Petronas Chemicals Group's RM 10billion investment in Perstorp is FUTILE

investingiscommonsen

Publish date: Mon, 23 Oct 2023, 09:24 AM

Hi, I am investingiscommonsense. I am going to discuss with you about Petronas Chemcials Group, especially the investment of RM10 billion in Perstorp in 2022, the result of the investment could be futile based on financial statement analysis of historical data , however, history is not an indicative of future performance, let’s see how Petronas Chemicals Group manages this company in the future.

Petronas Chemicals Group was listed in November 2010. It is the leader of integrated gas-based chemical producer in Malaysia and one of the largest in South East Asia with the production capacity of 15.4million TPA. It is one of the largest methanol ,urea, low density polyethylene and MTBE(methyl tert-butyl ether) producers in South East Asia. On Oct 15 2023, the company was the third largest company after Maybank and Public Bank in Malaysia with the market capitalization of 59.8 Billion. Petroliam Nasional Berhad(Petronas) is the largest shareholder with 64.35% of shares in the company. Petroliam Nasional Bhd's (Petronas) was ranked 216th in 2022 Fortune Global 500 with the total assets of approximately RM680billion.Petronas Chemicals Group’s biggest market is Malaysia that accounted for 30.3% in 2022, followed by Thailand at 12.7%, China at 11.5%, Indonesia at 10.6% and the rest of the world at 34.9%. The strategic locations of productions facilities enable the more efficient distribution of products to overseas markets. Petronas Chemicals Group can deliver the products to Thailand within 3 days, China within 6 days, Indonesia within 4 days compared to the competitors in Middle East and USA who spent more time for shipping due to smaller ships and higher frequency.The feedstock used by Petronas Chemicals Group are methane, ethane, propane, butane and naphtha to produce the products like methanol, ammonia, urea , ethylene, propylene, benzene, animal nutrition and silicones. 70% of our belongings are derived from petrochemicals. For example, fertilizers used to grow plants, credit card, hair wax, electronic equipments like laptop, toothpaste all contain petrochemical elements.

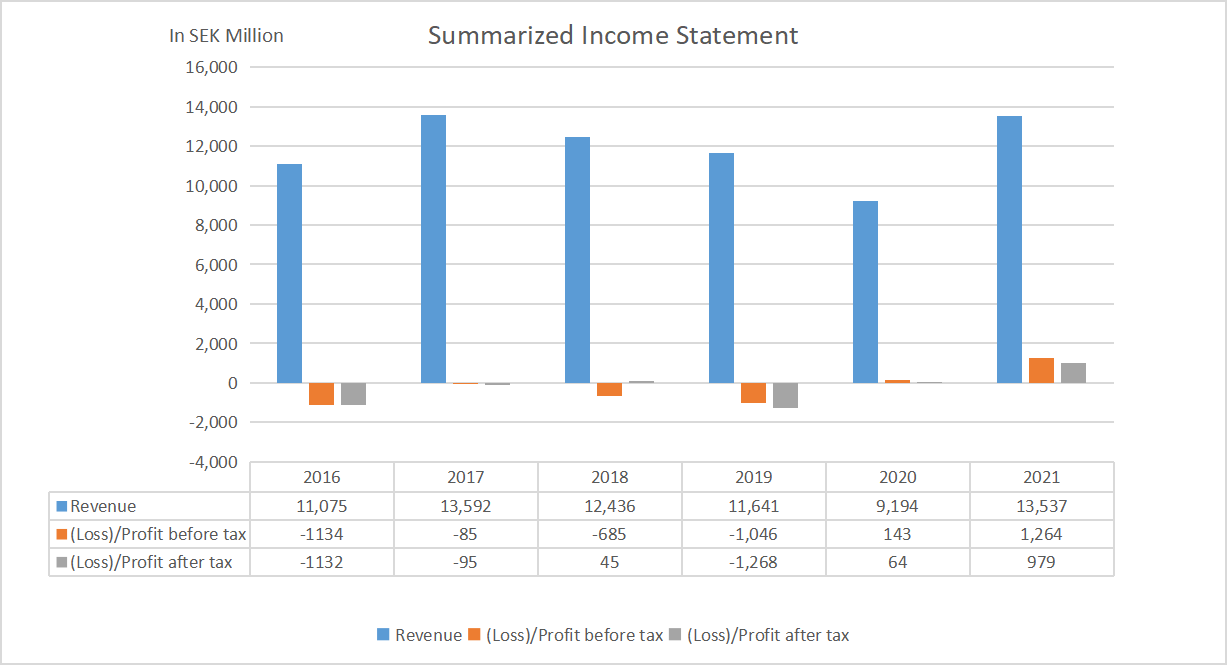

Above image is Perstorp's summarized financial statement

Petronas Chemicals Group ventured into specialties businesses to better hedge against market volatilities and less reliant on gas-related feedstock. In 2022, Petronas Chemicals Group acquired Perstorp Group, a niche specialty chemicals player for Resins & Coatings, Engineered Fluids, Animal Nutrition, and Advanced Materials; and a leading sustainability-driven global specialty chemicals company that enables Petronas Chemicals Group to move to the next growth journey in specialty area. Prestorp was purchased at the equity value of EUR 1.538billion with the price earning ratio of 16 based on FY2021 net income of EUR95.65 million using internally generated funds. In addition , Petronas Chemicals Group was required to pay all the existing net debt of EUR 762million. Therefore, if we added equity value of EUR 1.538billion and net debt of EUR762 million , the amount paid by Petronas for the acquisition of Perstorp was EUR 2.300billion, which represented enterprise multiple of 8.25 based on the Perstorp Group’s trailing twelve months EBITDA up to 31 March 2022 of EUR278.7 million. As at 31 December 2021, the cash and cash equivalents of Petronas Cheimcals Group and its subsidiaries stood at RM16.390 billion or EUR 3.592 billion. The acquisition represented 64% of the cash and cash equivalents in FY2021.As commented by Petronas Chemicals Group in the 2022 annual report, the rationale behind Perstorp acquisition was to hedge against market volatility and criticality. However, if we scrutinize the summarized income statement from 2016 to 2021, the company did not generate attractive net income. The company generated the net income of SEK979million in 2021 which was the best year out of 5 years. The company either suffered losses or generated minimal net income for the rest of the years. The acquisition cost was RM10.5billion or EUR 2.3billion, the investment could be futile. If we assume annualized EBITDA 1H2023 of the specialties segment entirely went to Perstorp, the EBITDA yield was only 2.52%, this is a very optimistic assumption given that there are other businesses in the specialties segment

In September 2019 Petronas Chemicals Group acquired another specialty company, Da Vinci Group (DVG),a leading independent producer and formulator of silicones, lube oil additives and chemicals at the purchase price of EUR163million.However, the acquisition cost was revised to EUR233 million in 2023 due to the exceptional financial performance achieved In FY2022 and realised an ebitda of EUR83 million, as a result of lower raw material and inventory costs, combined with strong market demand owing to supply chain disruptions and geopolitical conflicts.The earn-out portion of the purchase consideration has increased by EUR70 million resulting in the revised acquisition cost of EUR233 million. The acquisition is proven successful with the ebitda yield of 35.6%. The payback period is around 3 years without taking consideration into taxes and debts portions. What is an earnout? An earnout is a contractual provision stating that the seller can receive additional compensation based on performance. For example, if the company hits a 1 million operating profit, the seller can receive additional 5% shareholding. If the company hits a 2 million operating profit, the seller can receive additional 10% shareholding. However, in 1H(first half) 2023, the specialties division had an Ebitda margin of 3.78%, and net loss of 193million. If anyone is from Petronas Chemicals Group, can you answer that if there is a clawback clause? Clawback is a reverse earnout clause, the seller needs to bear the risk if the performance cannot be achieved. For example. The buyer needs to refund the purchase price if the company incurs a loss of 2million operating profit.

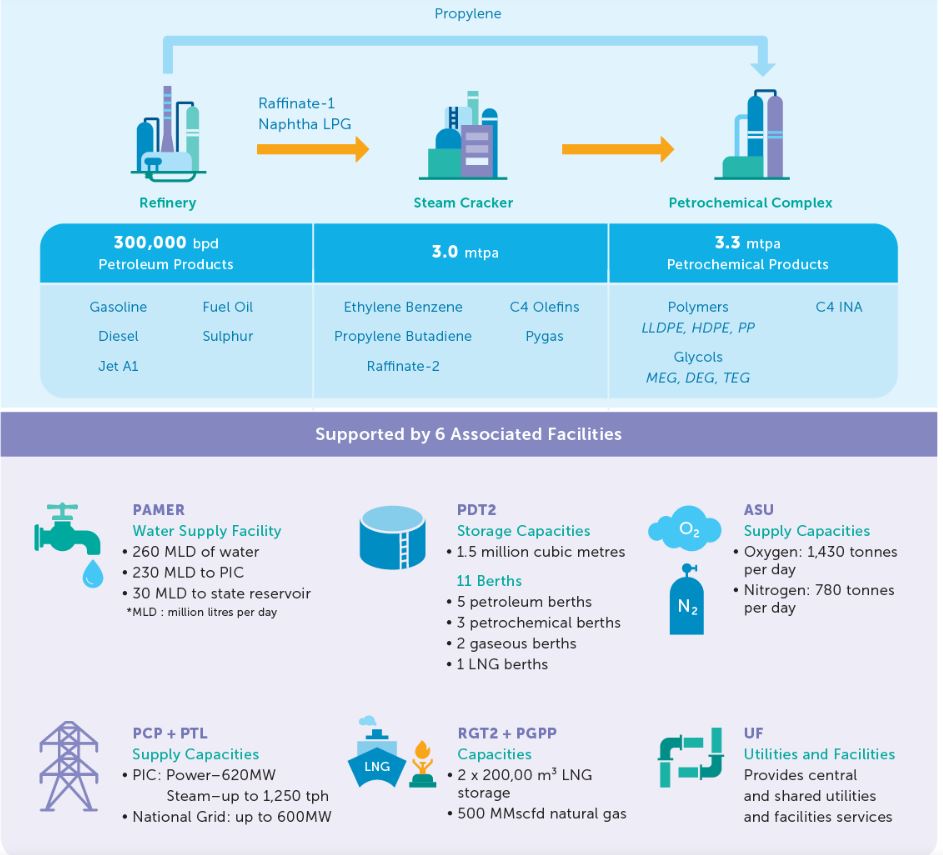

The company is supported by strong infrastructures that result in lower cost and high production flexibility. One of the best examples is Pengerang Integrated Complex which is ranked among the world’s best and is supported by associated facilities. The whole supply chain starts from feedstock to shipment. Saudi Aramco supplying 50 per cent of the refinery’s crude feedstock requirements with the option of increasing to 70 per cent.The refinery, which has a capacity of 300,000 barrels of crude per day, will produce a range of refined petroleum products and provide feedstock for the integrated petrochemical complex, with a nameplate capacity of 3.3 million mtpa. The supporting facilities like the Pengerang cogeneration plant fueled by natural gas and provides high reliability of supply at relatively low generation cost, supplying up to1,300 MW of electricity and 1,300 tph(ton per hour) of high pressure steam to PIC facilities, with 600 MW of power exported to the national grid. Pengerang Deepwater terminal 2 has a 1.5 million cubic metre storage capacity for petroleum products and a 200,000 cubic metre capacity for petrochemicals, PAMER supply approximately 230 million litres of raw water to Pengerang Integrated Complex and an additional 30 million litres daily supplements Johor state's existing water supply for public consumption, ASU(air separation unit) at Pengerang Integrated Complex, which has two separate trains producing Oxygen of 1,430 tonnes per day and Nitrogen of 780 tonnes per day .Centralised Utilities and Facilities supplies water, natural gas and critical services like industrial wastewater treatment, centralised maintenance and controls, as well as analytical and product development laboratory services for manufacturing processes within Pengerang Integrated Complex., The RGTP where the liquefied natural gas is received, stored and re-gassed,is used to power Pengerang integrated Complex's co-generation plant and also fed to the Peninsular Gas Utilisation (PGU) pipeline to boost the availability of gas in the country.The regasification unit has a capacity of approximately 500 million standard cubic feet per day (mmscfd) and is connected to the PGU via the 72-kilometre Pengerang Gas Pipeline (PGP).

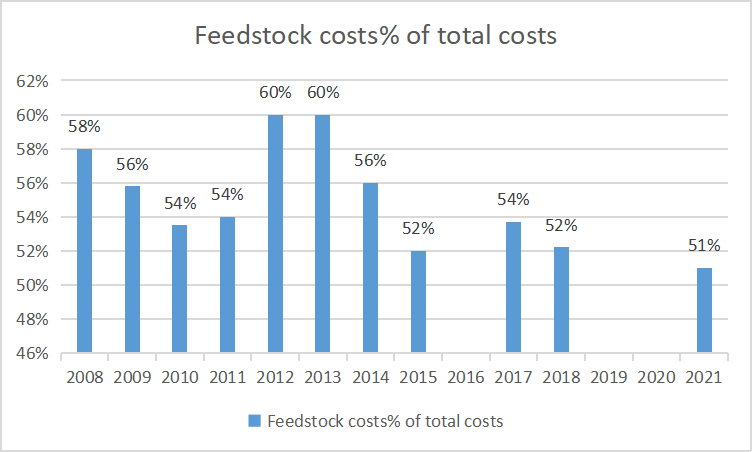

Feedstock is critical to the company’s success, without it , company cannot survive and proceed with production. Therefore, Petronas Chemicals Group commissioned a 3.5km ethylene transfer line, enabling the increase of export volume of ethylene that has helped to optimise the production of ethylene at PC Olefin which allow ethylene crackers to receive its highest amount of ethane feedstock supply and translated into Petronas Chemicals Group’s highest ethylene production volume. Feedstock costs carry the highest weight in the company’s cost of revenue, the 10 years average feedstock cost is 55% of the company’s total cost. Petroliam National Group is a major supplier of raw materials such as methane, ethane , propane, butane and heavy naphtha , and at times, the sole supplier. Petroliam National Group(Petronas) has been offering reliable supply and attractively priced feedstock to Petronas Chemicals Group to ensure the sustainability of the business. For example, Petronas Chemicals Group has renewed one of the ethane supply agreement within Petroliam National Group and Petronas Chemicals Group via its wholly owned subsidiary PETRONAS Chemicals Marketing Labuan for further 20 years effective October 1, 2016. The key terms and conditions of this ethane supply agreement will maintain PCG competitiveness against other players. Another ethane contract has been extended from July 1, 2023 on the same terms and conditions in the current contract for a minimum of six months.The long term contracts signed between Petroliam National Group(Petronas) and Petronas Chemicals Group Berhad ensure the fixed supply of feedstock for Petronas Chemicals Group, but in some situations they would cause a negative impact to Petronas Chemicals Group. According to the company guide, Petronas Chemicals Group written by Alliance DBS Research on May 12 2020, it concluded that the oil price crashes would lead to a negative impact on Petronas Chemicals’ bottom line. At that time, WTI(FUTURES FOR US CRUDE OIL ) dropped to -38dollar per barrel owing to Covid 19 and oversupply of oil. “Petronas Chemicals Group’s fixed ethane supply contract with Petronas offers Petronas Chemicals Group a stable supply of ethane feedstock at a competitive price. However, it will not bode well for the company now due to the steep fall in oil prices. Most naphtha-based players would be able to enjoy improved margins. This is because the fall in naphtha prices has exceeded the fall in overall product prices. On the other hand, Petronas Chemicals Group would have to bear the costs of natural gas price determined before oil prices crashed.”

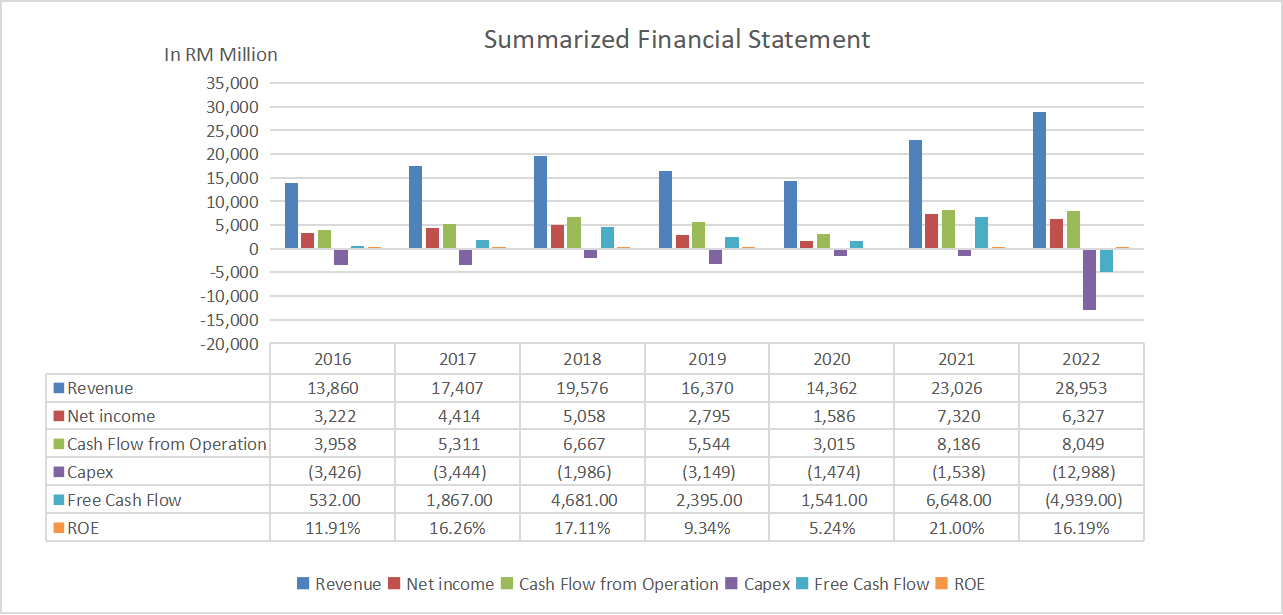

Petronas Chemicals Group’s revenue grew from RM13.86 billion in 2016 to RM28.95 billion in 2022 at a CAGR of 13.06%, net income grew from RM3.22 billion to RM6.322 billion at a CAGR of 11.89% during the same period. Over the years, the quality of earnings is good as the company did not have working capital issue, and able to generate cash flow from operation to spend money on capex, thus the company was still able to produce free cash flow. In the 7 year period, the company was able to generate free cash flow every year, on average RM1.8billlion a year, except for the year 2022 due to acquisition of Perstorp that cost around RM10billion. Thus, in 2022 free cash flow was negative RM4.939 billion. The company has no issue in repaying the loan since it is in a net cash position, around RM6.2 billion net cash in 1H 2023. The company can satisfy shareholders with its double digit ROE for most of the years, an average 13.86% ROE for the 7 year period. The company recorded 5.24% ROE in 2020 due to low net income of RM1.586billion on the back of covid 19 and oil oversupply leading to the crash in oil prices impacting the petrochemical industry.

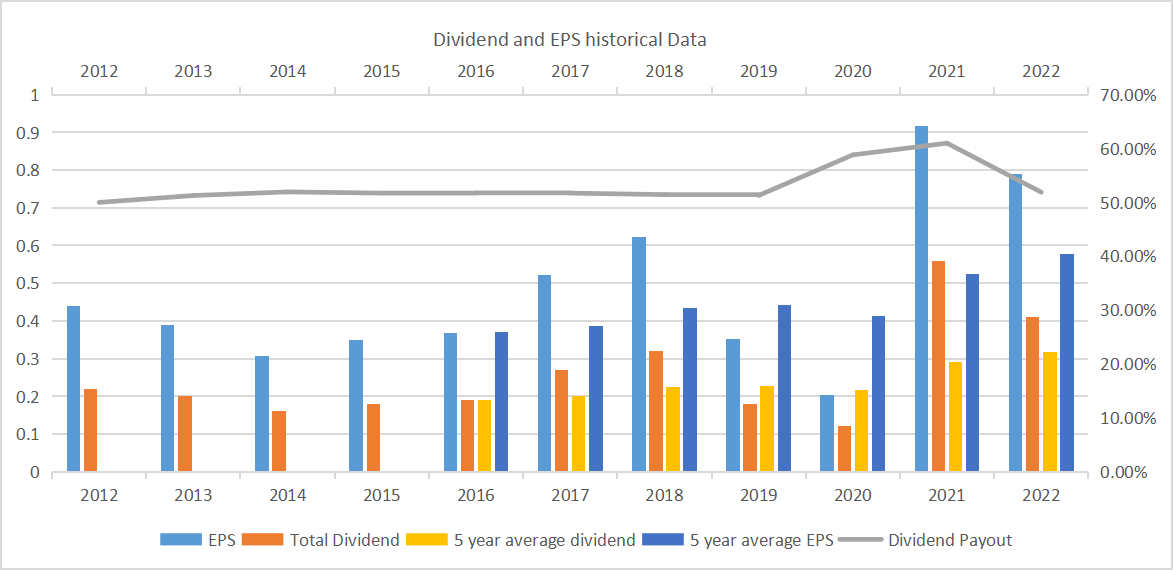

Petronas Chemicals Group targets a dividend payout of 50%. If you look at the historical data, every year the company had at least a payout ratio of 50%. On average, the company paid 53% of its earnings per share to the shareholder in the forms of dividend. If you purchased a stock at the closing price of 7.06 on Jan 04 2016, and the 5 year average dividend yield would be 5.25% in 2016 and increased to 8.17% in 2022. The CAGR of 5 year average dividend was 8.96%. 5 year average dividend was growing from 0.19 in 2016 0.32 in 2022, which is more attractive compared to Malaysia’s inflation rate of around 3 to 4 percent a year. The reason why dividend yield is increasing is due to the company’s 5 year average Earnings per share growing at the 7.66% per annum.

Moving forward,,Petronas Chemicals Group has different projects in the pipeline. First, building Asia’s largest advanced chemical that will use Plastic Energy’s patented technology to convert end-of-life plastics into pyrolysis oil, which can be used for the creation of recycled plastics,targeted to be operational by first half of 2026. Second,acquire the 113 ktpa(kilo tonnes per annum) Maleic Anhydride (MAn) that will broaden Petronas Chemicals Group ’s product portfolio and its derivatives. Petronas Chemicas Group will upgrade and rejuvenate the facilities to produce refined Maleic Anhydride , targeted to be ready by second half of 2025. Third, buildinga melamine plant with a capacity of 60,000 tpa(tonne per annum), Petronas Chemicals Group will be the sole melamine producer in South East Asia, targeted to be operational in 2024.Fourth ,an expansion of the 2-Ethylhexanoic Acid plant that will increase capacity from 30,000 to 60,000 metric tonnes by 2024. Fifth, commission Perstorp Group’s investment in Pentaerythritol (Penta) plant in Sayakha, India by the second quarter of 2023. That’s it for Petroans Chemicals Group.

If you like my analysis, please follow my social media: Facebook , Youtube , you can watch my analysis of Petronas Chemicals Group in a video format on youtube.

Disclaimer

This information is intended for educational purposes only. It shall not be understood or construed as, financial advice. It is very important to do your own analysis before making any decision

Hi, I am Lim Khai Woon. I passed CFA program in 2 years and achieved a distinction for my master degree in Finance, Investment and Risk from University of Kent .I was a senior investment analyst in a family office and a financial analyst in a physical commodity trading firm.

I will be providing an investment course for the participants who want to learn comprehensive fundamental investing. It is a 2 day training that will be conducted over the weekend that costs RM5,000. The course can be conducted in either English or Mandarin, but it will be taught separately. The date is not decided yet. The location will be held in Selangor/ Kuala Lumpur subject to availability of the training rooms . Other locations(e.g. Johor, Penang) can be considered if there are enough students interested to participate in the course.

If you are interested in learning the stock analysis from me , please fill up the google form.

https://docs.google.com/forms/d/19sr1vRPDctEmkN9Sx1bzjSDp6ff_XuypJHp7zJiGLlo/viewform?fbclid=IwAR2lN7hxdi9fYEovDp66h6XEHbDufW7_wJ1Nr-ScsmdH6fvMQ26wJkyTadQ&edit_requested=true

My email address is : investingiscommonsense@gmail.com

I am also providing the service of building the financial models for companies. If any company is interested, please fill up

or contact me by my email(investingiscommonsense@gmail.com).

https://docs.google.com/forms/d/1WLiYr4q8MRH6cu4mytyghaTaoPEDdF0jxHiT751Tsxg/edit

Sources

1: Perstorp Annual Reports

2: Annual Reports of Petronas Chemicals Group

3: Annual General Meeting

4: Quarterly Reports

5: Company Website

6: Bursa Malaysia

7: Research Report from AllianceDBS Research , source: Company Guide

Petronas Chemicals, 12 May 2020

8: Trading Economics

9: Analyst briefing

10: Others

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on investment knowledge

Created by investingiscommonsen | Nov 14, 2023

Discussions

Comprehensive fundamental investing.

Will people listen?

Only in Malaysia a PN17 company like capA third request to postpone submitting PN17 regularisation plan to 31/12/2023.

As at 30/6/23:

Net current liabilities of RM (11,938,731,000)

Shareholders' equity RM (8,390,820,000)

Total equity RM (10,304,487,000)

And can't make money flying people:

Revenue/ASK: Q2 USD 4.22 cents cumulative 6 months USD 4.28 cents

Cost/ASK: Q2 USD 5.01 cents cumulative 6 months USD 4.72 cents

Cost/ASK ex fuel: Q2 USD 3.32 cents cumulative 6 months USD 2.95 cents

But retail investors or maybe equity fund managers (icap TTB) still holding or buying capA.

Market Cap: 3,519 Million

NOSH: 4,214 Million

Avg Volume (4 weeks): 11,603,847

4 Weeks Range: 0.80 - 1.01

4 Weeks Price Volatility (%): 16.67%

52 Weeks Range: 0.56 - 1.12

52 Weeks Price Volatility (%): 49.11%

2023-10-25 10:33

By the way Petronas Chemicals Group's RM 10billion investment in Perstorp (foreign currency assets) already contributed to Foreign currency translation differences accounting book gain of RM 920 million in Q2 end 30/6/2023

2023-10-25 10:46

And capA USD borrowing, lease liabilities, maintenance and etc already contributed to Foreign currency translation differences accounting book lose of RM (1,576,850,000) as at Q2 end 30/6/2023

2023-10-25 11:02

Philip ( buy what you understand)

It is interesting how people are very eloquent when it comes to stock analysis but very suspiciously quiet when it comes to stock performance

2023-10-25 14:37

While your research has depth, I rather you start a managed fund to invest for people who may trust you. For me, your research may be good, but time is the essence here. It will take time to build your name plus full transparency and integrity. Just my 2 cents...

All the best

2023-10-25 14:45

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$â¬Â£Â¥

Lim Khai Woon, welcome.

2023-10-25 18:02

Philip ( buy what you understand)

May I have your track record history of stock pick selection from your latest managed fund sir? I would love to attend but would like to know your track record in these matters in terms of stock selection.

>>>>>>

I will be providing an investment course for the participants who want to learn comprehensive fundamental investing. It is a 2 day training that will be conducted over the weekend that costs RM5,000.

2023-10-24 11:48