EG - Is it REALLY Turning Around Successfully??

andyhard

Publish date: Sat, 31 Dec 2016, 05:26 PM

Today is New Year Eve. Wish everyone healthy, happy, joyous and prosperous in 2017.

First of all, I would like to convey my high respect to some of the reputable and successful investor. It is because of them I relook into this POSSIBLE GEM after it stuck in my pending list for sometimes.

Before you read forward, I hope you have an open minded whether you are owning or going to own EG as one of your portfolio.

If you are ready, let's go ahead.

I do not need to describe too much on EG and how it turns around to be black again in account. There are many great articles on EG. You may just refer to EG website in i3 investor. Everything looks fantastics for me, and this trigger me to understand it more.

However, there are some crucial things that make me feel discomfort with EG.

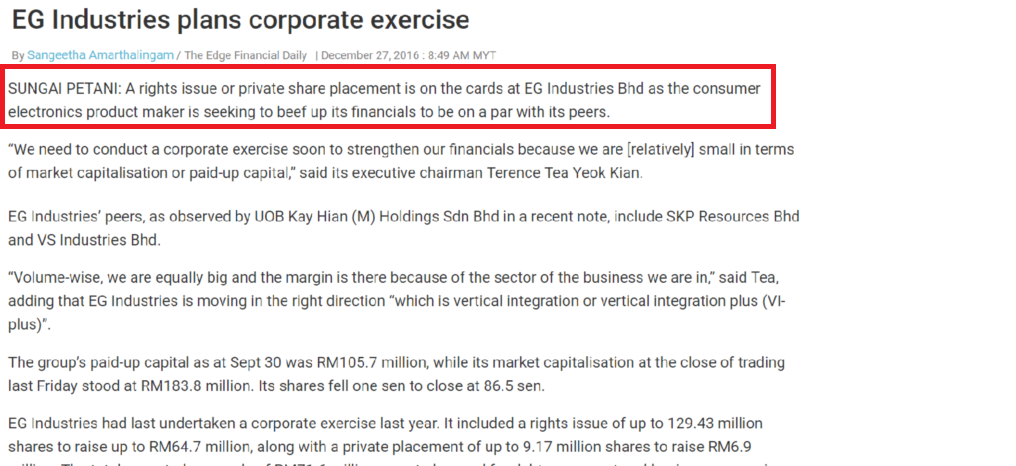

1)

EG just have done corporate with right issues and warrant in 2015. Why do they need to do corporate exercise in such a short time? To increase market cap? To pay dividen? To expand?

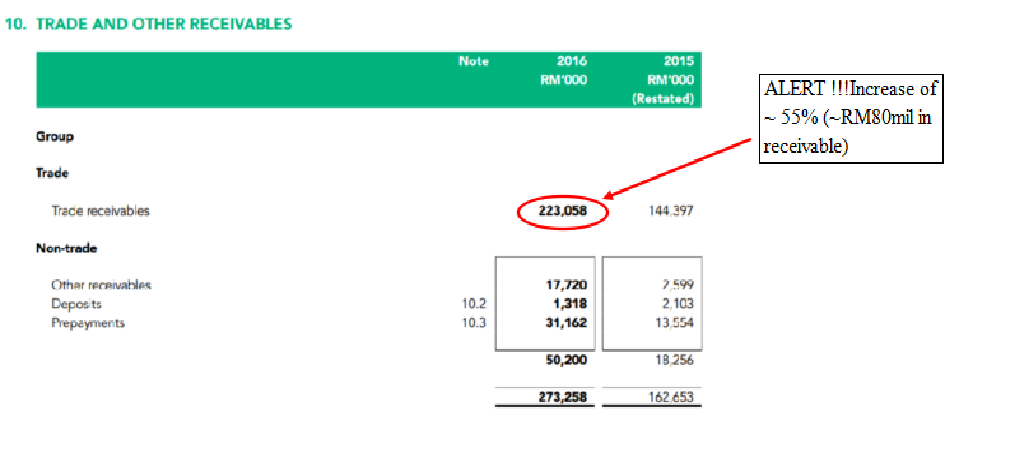

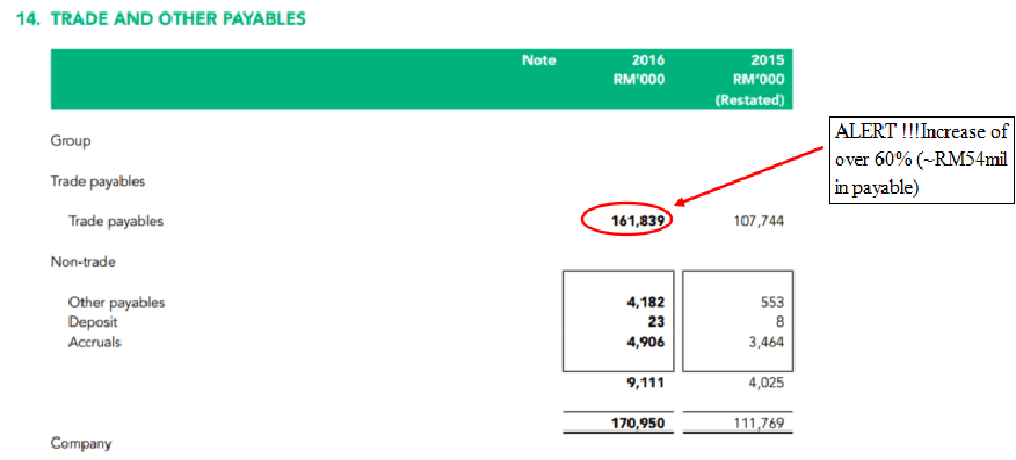

2) A Relook of the Balance Sheet

Let's see what is happening in the blance sheet in Annual Report 2016

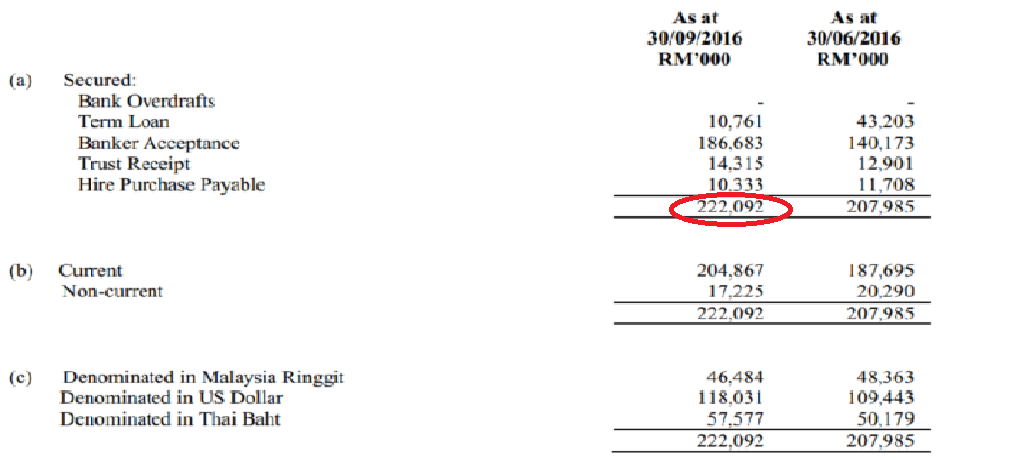

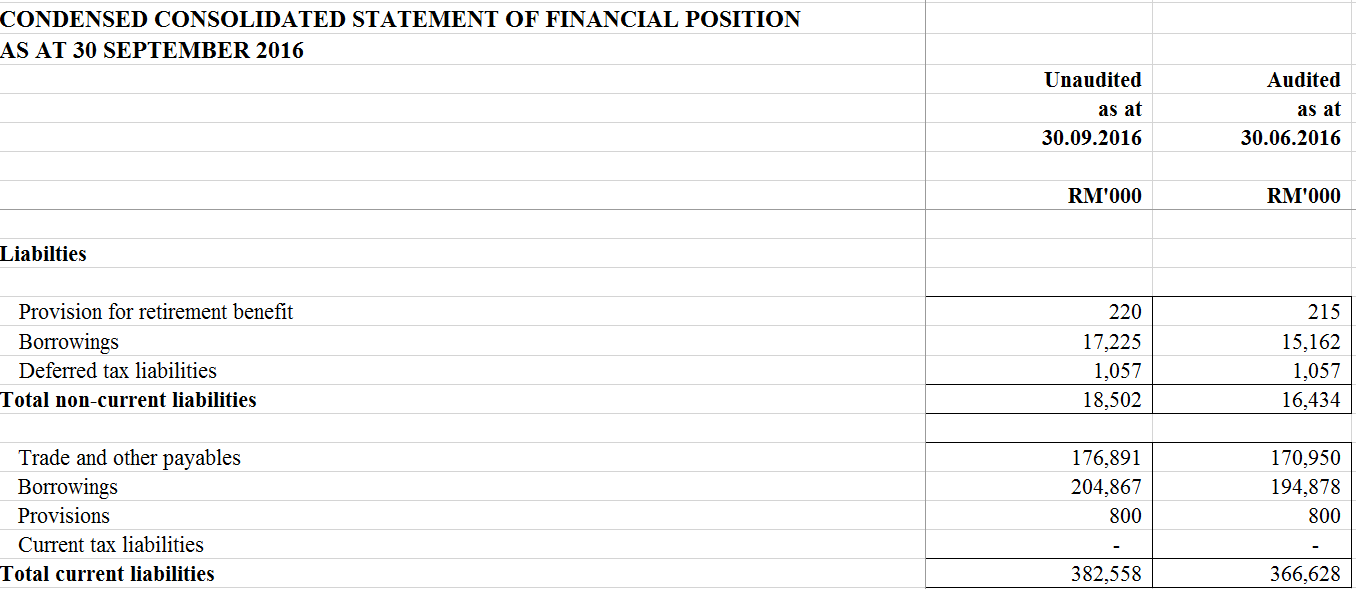

Let's see how much is the borrowing in Q1 FY17.

The total borrowing has increased by RM15mil in a quarter. The banker acceptance increase by whopping RM46 mil.

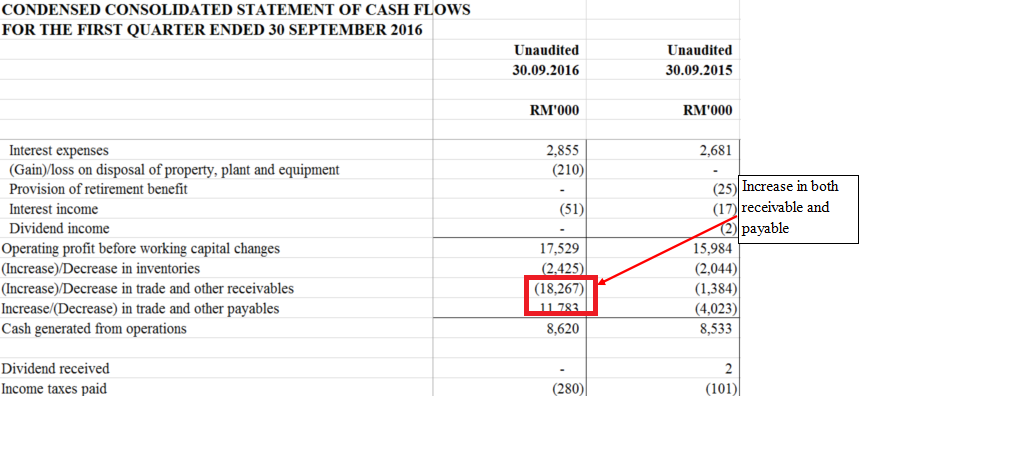

How about the cashflow in Q1FY17?

It is both increase in receivable and payabale. Genrally, more debts and more money pending to be 'RECEIVED'

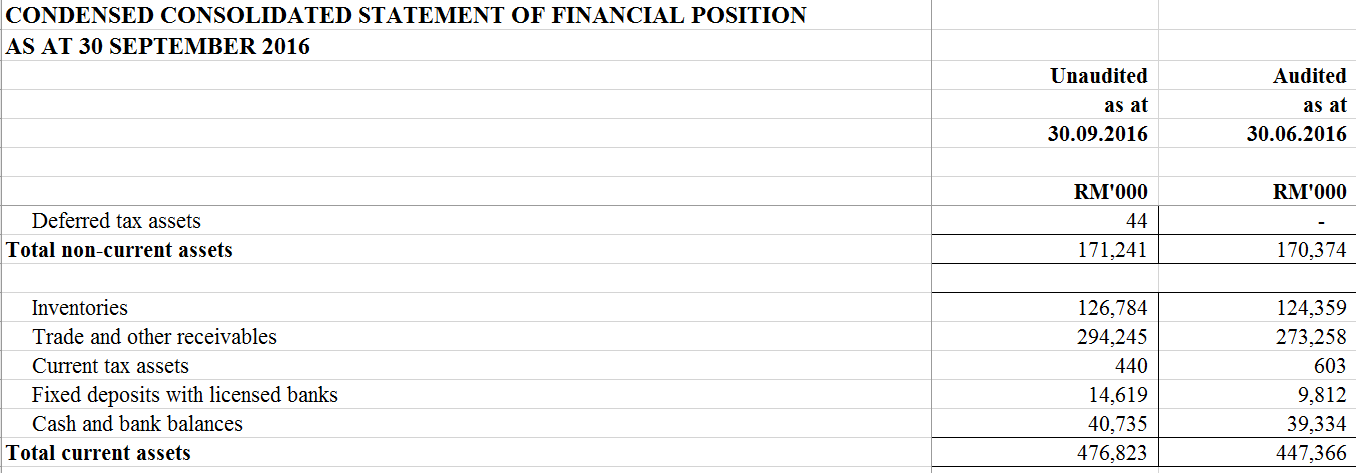

Let's see the overall condition of EG.

In overall, EG has

Receivable+ Inventory= RM 421.029 mil

Payable +Borrowings= RM381.758 mil

A quarter earning of RM7mil (as of 1QFY17), the receivable is 42 times of a quarter earnings, or 10.5 years profit. It is considerably fairly high receivable. If the receivable or inventory not able to turn into cash to pare down the debts or payable, the company will be running into cashflow problem. This is the main concern I have with EG. Cashflow !! Is EG sacrificing on cashflow to get more business?

3) TOP Management

I have browsed through on the profile of Board of Director. Most of them are fairly young. It is not a big issue. But, I blink my eyes twice when I see the person in charge of finance (I am sorry I cannot disclose too clearly here) is only 30 year old.

Now, is that something wrong? Again, nothing is WRONG. But, personally, I buy the concept of " You can't get a baby in a month by making 9 women pregnant at a time". This is a classic phrase by Warren Buffett. I believe certain things such as experience, character needs time to build up and it can't be built up overnight. Steve Job had been so successful when he is young but he was being kicked out from Appple because of his volatile character. A good managment team is the key for a company to success. A team with long term view, stability, back to basic and fundamental and full of experience is critical.

Back to the subtantial shareholder of EG is Jubilee Industries. I did read that Jubilee is not doing fairly well in Singapore as well.

Recalling during August 2016, I did have a chance to chit chat with a friend and get to know she works in EG as well. I quickly ask more and she told me she is leaving just about after 3 months there. I am curious of cause. She did tell me in a briefing, a director did tell in front of the employees that to be successful in the company is to make your boss happy regardless your performance. This is the reason she left as she feel no future work in such company.

(this is just extra information, might not related to financial investment, but it is a true story)

In summary, I will really think TWICE before I put money there. Coincidentally, there are some fund selling out (not sure if they use it to manipulate market or purely selling)

Technically, it has been sideway (81-90 sen) for long time (April 2016 till to date). In short term, I yet to see sign of breaking out.

So, do make your own judgement. I am just writing on what I think and feel. It might not be CORRECT

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Indiana Jones Searching the Gems

Discussions

Ya..i infact really plan to go ahead and buy..but, when I read thru, I have this doubt. And if coming quarter still cashflow problem, they will be running low on cash for expansion..the debt is not low in fact...I have been in E&E industry...I know it is very competitive especially OEM....

2016-12-31 18:46

The receivables definitely is an area that is not so well managed. However, I'm not sure if it is the industry norm is normal as in getting loan to finance the receivables by giving better credit terms to clients. Not so sure about this industry but certain industry I'm familiar with they have such practice.

2016-12-31 18:58

How to limit down if it never up for 1year ?

Frankly , I'll collect if it goes lower than 0.850

2017-01-01 00:41

@andyhard...thanks for highlighting to us....your article is very informative and direct to the point...thanks....by looking at company profiles and going through financial statement previously, i knew something wrong with this company.... for me, if no dividend, that's mean no money...end of the story..

2017-01-01 23:34

Lu eh hiao eh bo? revenue increase sure receivable and payable increase lah. If receivable increase but payable not increase got logic meh? If both also bo increase toh die liao, means no business. U got see annual report or attend agm bo? where got young, almost all lao cik.

2017-01-02 22:58

Ya, you're right, if i hv nvr been to the plant visit, having deep discussion with management, I also nvr dare to buy this counter

2017-01-03 21:41

I have attended the AGM, posted similar questions to them. This is a transition period when they move from PCBA to box build to increase the margin. Box build complete assembly needs more materials and longer production time.

The factory is busy, expansion on-going which I am happy about. Can see the growth prospects.

Chairman is 48, CEO 44, Independent Director 54, 39, 58. Average age is >40++, I don’t know from where you come out with the “most of them fairly young”. Personally, I like them cause I can see they work great as a team during the plant tour, again, performance says everything regardless of age.

I have the same doubts before I visited them, you can go and see them yourself, see to believe before you conclude.

Well, there is plenty of cash rich and blue chip counter to invest, however I buy EG cause I buy into their growth. Make your own judgment after you read.

2017-01-04 19:21

VenFx

Hope this are not the reasons , they are planning for the next Fund Raising.

2016-12-31 17:32