Lotte Chemical Titan Berhad's Line Project with high amounts of loan repayments can overturn the company's financial condition

investingiscommonsen

Publish date: Mon, 09 Oct 2023, 05:08 PM

Hi, I am investingiscommonsense. I am going to discuss with you about Lotte ChemicalTitan, especially the Line Project that is expected to be completed in 2025 with high amounts of loan repayments can overturn the company's financial condition. Let's how Lotte Chemical Titan manages this project in the future.

Lotte Chemical Titan is an integrated producer with two principal product categories, namely:Polyolefins and Olefins.Polyolefins are used to produce a variety of consumer and industrial products including packaging film, trash bags, automotive parts, plastic bottle and caps, compounds for wire and cable insulation. Olefins are used as the primary feedstock for the production of polyolefin products.

The company was relisted in 2017 after being privatized in 2011. On July 16th 2010, Honam was the flagship company of Lotte Group’s Petrochemical Division and entered into the SPAs with the Vendors to acquire approximately 72% of the issued and paid up share capital of Titan Chemical Corporation Bhd at RM2.35 per share. The exercise was completed on November 9 2010 so the company was obliged to extend an unconditional takeover offer for all the remaining shares at RM 2.35 per share. The offer was made at the 17.57 trailing price earning ratio with the earning per share of 13.37 cents. The Net asset value as at September 30 2010 was RM2.32. I believe that the takeover offer was accepted by the remaining shareholders at RM2.35 per share, so the company was delisted. I was searching for the result of the unconditional takeover offer but to no avail, if you have any information on the result of the unconditional takeover, please share with me.

In 2017, the company was raising RM3.77billion and the amount was reduced to RM3.544 billion after a share buyback. The proceeds were utilized to build the plants to grow the company. The Fluidised Naphtha Cracker (“FNC”) plant in Pasir Gudang was mechanically completed in July 2017 and began commercial operations on December 16 2017. The total nominal capacity of ethylene, propylene grew by 11.7% to 3,368 KTA in 2017.

The third polypropylene production plant commenced operation in Pasir Gudang, Malaysia, in September 2018. The plant has a capacity of 200 KTA and will cater for both the domestic and export markets. Construction of the project began in March 2017 and completed in June 2018.

The LINE Project will serve as the key expansion drive for the Group with the aim to solidify Lotte Chemical Titan’s position as a Top-Tier Petrochemical Company in the Southeast Asia region upon its completion. The project will also serve to integrate the Group’s three existing standalone polyethylene plants in Indonesia while boosting its production capacity by 65% to 5,878 KTAfrom its current 3,568 KTA. The LINE project is expected to be completed in 2025.

Lotte Chemical USA Corporation (“LC USA”) is an associate of the Group that successfully commenced commercial operations in August 2019 on an integrated basis that produces 1,000 KTA ethane cracker plant and 700 KTA monoethylene glycol (“MEG”) plant.

Petrochemical business a cyclical industry. Historic data suggests that average cycle lengths of this industry have been between 6 and 11 years in duration.

From 1988 to 1995, profitability for the industry climbed to a sharp peak in 1988 and again in 1995. Conversely, a weak global economy contributed to depressed profitability leading to a broad trough during the 1991 to 1993 period. Over this period, total ethylene capacity grew at approximately one percent higher than demand on a CAGR basis, resulting in lower industry utilization.

From 1995 to 2005, average profitability levels were high during the 1995 industry peak and this resulted in a significant investment wave. During the period 1997 to 2002, approximately 21million tons of new ethylene capacity was added to the market compared to incremental demand growth of less than 18 million tons. Capacity additions resulted across all major regions.The downturn over the period 1995 to 2005, was particularly prolonged partly due to the consequences of the Asia Pacific crisis which resulted in lower consumption growth from key industry sectors. However, this also resulted in longer lead times and delays for many new project investments which ultimately contributed to the extended up swing seen during the 2004 to 2007 period.

From 2005 to 2010, industry profitability had been increasingly turbulent, driven by increased volatility in crude oil and petrochemical feedstock markets along with irregular purchasing patterns, as consumers optimize purchasing volumes against rapidly changing prices. This period was characterized by robust consumption growth and limited capacity additions. Average industry profitability steadily increased through 2005, remaining at a broad peak through 2007. From 2008 to 2010 , the industry experienced a downturn in profitability which was partly attributed to a fall in global GDP and sharp increase in incremental petrochemical supply. A net ethylene capacity increase of 11million tons per year during the 2008 to 2010 period. This corresponded with consumption growth of approximately 9 million tons over the same period. From the second quarter of 2009, global demand appeared to stabilize as a result of government stimulus packages, lower crude oil and petrochemical prices, and revived consumer confidence. The full impact from new capacity additions was also partly alleviated by project delays. However, most product margins reached a low point in 2009.

Currently, the industry is facing the oversupply situation. According to ICIS, Asia Polyethylene capacity is expected to reach nearly 62million tonnes in 2023, up 8.3% year on year resulting from the new capacities which started up in South East Asia and China. ICIS also forecasts new polypropylene capacity from Malaysia and China in 2023. The Petronas’ USD 27 billion state-of-the-art Pengerang Integrated Complex will have a production capacity of over 3.3million tonnes of petrochemical products per year is poised to be a leading Refinery & Petrochemical hub in Asia. Maybank Investment Bank, in a July 4 2023 market outlook report, gave a sell on on Lotte Chemical Titan and forecasts that Lotte Chemical Titan could see see its domestic premium, around 50dollar or 100 dollar per tonne completely erode by 1H 24 with impending Pengerang Integrated Complex's COD in 4Q2023. The company also gave the operating rate guidance of 70% to 75% for FY2023 which was below 6 year average plant utilization rate of 81% and expected lower GDP growth globally in 2023 will have an impact to the demand growth of the products.

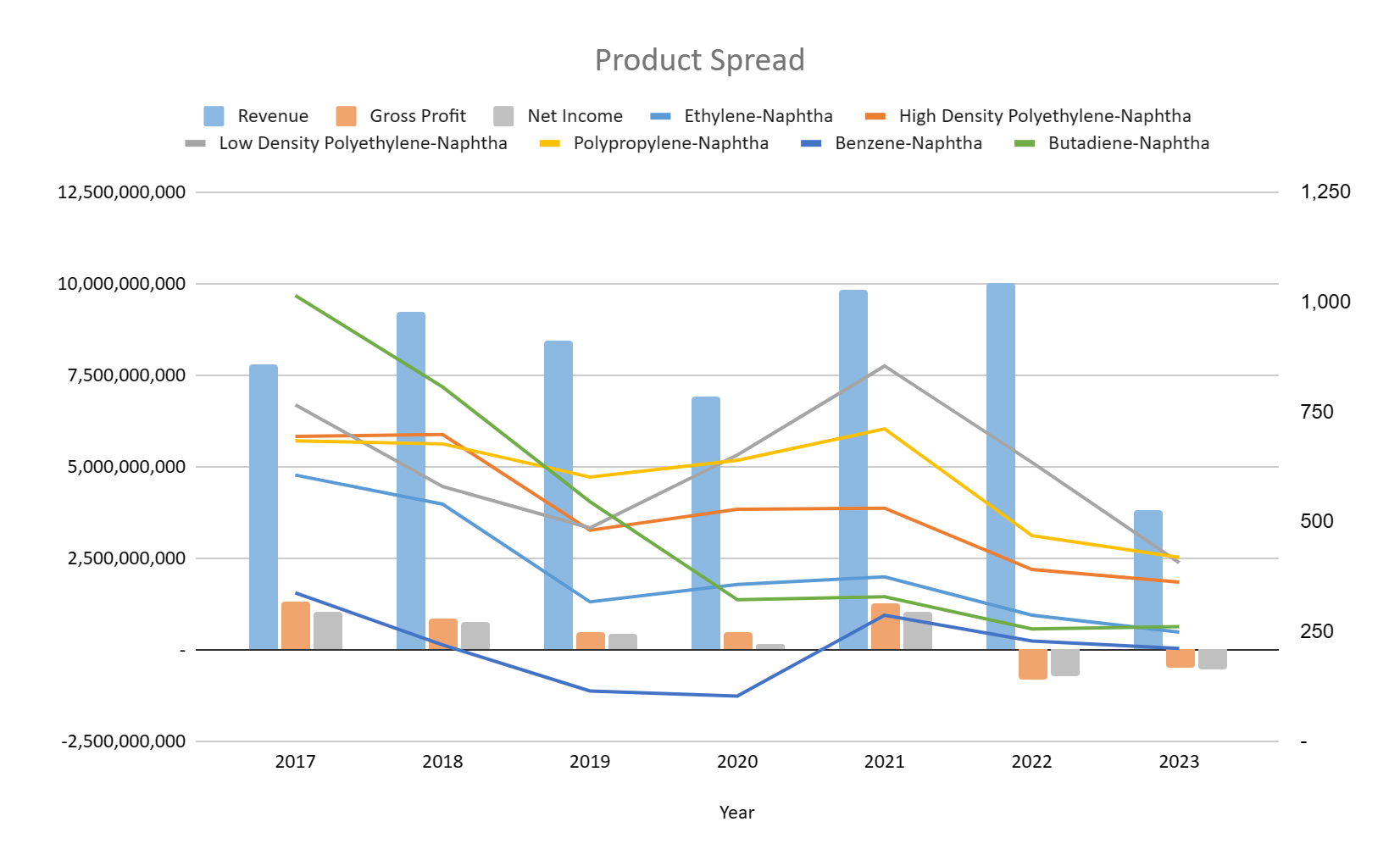

The company is a price taker, this means that the producer has no control over its price because the product is not differentiated. Generally, Lotte Chemical Titan’s gross profit follows the trend of margin spread, which means the difference in the prices between the products that they sell and naphtha. Naphtha is the main feedstock that the company uses to produce products. In 2017, when the margin spreads of the products were relatively higher than in 2018, the company recorded a higher gross profit of RM1.32billion in 2017 compared to RM0.84 billion in 2018. From 2018 to 2020 , the margin spread was in a downtrend, and hence the company’s gross profit followed the same trend in the same period. In 2021,the gross profit jumped to RM1.29billion due to higher margin spread owing to higher overall market demand supported by global reopening and post-pandemic economic recovery as well as supply disruptions to the region due to

shipment constraints . In 2022, the company was making a gross loss of RM796million due to lower margin spread . Gross profit is directly linked with net income. In 2017, the margin spread was relatively higher compared to other years, and hence the gross profit of RM1.32 billion in 2017 translated into the net income of RM1.06billion .

Currently, the company reported an average of net finance income amounting to RM50 billion a year. to In the future, the company will have a different financial performance owing to the Line project. The company has secured a 12 year term loan facility of USD 2.4billion for the project. The interest rate will be charged at Secured Overnight Financing Rate (“SOFR”) +agreed margin spread. The Secured Overnight Financing Rate (SOFR) is a benchmark interest rate for dollar loans. In October 6 2023, the Secured Overnight Financing Rate was 5.32%. The margin spread is subject to borrowers’ credit rating and negotiation between bank and Lotte Chemical Titan. If we assume the margin spread of the term loan is 1%, the interest rate for the loan is 6.32%. On average, the company will have cash outflow of USD286million or RM1.353bilion a year, USD86million or RM407million for interest repayment, USD200million or RM946million for principal repayment. Lotte chemical Titan has a 51% stake in the Line Project, and hence RM690million cash outflow. From 2017 to 2022, the company produced best free cash flow in 2021 amounting to RM711million . Therefore, the Line Project will have a significant impact on the cash flow of Lotte Chemical Titan. However, we also need to consider about the potential profit generated from the project which I have requested from Lotte Chemical Titan, I will keep you posted.

The Edge article”No relief in sight for Lotte Chemical Titan” discussed about the potential privatization of Lotte Chemical Titan due to heavy losses. In the 2Q FY2023, the company reported a net loss of RM327million . In the annual general meeting of 2023, the company was answering the question that the privatization of the company within 2 years time frame was not under consideration.

Let’s discuss. It is just a hypothetical scenario. What if the company were to make a takeover offer? In 2010, the company was offering to privatize at the price to book value ratio of 1. Based on the RM5.25 ringgit Net Asset Value in 2022, it represented a 360% premium to the RM1.14 share price in October 5th, 2023. However, the company was losing losing money in 2022. if using trailing Price earning ratio, the company can offer to buy at 0 cent.

In another hypothetical scenario, in the future the industry experiences mean reversion and move towards average profitability level from the current downturn. This industry’s average cycle lengths have been between 6 to 11 years in duration.The company is trading at 0.21 price to book value ratio due to heavy losses. The management is bearish for the outlook for this year. If the trend does not stop, the net asset of the company will reduce accordingly. However, if the trend changes and the company posts a positive result, the company share price can move towards its average historical price to book value ratio of 0.58. In this valuation methodology, the average yearly return depends on what the net asset per share will be. If we assume the company net asset per share will be the same from now until 11th year and the share price will be 58 percent of net asset per share, average yearly return will be 9.3%. If the company net asset per share increases , the average yearly return will be higher and vice versa.

Sources

1: Nexant

2" Annual Reports of Lotte Chemical Titan

3: Annual General Meeting

4: Quarterly Reports

5: Company Website

6: Bursa Malaysia

7: Research Report from Maybank Investment Bank

8: Trading Economics

9: Analyst briefing

10: Others

Disclaimer

This information is intended for educational purposes only. It shall not be understood or construed as, financial advice. It is very important to do your own analysis before making any decision

Hi, I am Lim Khai Woon. I passed CFA program in 2 years and achieved a distinction for my master degree in Finance, Investment and Risk from University of Kent . I was a senior investment analyst in a family office and a financial analyst in a physical commodity trading firm. I will be providing an investment course for the participants who want to learn comprehensive fundamental investing. It is a 2 day training that will be conducted over the weekend that costs RM5,000. The date is not decided yet. The location will be held in Selangor/ Kuala Lumpur subject to availability of the training rooms . Other locations(e.g. Johor, Penang) can be considered if there are enough students interested to participate in the course.

If you are interested in learning the stock analysis from me , please fill up the google form.

https://docs.google.com/forms/d/19sr1vRPDctEmkN9Sx1bzjSDp6ff_XuypJHp7zJiGLlo/edit?fbclid=IwAR0Qyg--zgteZP_wOi4BUkB1SfEgnJAN3vDn_TeRe8nh3yLbqG29XZyjiNU

I am also providing the service of building the financial models for companies. If any company is interested, please fill up

or contact me by my email(investingiscommonsense@gmail.com).

https://docs.google.com/forms/d/1WLiYr4q8MRH6cu4mytyghaTaoPEDdF0jxHiT751Tsxg/edit

My email address : investingiscommonsense@gmail.com

My youtube channel : https://www.youtube.com/channel/UCYKfyv6kdKPWACcml79iafw

My Facebook: https://www.facebook.com/profile.php?id=100091126774529

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on investment knowledge

Created by investingiscommonsen | Nov 14, 2023

Created by investingiscommonsen | Oct 23, 2023

Simonalibaba

Good analysis, I would buy on further weaknesses onto this stock.

2023-10-10 15:37