Mudajaya - Last String of Hope?

andyhard

Publish date: Thu, 01 Dec 2016, 06:53 PM

Mudajaya in loss AGAIN !!!

Most minority shareholders are scratching their head and wonder is there any more hope? When is the power generating unit in India going to operate? WIll the price continue to dive? What shall I do?

Be calm..go through the picture and only decide. Not BIG picture..just medium size would do.

Let's go through the pain before we go to the sweetening side.

A) PAIN

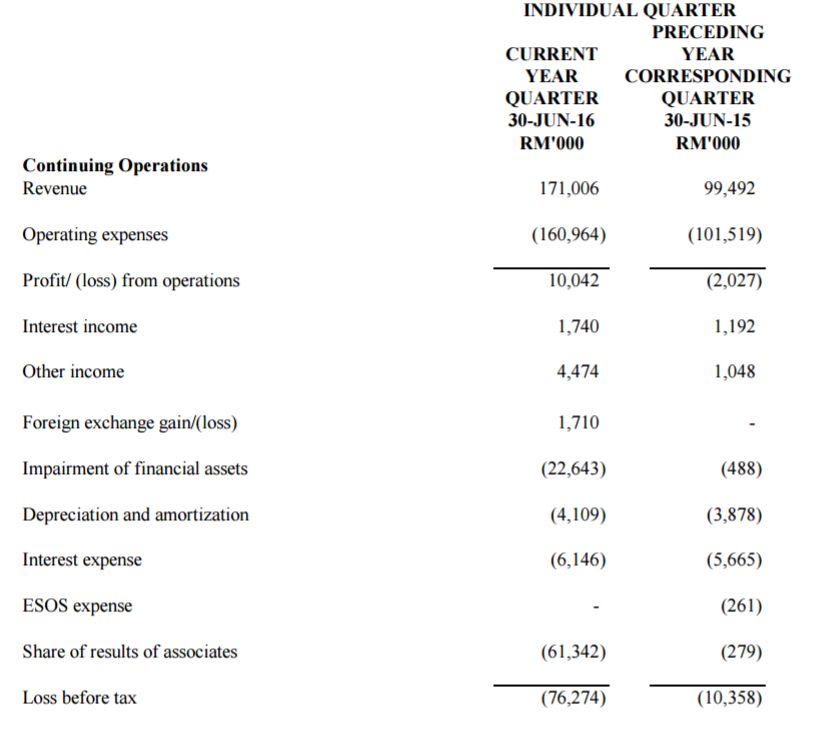

Let's review the 2Q of FY16.

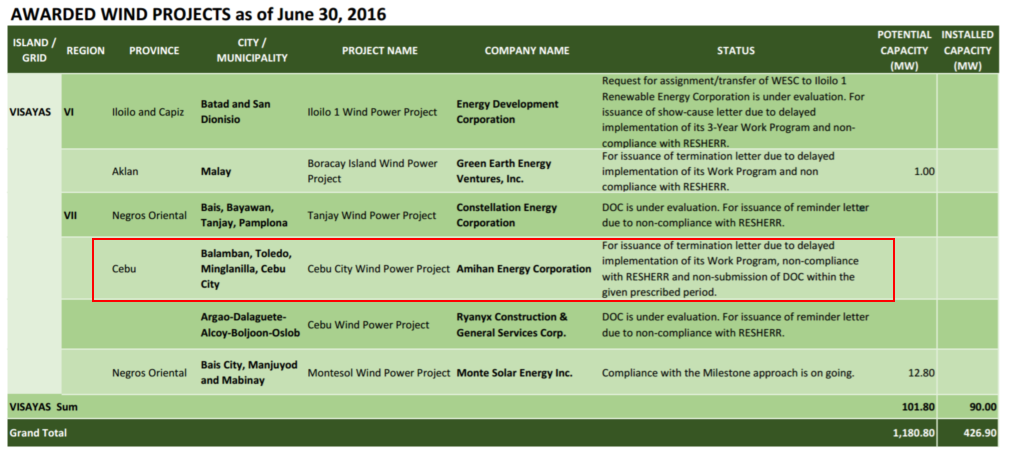

There is an impairment of financial assets of RM22.64 mil. What is this figure about? It is the Wind Project in Cebu, Philipines. Why do they write it off then?

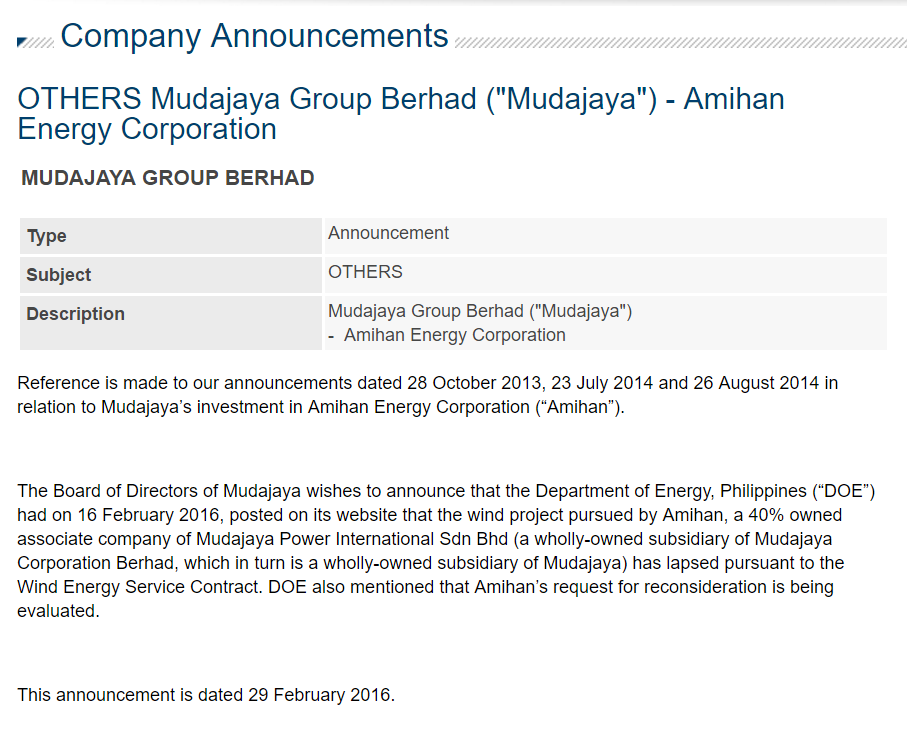

You might miss this out if you do not read company annoucement often. Company has announced on 29 Feb 2016 that they (40% owned Amihan Energy) have lapsed the service contract.

As of June 2016 the status by the Energy Department of Philipines has showned that it had been terminated. This is why they have written it off.

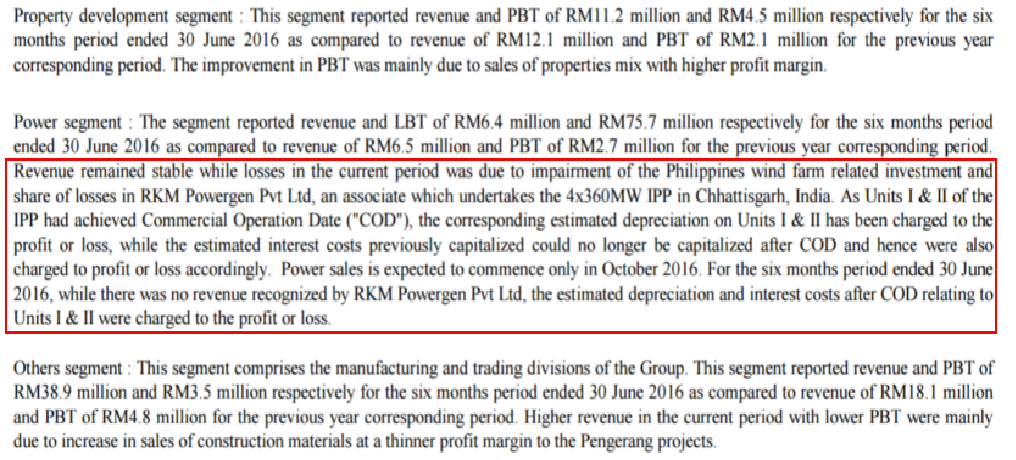

Now, back to the topics that most shareholders are interested about, the India Power Plant (RKM PowerGen). In 2QFY16, the icome statment has a loss of RM61mil in share of result associated. This is the interest cost and deprection charges of the IPP in India as it cannot be capitalised after COD. Based on2QFY16 quarter report, management has said that the power sales can only commence on OCT 2016. Thus, it is not surprising to see no contribution in 3QFY16 report as well.

| 3QFY16 | 2QFY16 | 1QFY16 | ||

| Share of Result of Associates | -39,091 | -61,342 | - |

B) SWEETENER

We need to look at the substantial shareholder.

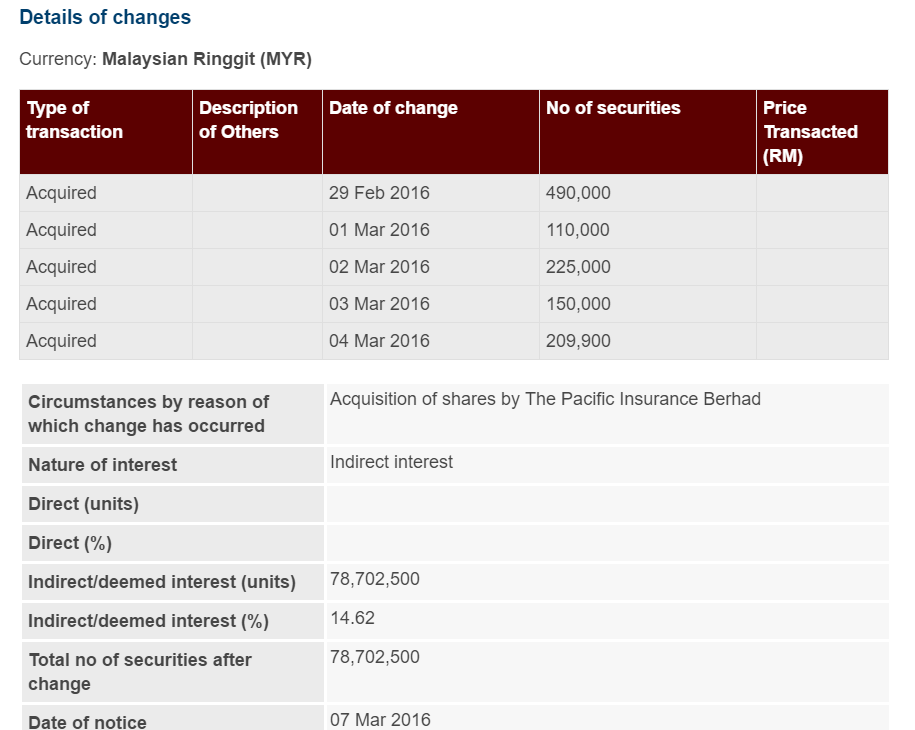

However, during Jan and Mar 2016 timeframe, FFHL has increased it stake to 14% in Mudajaya.

Mudajaya has two giant financial fund as back up, BlackRock and FFHL Group.

COINCIDENTALLY, Mudajaya has internal reorganisation during March 2016. In a simpler way of description, construction arm and power arm was reorganised in such a way directly under Mudajaya Corportation Berhand (MCB). Thus, construction and power arm is not under an indirect wholly owned subsidiary. It is a way to separate this two sectors. What is the motive behind? My guestimate is easier disposal if necessary.

c) Summary

Generally, I will very emphasize on the quality of management in such a crisis.

James Wong was apointed as CEO of Mudajaya replacing Anthony. From the project replenishment point of view, the Pan-Borneo Highway and RAPID project clinchment during end of 2015 had helped the company boost the orderbook to RM1.2bil. This is a good job. However, the only bad thing is in 3Q FY16, loss in construction sector was due to cost overrrun which I think is not great. An excellent contractor should cover job scope and cost well. Thus, I think improvement still needed in Mudajaya either in technical or business perspective to clinch a higher margin job.

On the power sector side, it is sad story that it delayed so so long. The 26% stake in RKM Powergen in India IPP really dragged the company to a deep hole. But 26% stake only, can the Mudajaya management intervene? It is not that easy. This also explains that even 45% owned Amihan project in Cebu Philipines also failed. The only success is in Indonesia PT Hei Coal-fired powerplant and Gebeng Solar Plant in Pahang.

Since the COD of IPP in India in Mar 2016, the interest cost and deprectiaon charges no longer can be contained and it will be showned in P/L. I believe RKM will work harder to make sure it operates the soonest so that it had the cashflow to pay back the bank loan. So, since the managment had indicated OCT 2016 will start commence, why not wait to see the Q4FY16.

Good news is CEO has indicated the Gropup has intended to divest the stake in RKM PowerGen and few parties has approched Mudajaya as well. I think it is worth a wait. Do not forget the back up of the substantial shareholder which have a long list of clients which they can help to approach if a sales is intended.

In summary, the ride in Mudajaya is not easy. But, can your patience be paid off?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Indiana Jones Searching the Gems

Discussions

I really like this guy... very positive. but to most of the people in market, only look at the result. no matter how good is your explanation . cannot deliver mean fail !

2016-12-01 19:26

Everyone can have their own opinion.He could be right or wrong only time will tell.

2016-12-01 20:49

Flintstones

Hahahaha. Good guy Andy must be a new bird in stock market. I see a man who is soon to get his hands burnt in the stock market due to insufficient homework done.

2016-12-01 18:58