Bright- Is it Really Bright Enough

andyhard

Publish date: Sat, 22 Oct 2016, 08:52 PM

I have to thank for some bloggers for highlighting this share.

I just add on what I think personally. You may just take it as reference.

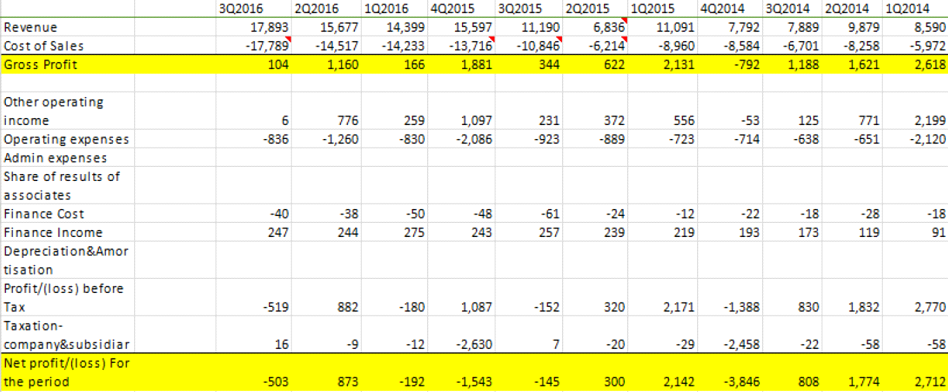

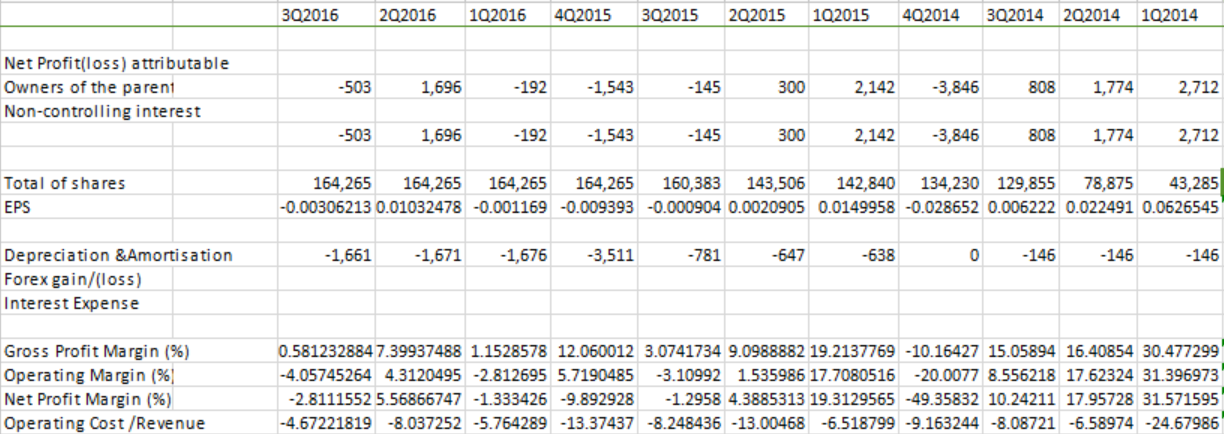

First, let's go thru some of the quarterly result

Notes and Observation:

1) From 3Q2015 onwards (April 2015), the two new machines to cater for the extra demand has started operation. Expected to double the revenue in FY2015. We can see increase in revenue from 3QFY15 onwards.

2) Gross profit has been fluctuating. Few reasons are there

(i) Depreciation has gone up from ~140K (FY14) to ~600K (FY15) to ~ 1.6mil (FY16)

(ii) Material cost. (if you check the balance sheet, inventory stay low at 7mil, it means they never do stock up when raw material such as aluminium is at low price, I will show you later)

(iii)Lower pricing to be more competitive. It is mentioned in FY2015 Annual Report.

3) Q4 of FY14 and FY15 has high taxation due to deferred taxation of 2.4mil and 2.6 mil compared to other quarter which is less than 100K. I suspect this is their account practice. Will Q4 FY16 repeat again?

4)No information on FOREX. But, based on management guide, strong USD is good for them as they have exported their goods.

Now, to invest or not invest? I have been cracking my head how to analyse such companies. I think I found some answers. Lets recall some of the signifcant events happen to the company AGAIN.

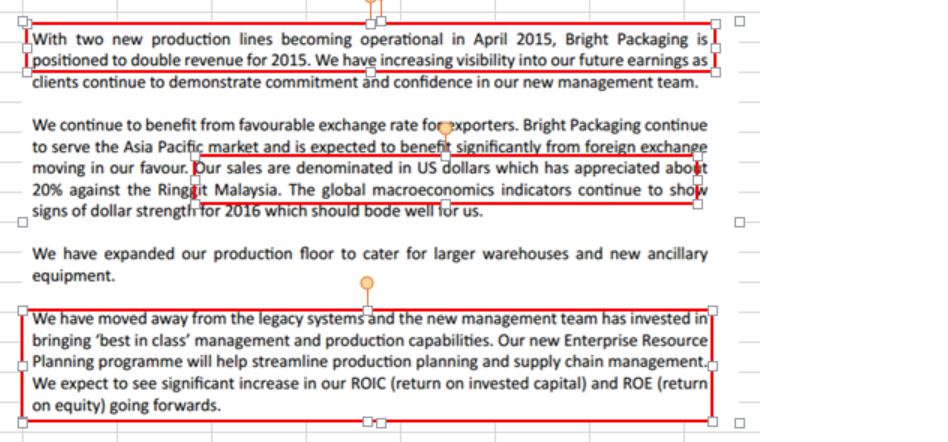

1) Bright has some real bright past until 2013 that Dato Ricky Wong has controlling power over the company and change the board of directors. 2 critical person sit on the board after the reshuffle. One is the past executive Chairman are redesignated as Deputy Executive Chairman (ENCIK NIK MUSTAPHA BIN MUHAMAD) and Mr Yeap Kok Eng, general manager in Bright and have been in companies for 16 years was designated as excutive director. I feel the new major shareholder is retaining some of the talent to lead the company instead of putting their own people.

2) Two new production lines has been installed and operated on April 2015.

3) ERP system has been upgraded to enhance the production planning and improve on ROIC as stated in 2015 Annual Report.

4) In Jan2015, they obtained a RM53mil contract with Zhao Philips Morris, Russia , a leading tobbaco manufacturer to supply the packaging material

My PERSONAL way of analyze this company

1) Industry

This is an industry full of competition. See below link. US has closed a number of factories and left a little due to China competition.

http://blog.alcircle.com/2016/08/31/u-s-aluminium-foil-industry-red-succumbs-chinese-competition/

If we look at how gross profit has been affected, we can get to know that not easy material cost pass thru.

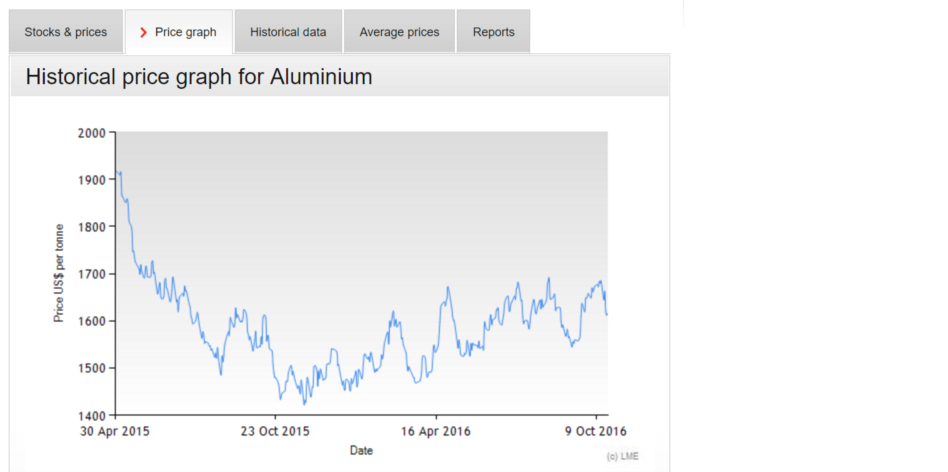

Look again at what is the current trend. Material cost of aluminium has been increasing. That s why you can see more and more local aluminium companies having strong profit such as LBAlum, PMetal. Aluminium price has been increasing from end of 2015 ~1400 to ~1600 in OCT 2016

http://www.lme.com/en-gb/metals/non-ferrous/aluminium/#tab2

2) Company competitiveness

- in tobacco and liquor as main stream of income (90% of revenue from tobacco industry) where barrier of entry is very high. Been 20 years of working relationship with some tobacco manufacturer. Higher profit margin as well.

-High quality aluminium converter (premium product). Another Hevea?

-Management has highlighted they would like to diversify more to non-tobacco industry.

3) Free Cash Flow.

- Good free cash flow of ~RM6 mil per year. ~3.6 sen per share

- Good cash on hand of RM35mil (21.3 sen per share)

Summary:

1) If Bright would like to stay competitive, they cant stay as there are. They need to be bigger to be more competitive in size just like TOPGLOVE and high in quality like HEVEA. The change of company top managment means a change in company direction. Company has become more aggressive in securing more contract and expansion as can be seen from their action- GOOD. The other main point is the top managment also have done some corporate exercie such as capital reduction in making the account looks good in retained earning. This is good point if they plan to declare dividen. I understand corporate exercise no value added but it boast investor sentiment.

2) Indusry wise it is still in blood cutting mode. We need to wait till more M&A happens and those not competitive should be ousted.

3) Bright still looking to diversity to rely less on tobacco industry. This will take time.

4) In conclusion, company has the issues solved. The managment is doing something. But, times needed to see the result. new production just operate a year. We need to have more time to see more.

| **Assuming 70mil revenue, net profit margin of 6%; Net profit would be 4.2mil. EPS is 2.5 sen and yet to include dilution effect |

| ** AT price of 0.37; the PE would be 14.8. It is not cheap the only catalyst is the corporate exercise and high dividen from high cash pile |

Before I end, look at TA. I believe some consolidation will happen. We need to see some sign of strength before confirm a reversal will happen

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|