega infrastructure development in place, this new capacity from Alliance Steel would have minimal pressure towards selling prices for 2018 - Kenanga Research says.

Source: https://www.thestar.com.my/business/business-news/2018/02/03/steel-recovery-seen-sustainable/

3. Good Buying Opportunity caused by Panic Selling

Based on some reliable source of information and data analysis, get to know that the huge drop in the share price of MASTEEL (dropped more than any other steel companies) is mainly due to margin calls by bankers, and partly due to the heavy sell calls issued by some subscription-based groups. These are known as irrational selling, and historically, all these moments provide a opportunity of value buy. Most importantly, most of them haven't bought back the share yet.

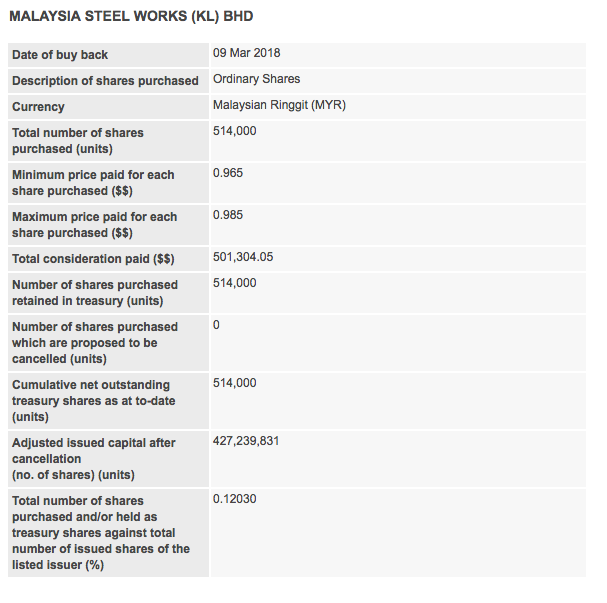

Last Friday, Masteel has announced on Shares Buy Back, bought back 514,000 units of shares between RM0.965 - RM0.985.

If you're a thinker and able to evaluate and analyze on the points above indepedently, I believe market does offer a golden opportunity at current point. Good luck!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on IBanker - Smell The Golden Opportunities

Discussions

ann joo directors are also buying back their shares. therefore, the rebar industry have already found a very strong support level

2018-03-11 14:10

China rebar price dropping. Parliament dissolve very soon. Be careful.

http://www.sunsirs.com/uk/prodetail-927.html

2018-03-12 08:08

Very good explaination and professional. So regret to pay for rm 1000 for the useless sifu who just know how to ACT SIFU. and just look at the sma 200 and 20. With thiz 200 and 20 then can collect rm 1000 and make a lot of subscriber losing money

2018-03-13 18:40

Soemtimes we have to blame ourselve. People who are real good in analysis are giving us info free yet we choose to pay the stupid useless con man

2018-03-13 18:42

- Dow Jones drop from around +100 to -249.

- China Rebar price keep dropping. Refer to link as below.

- Parliament dissolve very soon. Election coming soon.

http://www.sunsirs.com/uk/prodetail-927.html

BE CAREFUL

2018-03-15 08:22

JayC

yes, now the support level is at 0.96. can consider to pick up

2018-03-11 14:05