Ringgit is Doomed to Break Asian Financial Crisis Low

InvestingPlaybook

Publish date: Thu, 28 Apr 2022, 08:59 PM

One of the top headlines dominating the Malaysian financial press is the currently exchange rate of Ringgit Malaysia to US Dollar. As at 28/04/2022 Bank Negara Malaysia’s official exchange rate with USD is 4.3615. The decline in RM has been persistent and it is inflicting severe damage to the economy and its people through inflation and increase in foreign debt value. Unfortunately, this pain is likely to get worse as RM is poised to fall further on the following factors:

Peak Crude Oil Price

Driven by COVID-related supply chain disruptions and war in Ukraine, global oil prices has made a very significant rally. As at today, Brent price is hovering around $105 per barrel. While the war and supply chain issues are unlikely to be resolved soon, the price of oil is unlikely to make a another significant rally. This is bad news for RM, with oil being one of Malaysia's key exports, the currency is very positively correlated with oil price.

Peak Palm Oil price

Similar to the factors around crude oil price, crude palm oil has also made very significant rally in recent months. As at today, CPO is hovering around RM6,900. This represents a parabolic price appreciation that is unlikely to persist if Indonesia later lifts its export ban and the supply chain issues recede. Being the world’s second largest CPO exporter, the expected slowdown in CPO price is likely to exert a downward pressure on the current RM level.

Shrinking OPR spread with US Fed Funds Rate

Besides the war in Ukraine and supply chain issues, one of the key economy news dominating global headlines is the US Federal Reserve’s rate hike campaign. The continuous rate hike in the US is likely to increase the attractiveness of US markets & increase the cost of foreign capital in Malaysia. Both of these factors will contribute to the curtailment of capital inflow into Malaysia, thereby creating downward pressure on the RM. As at today, US fed fund’s rate is at 0.33% while Malaysia’s OPR rate is 1.75%. The US is expected to hike a further 100 basis points over the course of few months. This means if Bank Negara does not amend its OPR, the spread will shrink from the current 1.42% to 0.42%.

Why is RM doomed:

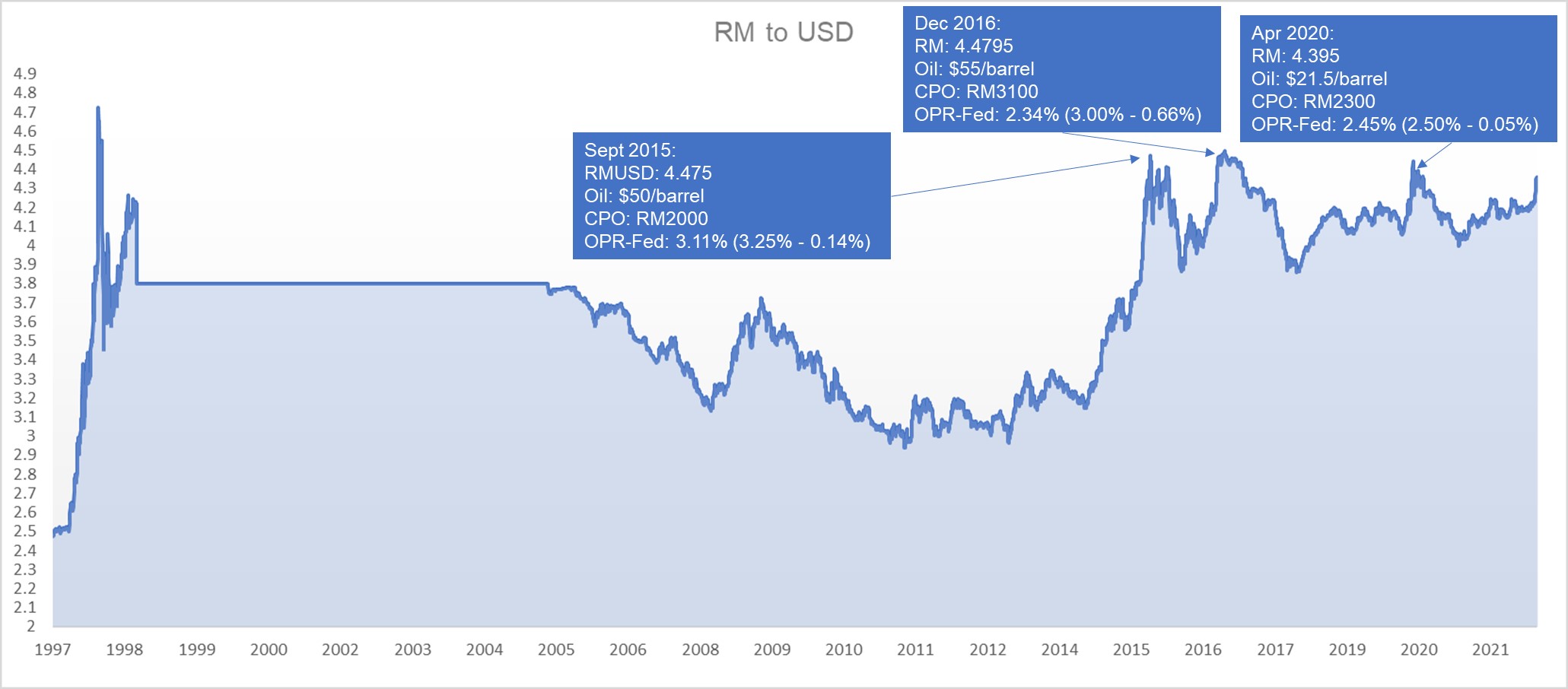

The prospect for RM is very bleak if the current metrics are compared with the historical environment and RM exchange rate. Besides the 1998 Asian Financial Crisis, the only few occasions where the exchange rate is weaker than current rate is in 2015, 2016 and 2020. The following chart shows the oil price, CPO price & interest rate spread during the three occasions:

The current oil price and CPO price is approximately 3 times higher than the prices in 2015, 2016 and 2020. As such, RM is supposed to be significantly higher than the exchange rates during those times instead of being close. Additionally, the average interest rate spread with the US during those thre occasions was about 2.50%. Today the spread is 1.42% and expected to shrink more. With the expected further shrink in interest rate spread and decline in both brent and CPO price, the RM is not expected to have significant support that will prevent it from breaking the Dec 2016 resistance level of 4.4795, which is 2.7% away from current exchange rate, and retest the 1998 Asian Financial Crisis low of 4.725. That is another 8% lower. If it breaks that level, then RM will be in uncharted water and very strong downtrend.