Does Eversendai still got HOPE?

andyhard

Publish date: Wed, 20 Sep 2017, 07:40 PM

What happens to Eversendai?? Probably this is the question of some of the shareholders. I choose to write at this time, it is because Eversendai is at a turning edge.

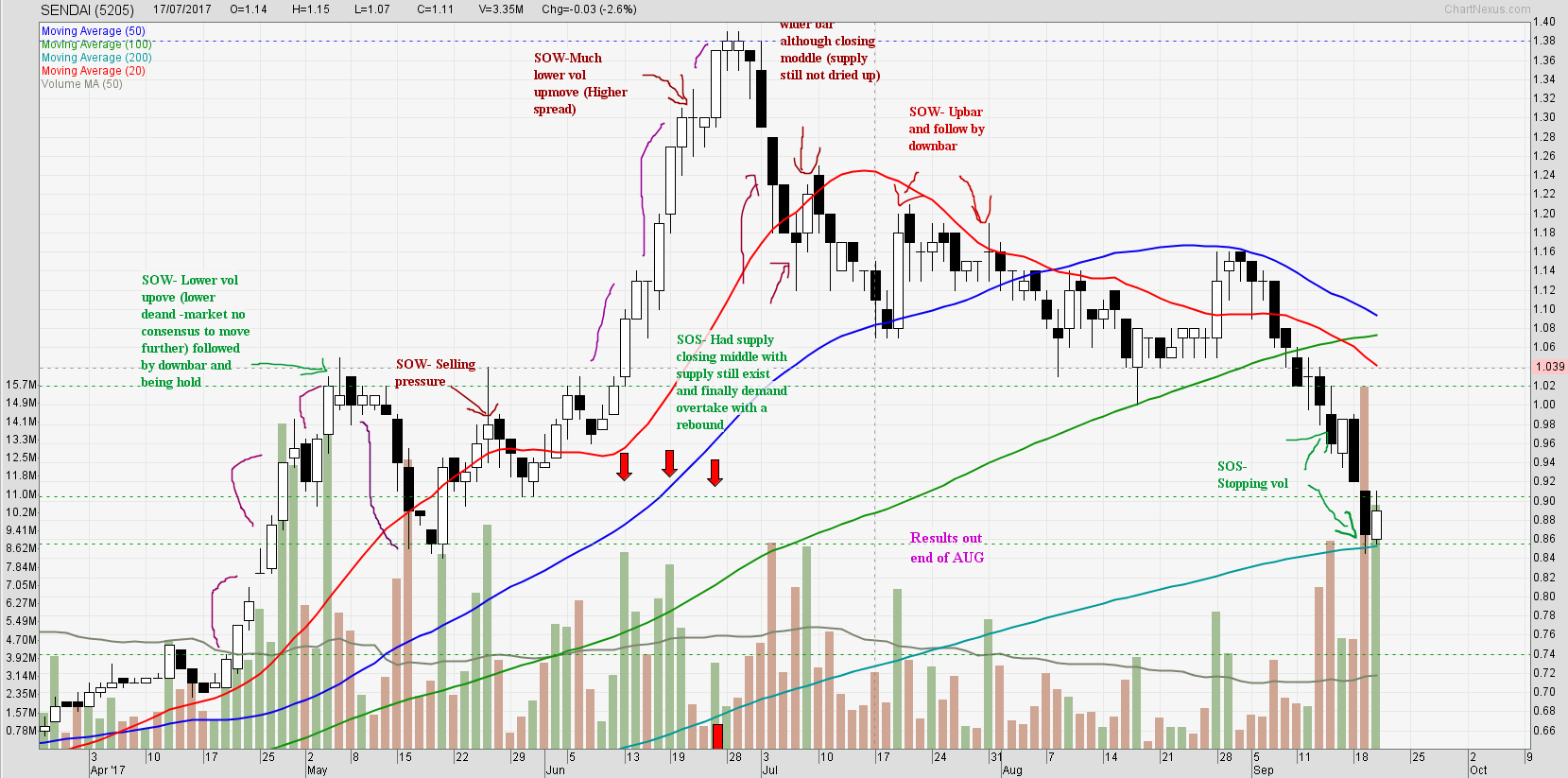

First, Let's see the chart to have a feel what happens in past weeks.

On 28th AUG 2017, a white strong upbar appeared and followed by a reverse signal (29th Aug 2017). This reverse signal is confirmed with the following day with increasing volume and not being holded.On 7th Sept 2017, the catastrophic has created panic with huge volume and not being stopped and crashes further and being holded on on 12th Sept, another holded on 15th Sept.

Technically, we do see manipulators are collecting on the stopping volume on both 7th and 12th SEPT. (refer to the chart on the GREEN wording). This stopping volume is telling us that manipulators are collecting on each massive volume crashdown.

Let's back to reality and see how it relates with this.

On 15th Aug 2017, Company has issued a memorandum saying that Macquarie Bank has inked agreement with Eversendai to take the private placement up to 77.389 mil shares at a floor price of 90 sen. The subscription period is for 12 months in tranches.

Subsequently, on 24th AUG 2017, Eversendai receive notice from Macquaire Bank they have sucribed for 500,000 shares at 0.9444.

Thereafter, 6th Sept 2017, 2nd subscription of 600,000 shares at 1.0061.

The summary of the subscription is as follow

| Date | No. Of Shares | Price |

| 24-Aug | 500,000 | 0.944 |

| 6-Sept | 600,000 | 1.0061 |

| 8-Sept | 1,000,000 | 1.0055 |

| 13-Sept | 1,5000,000 | 0.9608 |

| 18-Sept | 1,000,000 | 0.9 |

I am not saying we should follow banker's purchase. But, why the share price collapse in coincidence with the subscription period?

Logically, if you were the banker, would you prefer to buy at lower price? Yes, the floor price still can be adjusted according to the agreement if both parties have agreed. But would you think Eversendai hope to raise lesser capital with the same amount of share?

So, my logic tells me the manipulator is driving the price down so banker can subscribe cheaper.

Back to technical. What do I see in the chart? With the heaviest volume created on 19th Sept, yet the next day (20th Sept), the chart rebounded strongly with good volume. This is an indication a strong support is already there. If tomorrow (21st Sept), strong buying continues, it would mean that the buying demand has overtaken the supply. The upmove may continue from here.

My point is dont' be panic because of the recent selldown. This is just a market manipulation.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Indiana Jones Searching the Gems

Discussions

• What is a cynic? A man who knows the price of everything, and the value of nothing. Oscar Wilde, Lady Windermere’s Fan

2017-09-20 20:55

I welcome it if it really drop till to 0.5... May be can sleep earlier. This is no longer a hope/fundamental/technical analysis... Is goreng and competition of patience/holding power...

2017-09-20 21:30

Your argument doesn't add up, spent so much to press down and save so little. It should be: as share price is lower, then subscription price is lower, mah!

2017-09-20 22:07

as long as sendai no loss a few hundred millions,surely got hope.same goes to other companies,profit down can make the price down but not collapse unless loss a lot

2017-09-20 22:12

Just write some comment:

Existing shareholdings before any PP - let's say 773 million

PP shareholdings - 77 million

After PP - 850 million

Profit per quarter - 23 m (using 5% profit margin, recent crude price increase and middle east business recovering may even further boost up the margin, Company also expect following quarters will do well)

Annualised profit = 23 m x 4 = 92 million

Using PE 10, price will be 92 m / 850 m x 10 = 1.08 (after PP)

Using PE 10, price will be 92 m / 773 m x 10 = 1.19

So we will expect even after PP, price will move to 1.10 level. If before PP, the price target think is around 1.20.

How about current borrowings ?

We need to exclude bills payable since this relate to customers receipts and also exclude bank overdraft since small figure. Then the main focus is term loan 579 m.

Company how to repay the loan, might use following funds:

- Cash and bank balance 150-200 m (within 4 qtrs)

- PP funds received about 70 m

- Balance 50% will be thru liftboats payment received within next qtr and any and term loan drawdown (you can refer to amount due to contract customers for liftboat and other construction project)

Estimate if need to raise fund about 70 m, PP price need to be around 0.90 - 1.10 level otherwise the PP fund received will be lesser (so far think only 5th tranche of PP), and PP investor think have at least 15%-20% margin on this, if 20% margin, price will need to go to 1.10 level.

So, think price will rebound and cross over 1.00 soon. Sendai is also O&G counter, think still missed today run .... should catch up soon .......

Buy before surge ..... last call ...................

2017-09-21 01:35

This is the message I want to bring out. I have bought this share around 50 sen. The main purpose of this message wants to bring about is to alert shareholders not to be panic. I am not saying this is a worldclass company but they are building worldclass building. Industry wise, they are in construction which is fairly competitive. Margin is definitely is not a nice double digit figure.

But, if you sell at this moment, it might indicates you do not understand the rule of stock market, being shaken out. Fundamental is an important knowledge. Understanding the rule of finance market is also equally important.

2017-09-21 07:51

@andyhard, I agreed with your logical thinking but my point of view is when the manipulator will push up the price as I have seen they taken this opportunities for profit taking. Furthermore, the new PP share being subscript now will gain ~9-10% if market price stay above 0.90 as they can start offload the share into market.

2017-09-21 16:58

Hi ymchan,

Technically, it is end of the falling market. How fast it would rebound? We need the confirmation on the supply side... Generally, it is a good sign...There are quite a number of stocks performing the same way...If u wish to learn...I may give you the sign when it is ready...Btw..I don't think the banker is here to have fast gain...

You may private message me..I do not do open comment as everyone have different view

2017-09-22 18:52

@greatful...It is not same as Supermax...The way they being stopped..And if you see it rebounded

2017-09-22 18:59

john doe

Only those who bought high will get scared out of shit! haha...

2017-09-20 19:50