Malakoff Corporation Berhad is OVERVALUED based on dividend discount model and discounted cash flow

investingiscommonsen

Publish date: Thu, 30 Nov 2023, 06:49 PM

Hi,I am investingiscommonsense. I am going to discuss with you about Malakoff Corporation Berhad, an overvalued company based on dividend discount model and discounted cash flow model on 30 Nov 2023. However, my valuation is not a buy or sell call, please do your homework while buying a company

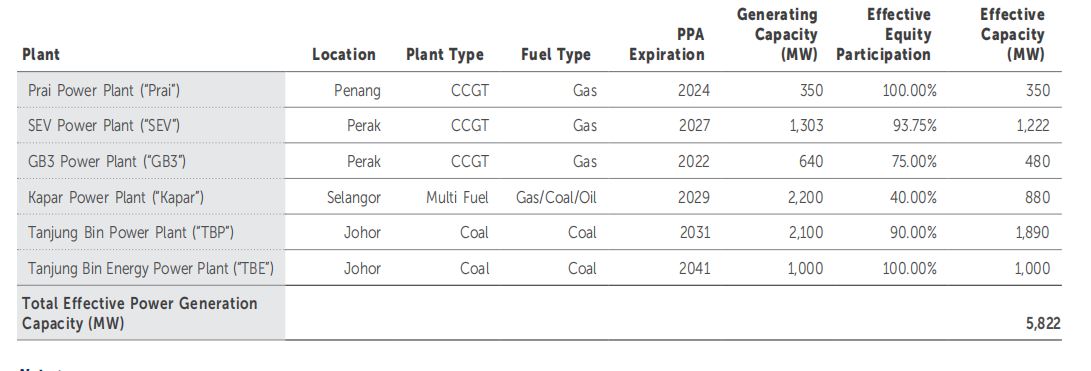

Malakoff has 2 major segments, namely power generation and waste management and environmental services.Malakoff’s foreign power generation segment has an effective power generation capacity of 588 MW and water desalination capacity of 472,975 m³/day with the businesses in Saudi Arabia, Bahrain and Oman, . It is the largest Independent Power Producer (“IPP”) in Malaysia with an effective generating capacity of 5,822 MW and this segment is the biggest contributor to the company in terms profit and loss. In 2021 and 2022, revenue of domestic thermal power generation accounted for 85% and 90% of total revenue respectively. Therefore, the performance of Malakoff is highly affected by the fuel price.

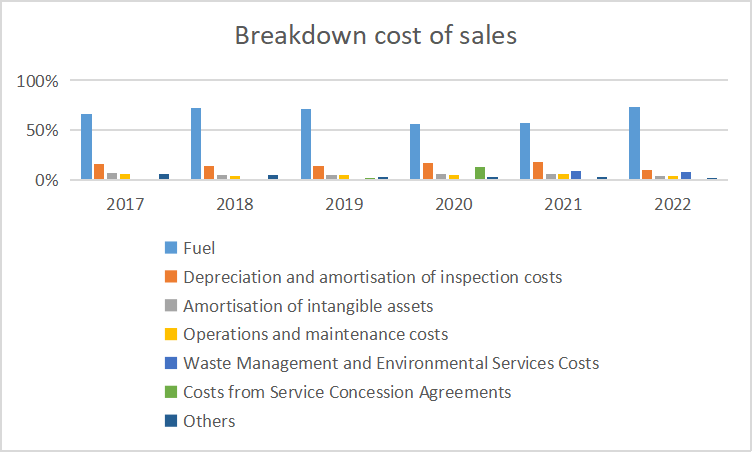

The fuel cost accounted for 66% of total cost of sales in a 6 year period from 2017 to 2022. The fuel mix is coal , gas and oil.

\

Based on the effective capacity by each power plant, Tanjung Bin Power Plant and Tanjung Bin Energy Power Plant which use coal as the source of power generation,accounted for almost 50% of total effective capacity, we can assume that coal is the main source for electricity generation.

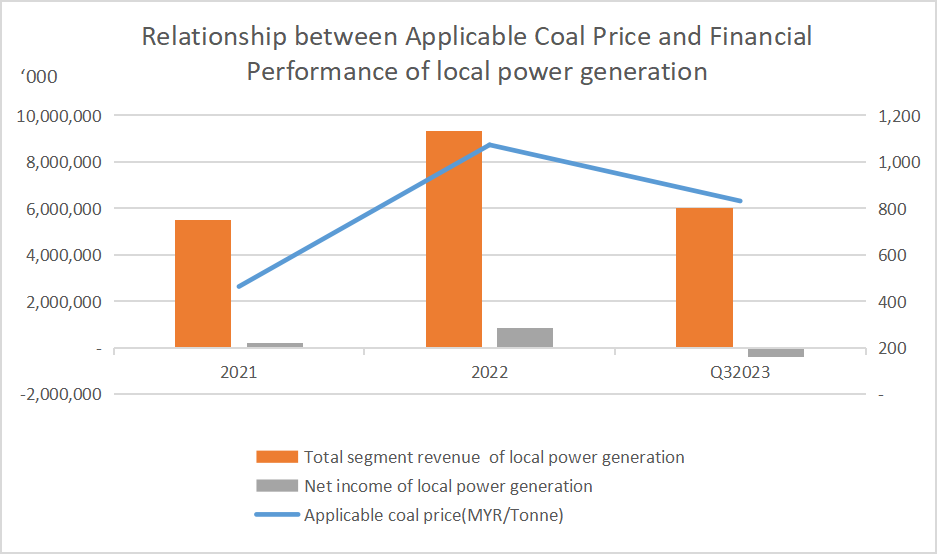

According to PPA, Malakoff needs to keep at least one month of coal inventory. The purchase price is called weighted average coal price which is the coal price that Malakoff purchases from TNB fuel, while applicable coal price is used to calculate energy payment to Malakoff which is set on a monthly basis by Energy Commission since August 2022 . Malakoff usually purchases coal 3 months in advance and set the selling price 1.5 months before the delivery of electricity. Therefore, when the global coal prices are increasing, Malakoff is the beneficiary and vice versa. Let me demonstrate this using a hypothetical example. Assuming the coal price in June is RM1, Malaoff purchases it. In the mid of July , the coal price increased to RM2 and Malakoff makes an agreement to sell the electricity for September based on the coal price of RM2. Malakoff earns RM1 from the price gap . I am using applicable coal price as a proxy for weighted average coal price because I could not get the data.

From 2021 to 2022 the applicable coal price jumped from RM464 per tonne to RM1,073 per tonne the local power generation’s revenue and net income increased from RM5.5billion to RM9.3billion and RM215million to RM844million respectively. However for the 9M2023 the average applicable coal price decreased to RM832 per tonne, the revenue and net loss decreased to RM6billion and RM386million from RM6.6billion and RM567million in the corresponding period. I was just showing you a very simplistic example for illustration purpose because the time period that I used was a 1 year period gap and applicable coal price as a proxy for weighted average coal price. In fact, the company has 2 months of inventories, the price gap is 2 months instead of 1 year, Secondly, Malakoff is using the weighted average coal price for the purchase price but the information is not available, so I used applicable coal price as a proxy.

Malakoff started to venture into the sector waste management and environmental services by acquiring a 97.37% stake in Alam Flora in December 2019 from DRB Hicom for RM869million at the price earning ratio of 8.98, price to book ratio of 3.14. It is the biggest environmental services company, providing the services of solid waste collection and public cleansing in Kuala Lumpur, Putrajaya and Pahang and waste recovery&treatment like generating electricity and fertilizers using food waste, recovering recyclable materials from municipal solid waste. It is managing 5,748 tonnes of waste per day, accounting for 15% of 38,000 tonnes of waste per day produced by Malaysia. It aims to achieve a recycling rate of 15% to 20% by 2025 that is enough to fill up the whole Petronas Twin Towers with the capacity of 315,000 tonnes a year. In addition to that, On 27 October 2023, Malakoff entered into a share sale and purchase agreement for the proposed acquisition of a 49% stake in E-Idaman which provides project management, consultancy and contracting services in the field of solid waste management. E-Idaman has the same services with Alam Flora like sold waste collection and public cleansing but in different areas like Kedah and Perlis with the concession agreement expiring in September 2033.

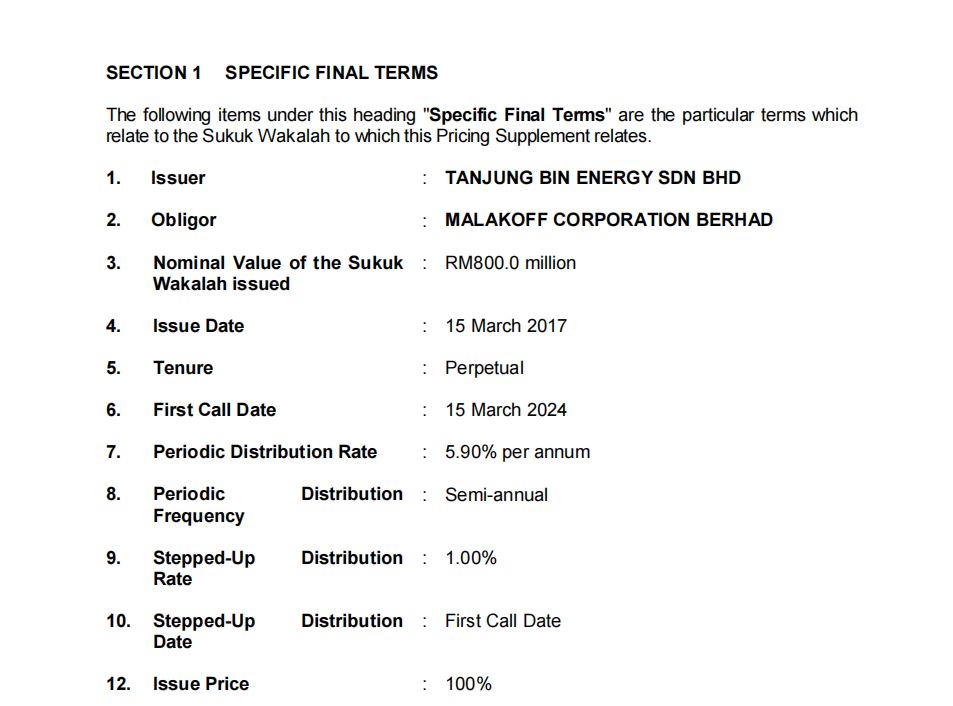

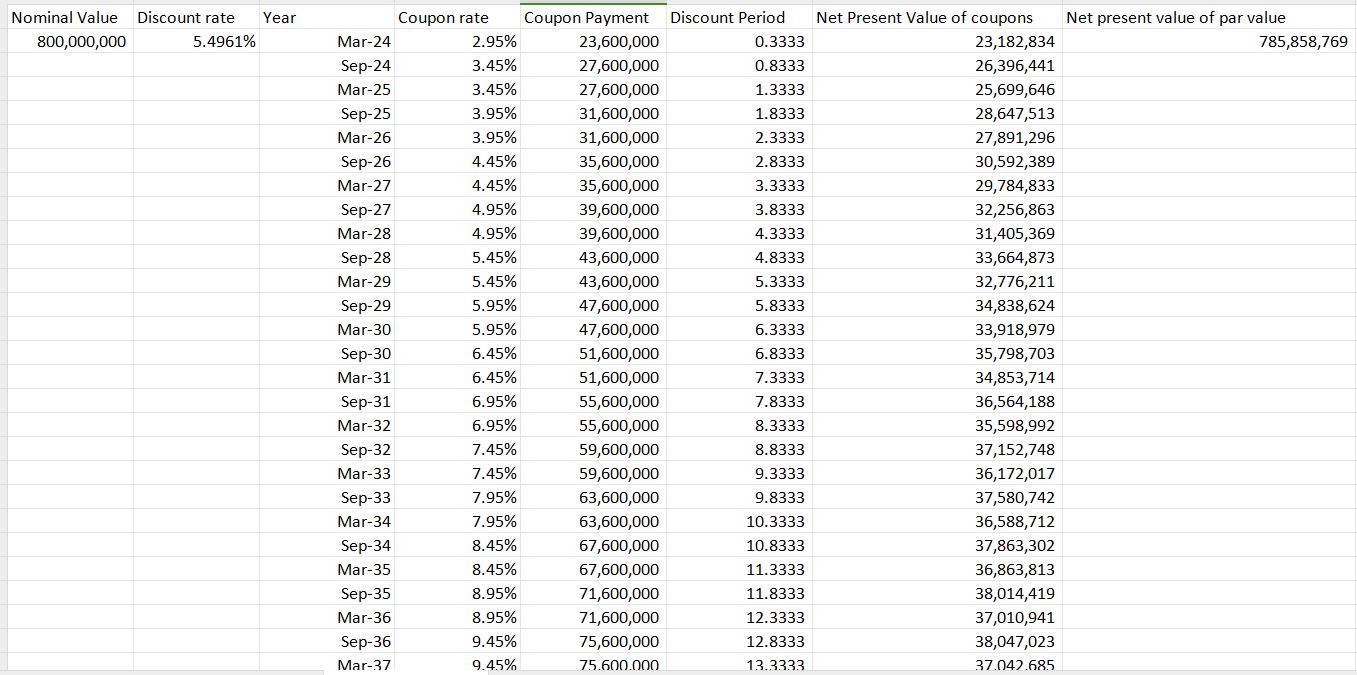

On 15 March 2017, Malakoff issued a perpetual sukuk with the nominal value of RM800million.It is a semiannual perpetual bond with the first call date on 15 March 2024 which means the company can redeem the bond on the 15 March 2024. The period distribution rate is 5.9% from year 1 to year 7, it will be increasing 1% a year starting from year 8 or 15 March 2024. For example,the company is obliged to pay the distribution of RM47.2million per annum from 2017 to 2023, in 2024 the company needs to pay RM55.2million and RM63.2million in 2025. It is shown under Shareholder equity and treated as equity financing because there is no obligation to repay the principal of RM800million but only the coupon payment which is likened as dividend. However, I beg to differ, Malakoff is obliged to pay coupons , I will be treating Malakoff’s perpetual susuk as a debt instead of equity. Reason being is dividend payment is not an obligation but coupon payment of perpetual sukuk is an obligation. The company may choose to pay or not to pay dividend to the shareholders every year. If the company is losing money this year, it may choose not to pay dividend. However, if the company is losing money this year, the company is still obliged to pay coupon for perpetual bonds. We can calculate the net present value of a debt by discounting future cash flows of the coupons.

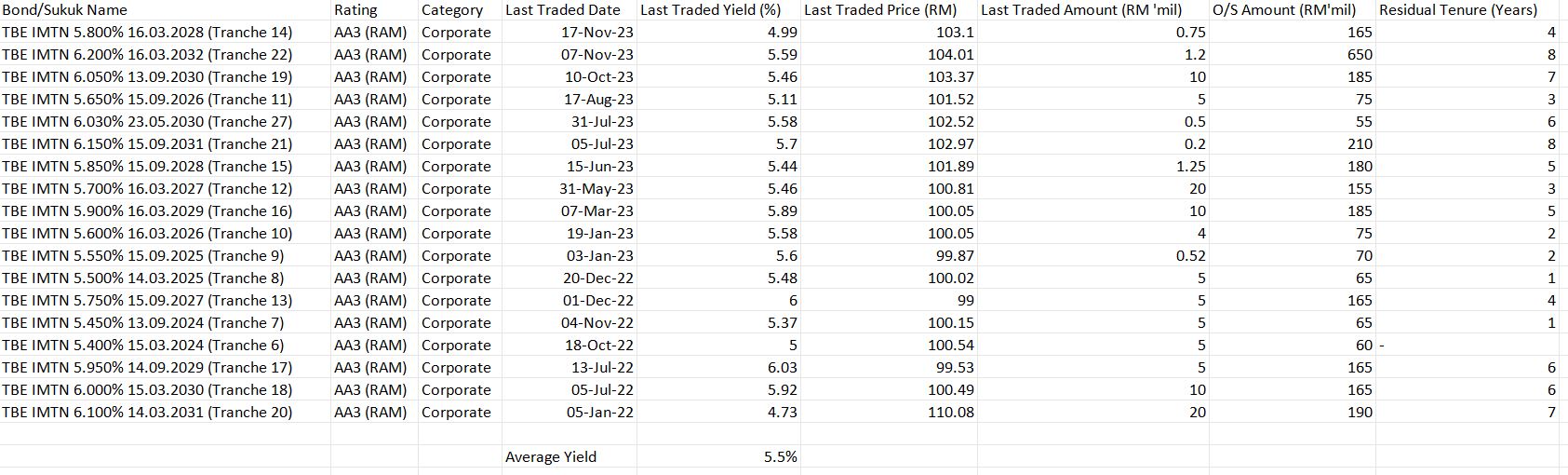

I am using Tanjung Bin Energy Islamic Medium Term Notes’s average yield of 5.5% as the discount rate for Malakoff’s perpetual bond.

If the company calls the bond on the first call date which is on 15 March 2024, the net present value of the perpetual sukuk will be RM809million. However, if the company chooses not to call the sukuk forever, the net present value of the perpetual sukuk will be RM3.66billion. Therefore, we can presume that the company will call the bond in one day, therefore, it must be treated as a debt instead of equity in this case.

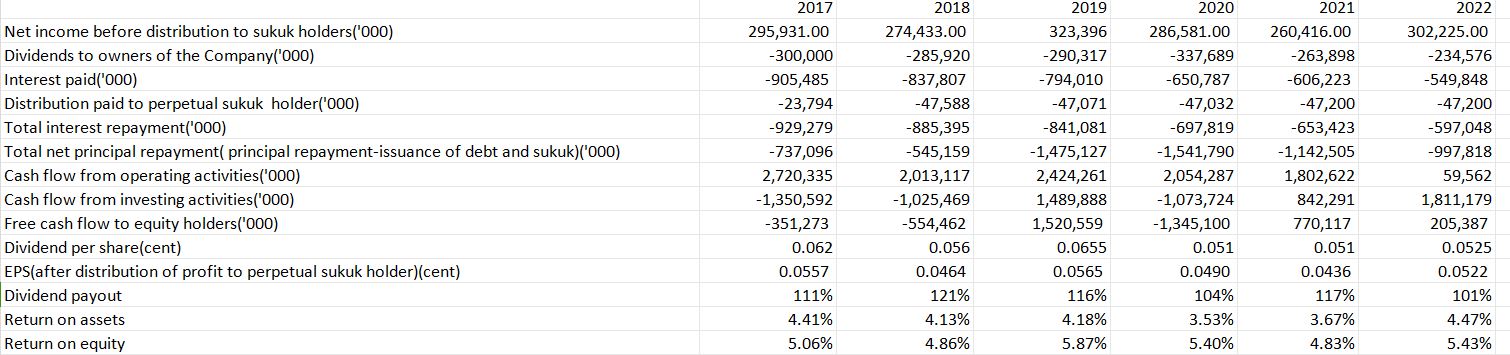

From 2017 to 2022, Malakoff made an average RM290 million per annum, but it still had high accumulated losses of RM358million in 2022. The reasons are the company company paying high dividends to shareholders and profit distribution to perpetual sukuk holder. The company dividend payout ratio was more than 100% over the 6 year period, averaging 111%. The sources for the payments of dividends were most likely from cash brought forward or debt financing because it just made the total of RM245million free cash flow to equity compared to RM1.712billion dividends issued to owners of the company over the 6 year period.For the 9M2023, the accumulated losses increased drastically to RM1billion partly due to negative fuel margin as I mentioned before. This is a highly levered company, as the debt to equity ratio was around 3 in 3Q2023. Therefore, the high debt is a reason behind low free cash flow to equity. Since I am treating perpetual sukuk as a debt, I include the distribution as a form of interest repayment. The company repaid an average of RM767million interest on borrowings and RM1.073billion principal on borrowings a year and total of RM4.63biillion interest repayment and RM6.439billion principal repayment over the 6 year period. Therefore, even though the company was making RM1.85billion cash flow from operations and RM116million cash flow from investing a year, the company was still ended up a small amount of RM40.87million free cash flow to equity holders. Also, this company’s earnings quality is bad as shown from an average of 5.24% return on equity. On top of that , average return on assets stood at 4% over the 6 year period. Return on assets is an unlevered return or the return before any debt financing . Return on equity is an levered return after debt financing. As we can see from these two metrics, return on assets, return on equity show that the returns on investment for the projects invested by Malakoff are a single digit . Over the long term, the returns of the projects will be affecting the performance of the company which will directly affect the return of the ordinary shareholders.

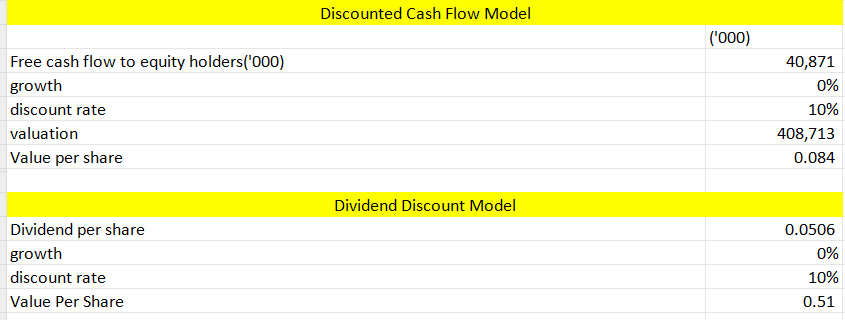

To value this company, I am using both discounted cash flow and dividend discount model Firstly, I am using discount rate of 10% for the cost of equity for four reasons :1: the earnings quality is bad as shown by return on equity and return on assets, 2: due to ESG issue, the company needs to transform itself as the key priority which is uncertain and take time 3: the company produced a small amount of free cash flow to equity holders .4:Malakoff is subject to commodity pricing risk like coal price. As I mentioned before, this company produces an average free cash flow to equity holders is RM40million a year or RM0.0084 per share . I am using RM40million ringgit as free cash flow to equity and the discount rate of 10% for my discounted cash flow , and no growth due to highly volatile financial performance over the years. Therefore, the valuation will be RM400million or RM0.084 per share . If we were to use dividend discount mode due to Malakoff’s dividend payout ratio had been more than 100% over from 2017 to 2022, the valuation of this company is RM0.506. However, the dividend is not likely sustainable owing to small amount of free cash flow to equity holders over the years as I mentioned before. Therefore, the dividend might be reduced or the company needs to borrow debts for dividend purpose, it is not the best model to value this company. In the dividend discount model, I am assuming no growth due to highly volatile financial performance of Malakoff , the average 6 year EPS at 0.0506 as my dividend and the 10% discount rate . The valuation of this company is 0.506 using dividend discount model.

Disclaimer

If you like my analysis, please follow my social media: Facebook , Youtube , you can watch my analysis of Malakoff Corporation Berhad in a video format on Youtube.

This information is intended for educational purposes only. It shall not be understood or construed as, financial advice. It is very important to do your own analysis before making any decision

Hi, I am Lim Khai Woon. I passed CFA program in 2 years and achieved a distinction for my master degree in Finance, Investment and Risk from University of Kent .I was a senior investment analyst in a family office and a financial analyst in a physical commodity trading firm.

I will be providing an investment course for the participants who want to learn comprehensive fundamental investing. It is a 2 day training that will be conducted over the weekend that costs RM5,000. The course can be conducted in either English or Mandarin, but it will be taught separately. The date is not decided yet. The location will be held in Selangor/ Kuala Lumpur subject to availability of the training rooms . Other locations(e.g. Johor, Penang) can be considered if there are enough students interested to participate in the course.

If you are interested in learning the stock analysis from me , please fill up the google form.

https://docs.google.com/forms/d/19sr1vRPDctEmkN9Sx1bzjSDp6ff_XuypJHp7zJiGLlo/viewform?fbclid=IwAR2lN7hxdi9fYEovDp66h6XEHbDufW7_wJ1Nr-ScsmdH6fvMQ26wJkyTadQ&edit_requested=true

My email address is : investingiscommonsense@gmail.com

I am also providing the service of building the financial models for companies. If any company is interested, please fill up

or contact me by my email(investingiscommonsense@gmail.com).

https://docs.google.com/forms/d/1WLiYr4q8MRH6cu4mytyghaTaoPEDdF0jxHiT751Tsxg/edit

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on investment knowledge

Created by investingiscommonsen | Nov 14, 2023

Created by investingiscommonsen | Oct 23, 2023

.png)

Iwillbeback

Raymond Lim, I like your comment about all article the stocks.

Thanks for hard working for the sharing homework.

2024-01-10 05:54