Part 1 :Mega First Corporation Berhad is FULLY valued

investingiscommonsen

Publish date: Tue, 14 Nov 2023, 07:42 AM

Hi, I am investingiscommonsense. I am going to discuss with you about Mega First Corporation Berhad , a fully valued company based on my assumptions on 13 November 2023 at the share price of RM3.50. My opinion is different from mainstream opinions who think that this company is undervalued. The Ambank analyst gives the fair value at RM4.45, Public Investment Bank at RM4.75, Maybank at RM4.30 However, my valuation is not a buy or sell call, it is a demonstration of how I build the financial model and determine the valuation while analyzing a company. Please do your homework while buying a company. Assumptions are important while building a financial model, rubbish in, rubbish out. To get more accurate assumptions, we need to get the answers from MFCB.

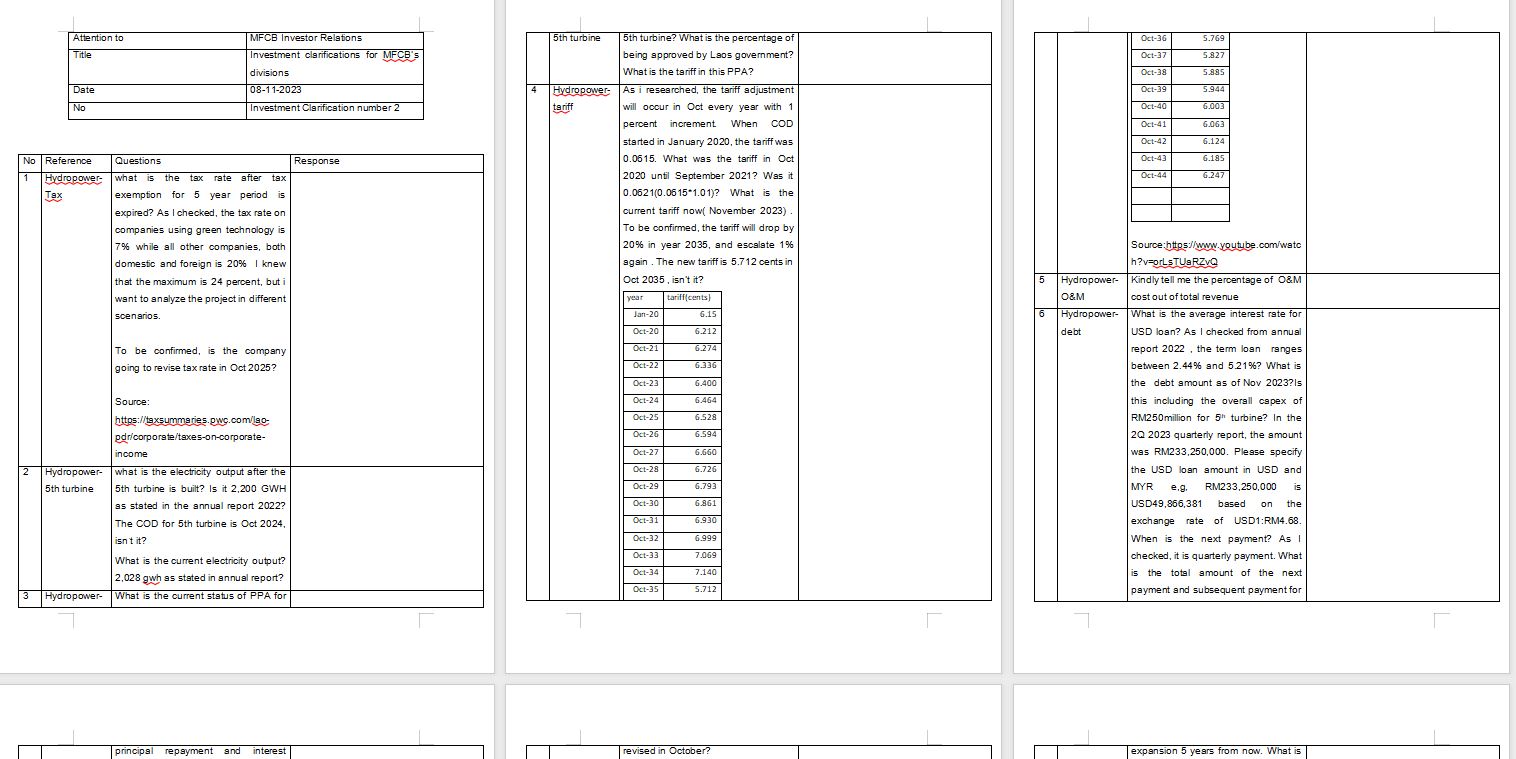

Investment clarifications

I had sent investment clarifications to the Investor Relations in MFCB, if there is any update, I will keep you posted.

MFCB’s businesses include hydropower, solar power, packaging, resources, oleochemical and plantation.

Assumptions

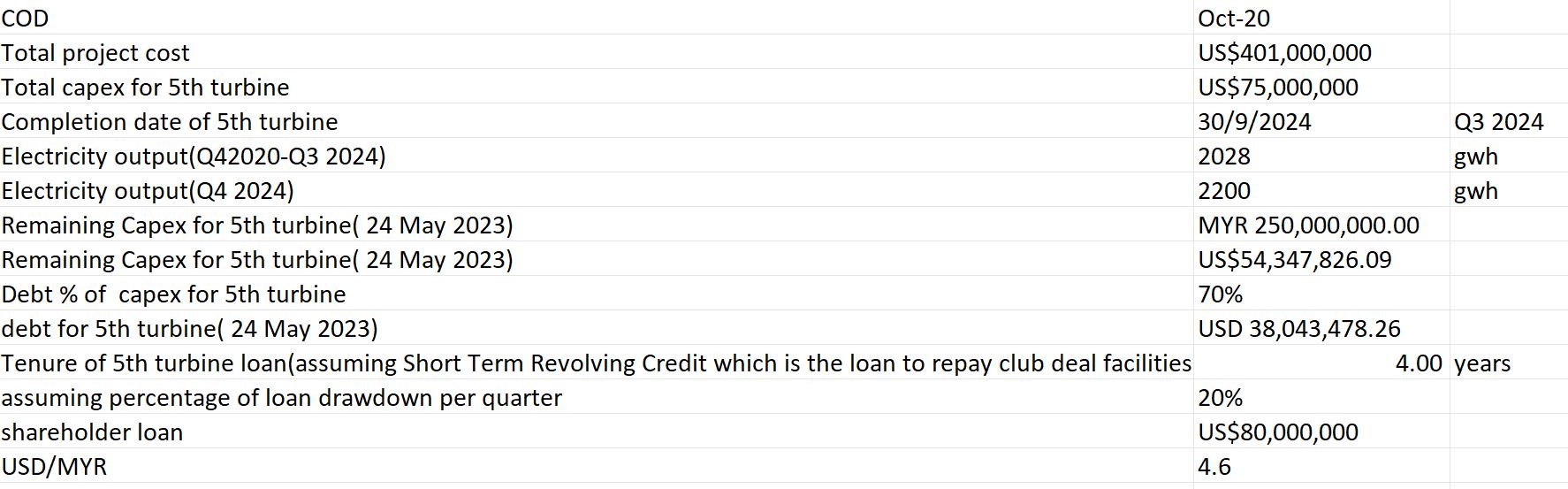

The 260MW Don Sahong Hydropower Project(DSHP) in Laos has commenced on 1 October 2020 and the total electricity generation is around 2,000GWh per annum. The total project cost is USD 401million. From 2025 to 2028, one unit of turbine will be out of service for four months each year, therefore, the company is building the 5th turbine that costs around USD75million and is expected to be completed on the third quarter of 2024. The construction of the 5th turbine will ensure MFCB will be able to deliver sufficient energy to its customer, Electricite du Laos which is like Tenaga in Malaysia. Electricite du Laos will resell the energy to Électricité du Cambodge in Cambodia.The total capacity of the hydropower project is 325MW when this expansion project is completed and total energy generation is expected to be approximately 2,200 GWh per annum. On May 2023, the remaining capex for the construction of the 5th turbine was RM 250million or USD 54.35million at the exchange rate of USD 1:MYR4.6. I am assuming the remaining capex for this project will be funded by new loan with the 70:30 debt to equity ratio for 4 years which is similar to the duration for short term revolving credit facilities, the percentage of the loan drawdown will be 20% per quarter, the loan moratorium period will be finished in Q3 2024 once the full drawdown of the loan occurred at this stage. Interest rate is 7.77% which is based on 5.32% secured overnight financing rate on 7th November 2023 which is a benchmark interest rate for dollar-denominated loans plus 2.45% margin, payable on a quarterly basis .

Debt repayment schedule

For your information, when I mentioned about loan moratorium, I meant that moratorium for principal repayment only, but has no interest repayment. Apart from that, In the results briefing for Q2 2023, the current loan which is a shareholder loan for renewable energy division was USD 80million, I am assuming all this amount was granted for the hydropower project. The structure of the interest rate for the shareholder loan is as same as the 5th turbine loan .The principal repayment for both loans is assumed to be practiced on the straight line method.

Assumptions

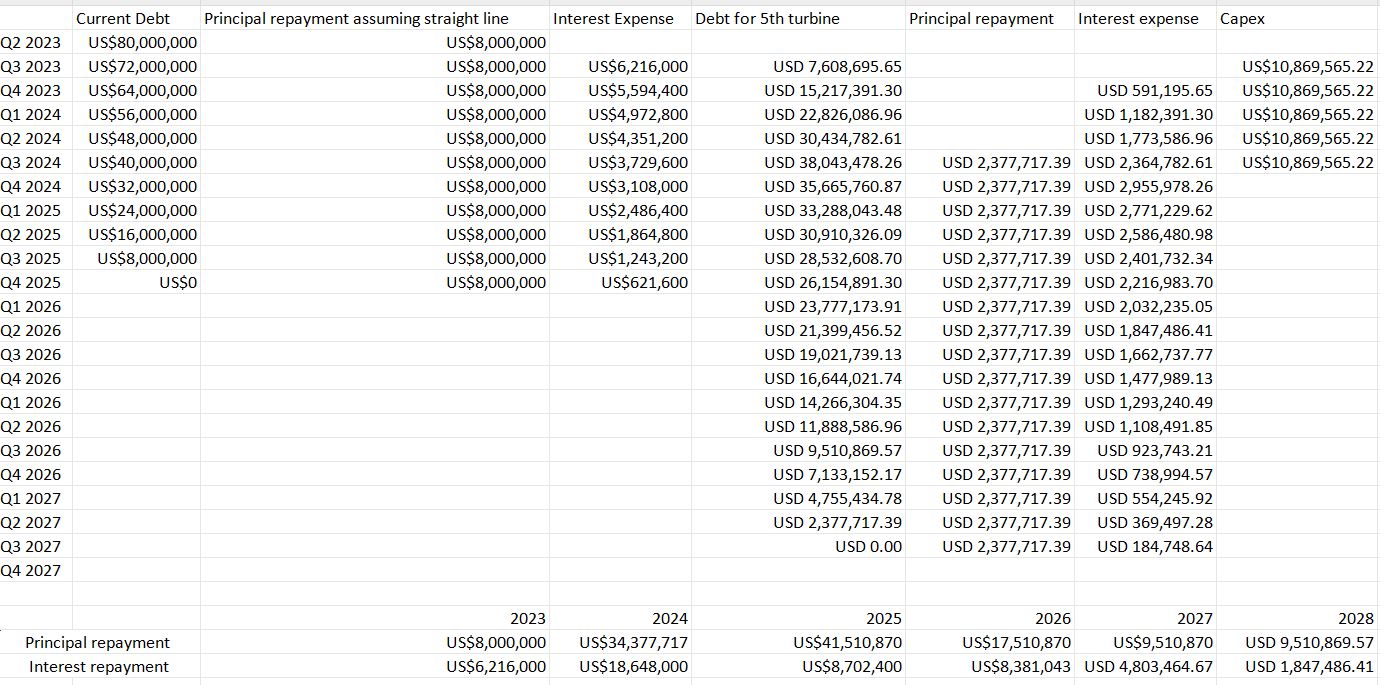

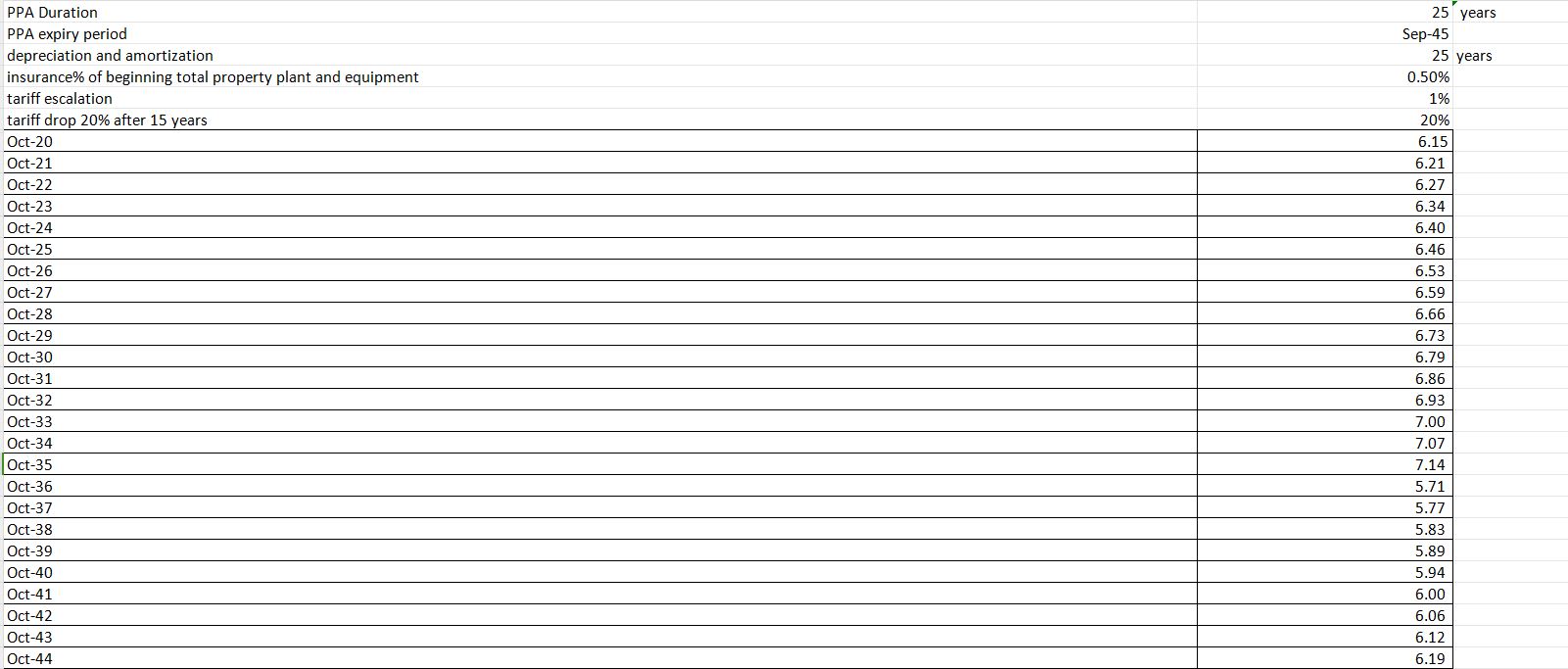

According to the concession agreement, the duration of this project is 25 years .The depreciation and amortization that I am using is straight line method for 25 years or 4% a year which is in accordance with their accounting policy, and I have assumed depreciation and amortization is tax deductible. Insurance premium is 0.5% of the beginning total property , plant and equipment a year. The tariff of this project started at 6.15 cents and escalation is 1% per year on the compounding basis until 15 years, the tariff will drop 20% and escalate again 1% per year. Meaning to say, from October 2020 to September 2021 the tariff was 6.15 cents, from October 2021 to September 2022 was 6.21 cents, from October 2022 to September 2023 was 6.27cents, from October 2036 to September 2037 the tariff will be 5.712 cents, a drop of 20% from 7.14 cents in September 2036. Then the tariff will increase 1 percent a year starts from October 2037.

The project is given tax exemptions for 5 years since Commercial Operation Date. The company will start to pay corporate income tax rate in Laos in October 2025. The tax rate is a lower of 24 percent or the prevailing tax rate which is 20% . I am assuming 24%in my financial model as the worst case scenario and the average corporate tax rate was 25.67% from 2009 to 2023. Also, I am curious, Mega First Corporation Berhad, since you are using green technology, why are you not paying 7% instead paying corporate income tax rate of 20?(Source: PWC) In addition to that, the withholding tax of 5 % will be charged on the dividends paid by a Laos company that owned by 10% or more by a Malaysian shareholder under the Double tax treaty agreement. Therefore, in my assumption, I put a 5% withholding tax rate on the free cash flow to equity after the end of tax free status in 2025 since MFCB owns 80% of shareholding in the Laos hydropower project and MFCB will repatriate the free cash flow in the form of dividend. MFCB needs to pay 5% of revenue to the government as a royalty in the first 10 years, 15% in the next 10 years, 30% in the last 5 years. MFCB made a commitment to contribute USD1 million to the Laos Government every year. I am assuming this will be paid every September. On average, the receivables collection period is 5.85 months, I am using 5.85 months for the financial model to calculate account receivables . However, i do not calculate changes in inventories and payable because I do not have data for it, therefore I assume all purchase is cash expense.

The discount rate or cost of equity in this case is 10% based on the different factors like the risk profiles. This project carries a foreign exchange risk. In 2022 the 6.2% appreciation of the US Dollar against Malaysia Ringgit increased 11.8% and 8.8% in revenue and profit before tax in the renewable energy division of which the majority made up by the hydropower project. Another risks are weather risk and project risk. In 1H2023, the sales volume was 6.7% lower than the corresponding period. The decline in energy volume was due to scheduled turbine maintenance in 1Q 2023 and sub-normal dry season in 2Q2023 as compared to high water level in the corresponding quarter .The hydropower project also carries a single customer risk. MFCB sells energy to Electricite du Laos which resells energy to Électricité du Cambodge. The ultimate and only buyer is Électricité du Cambodge.

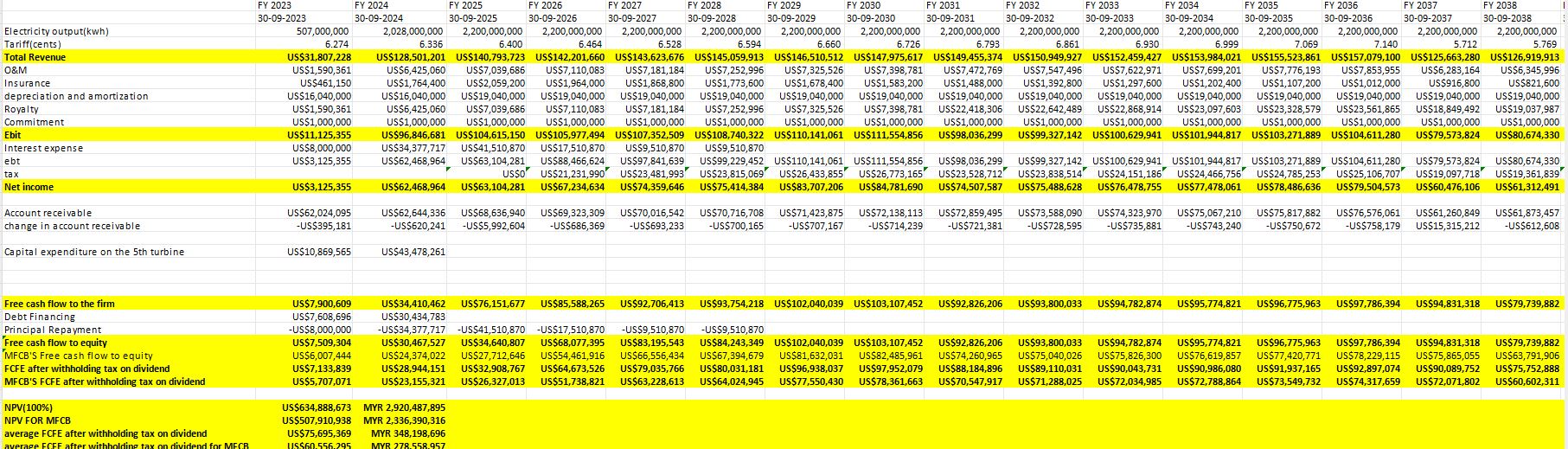

Cash flow of the hydropower project

Now, let us see the cash flow capacity of this hydropower project. I am assuming the financial year end is in 30th September because the COD was started on 1 October 2020. As you can see, on 30 September 2023 all the numbers are smaller because I am assuming 3 months left from 30 June 2023 , electricity output for only 3 months, operation and maintenance for only 3 months and etc. I am practicing this way because the latest data about the company is from 2Q 2023 Quarterly Report. As you can see, there are net income, free cash flow to the firm and free cash flow to equity. Free cash flow to the firm is adjusted after non cash expense like depreciation ,capex and changes in working capital. Free cash flow to equity is free cash flow to the firm minus principal repayment. As you can see in the financial model, the net income is increasing every year because there is an increase of tariff, and a decrease of insurance premium. Every year there is wear and tear of concession assets, and hence MFCB pays lesser amount of insurance premium. From FY 2025 to FY 2026 onwards and FY 2028 to FY 2029 onwards, there are substantial increases in net income, free cash flow to the firm and free cash flow to equity because MFCB has fully repaid the shareholder loan in FY2025 and the 5th turbine loan in FY 2028. From FY2037 onwards, the net income , free cash flow to equity and free cash flow to the firm decrease substantially because the tariff drops by 20%. This projects incurs an average free cash flow to equity after withholding tax on dividend of USD 76milion a year, or MYR 348million at the exchange rate of USD1:MYR4.6. Therefore, the valuation of this project is USD 635million or MYR 2.92billion at the cost of equity of 10%. However, for MFCB the free cash flow to equity after withholding tax on dividend that it incurs is around USD 60million a year or RM279million, the valuation is USD508 million or MYR2.34billion or RM2.47 per share after taking into consideration 80% ownership by MFCB on 30 June 2023. Therefore, the future value of this project for MFCB on 13 November 2023 is RM2.56 with the discount rate of 10%. Mind you , the valuation in MYR is subject to change because there is currency fluctuation between MYR and USD.

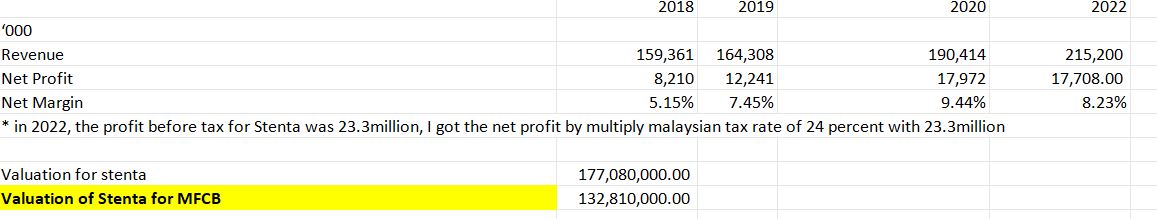

The company’s packaging division is performed by two subsidiaries, Hexachase and Stenta . In 2021, MFCB is acquiring 75% of Stenta for RM153.75 million in cash. The minority shareholders were granted put options to sell their shares at the end of the third and fifth anniversaries. The company was purchased at the valuation of 11.4 Price to earnings ratio , 7 enterprise multiple ratio, 2 price to book value ratio. Stenta produces flexible packaging film like Biaxially Oriented Polypropylene Film (BOPP) and Linear Low Density Polyethylene films (LLDPE) in Malaysia.Stenta has a 5 year plan that will increase the production output from 10,000 MT to 45,000 MT per annum. Currently, its products are exported mainly to Asia, Middle East, Africa, South America and Europe.

Financial information of Stenta

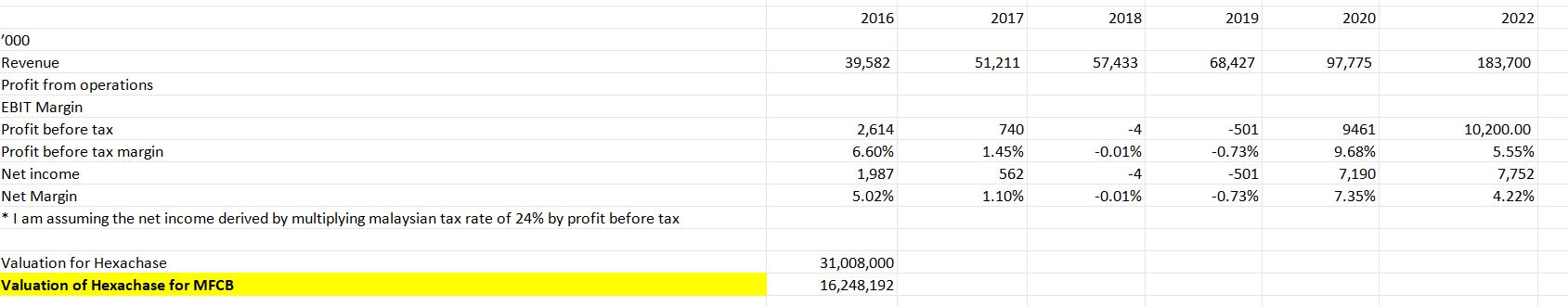

From 2018 to 2022, Stenta’s net margin ranged from 5.15% and 10.83%, revenue and net income increased from RM159million and RM8.2million in 2018 to RM 215million and RM18milion in 2022 at the CAGR of 11% and 29% respectively. Therefore, I am assigning the PE ratio of 10 which is similar to the Median PE ratio for packaging industry(Source: Isaham). The valuation of Stenta is RM133million based on 10 times 2022 net income at the 75% ownership. MFCB owns 52.4% of Hexacase which manufactures paper bags, labels and stickers, flexible packaging materials in both roll forms and pre-made pouches, for food and FMCG (fast-moving consumer goods) products. Hexachase Flexipack is constructing a new double-storey warehousing and production site in Malacca and is expected to be completed in the first half of 2024 that will bring the capacity to 30,000MT per annum from 10,000MT.

Financial information of Hexachase

Hexachase Packaging is constructing a new double storey factory warehouse due to be completed by the end of 2023 and the capacity of self opening sack bag machines will be added and boosted by additional 240MT to its existing 270MT capacity in 2022. Hexachase ’s net margin was very volatile, ranging from -0.73% and 7.35% from 2016 to 2022. Due to this reason, I am assigning a PE ratio of 4, which is the average PE ratio of TomyPak’s 2.1 and KYM’s 5.9. The valuation of Hexachase is RM16million based on 4 times 2022 net income at the 52.4% ownership.

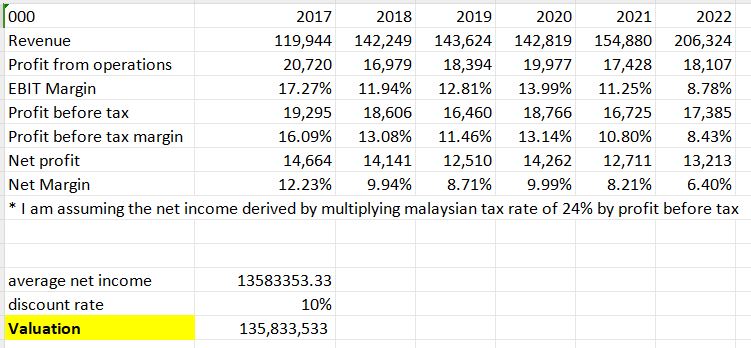

Financial information of Resources

Resources Division is mainly involved in the quarrying of limestone and the manufacturing of lime products such as quicklime, hydrated lime and quicklime powder.It is the largest commercial quicklime producer in Malaysia with abundant amount of reserves to last for at least another 100 years. MFCB is confident with the sustainability of the business as there is simply no substitute to limestone, which has been used for centuries mainly in construction ,agriculture, and manufacturing, The functions of limestone are increasing soil PH and improving crop yields, serving as a base for roads, buildings ,reducing the levels of hazardous chemicals present in the water. Although the divisions’s revenue grew at a CAGR of 11% from RM120million in 2017 to RM206million in 2022, profit before tax and net income declined at a CAGR of 2% from RM19million and RM14milion to RM17million and RM13million respectively during the same period. For this division, the valuation is RM135million based on an average 5 year net income of RM13.5million and a discount rate of 10%. It is a wholly owned subsidiary of MFCB, so for MFCB the valuation is RM135million.

In 2021,Edenor Technology, a 50:50 JV between MFCB and 9M Technology Sdn Bhd was set up to acquire Emery’s Asia Pacific oleochemical business from Sime Darby Plantation Berhad and PTT GC International Limited that produces both basic oleo products and specialty chemicals which are used in cosmetic, pharmaceuticals and home care products. Emery’s book value was RM430million in 0ct 2021 but It was initially purchased by Edenor Technology at the equity value of RM38million, of which RM20million contributed by MFCB and the enterprise value of RM243million. Post EY review, the equity value was revised downward to RM12.6million. From 2019 to 2020, the estimated loss was RM70million to RM75million. Emery was purchased at a cheap valuation compared to the book value because it was a loss making company. In 2022, MFCB’s share loss of this joint venture was RM1.2million and RM5.8million in 1H2023. The valuation of Edenor Technology for MFCB is RM158million which is based on 50% of the 2022 net asset of RM315million . This division is being upgraded in 3Q2023. The division currently has the integrated capacity of 300,000-tonne per annum

MFCB is developing a coconut and macadamia plantation in Cambodia on a plot of concession land measuring 6,420 hectares with a 50 year concession period commencing from 29 April 2013. The plantable area is 4000-4500 hectares and cumulative area planted as at 30 June 2023 was about 2,500hectares. Target to complete planting by end of 2025 to 2026, MFCB expects this division will contribute in earnings after 2026. The cumulative investment as at 30 June 2023 was RM127 mil (including land cost). Therefore, valuation for this divisions is RM127million with 100% ownerhsip

As at 30 June 2023, a total of 20.5 MWp commercial and industrial solar projects have been completed and energised. Assuming 1MWp is around RM2.5million, 20.5MWp costs RM51.25million. Assuming 30% of the project cost was funded by equity, the equity contribution by MFCB was RM15million which is the valuation for Solar division. It is a very simplistic way to value this division, the most appropriate way is to calculate NPV of this project as I did for the hydropower project. Moving forward, 10.8 MW of Commercial and industrial solar power projects to be progressively energised over the next 12 months. 11.4 MW solar farm project in Maldives will be completed in 3Q2024 and 46.5 MW solar farm project in Malaysia under the Corporate Green Power Programme of the Energy Commission, expected to achieve commercial operation in 2025.

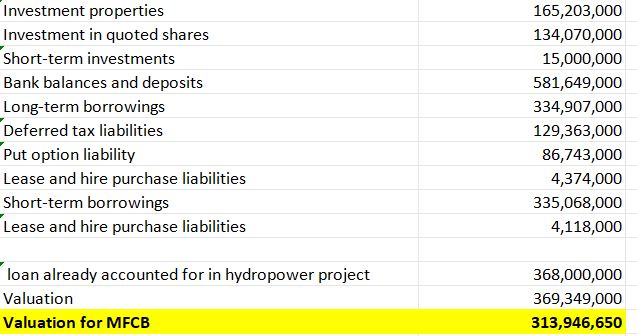

Valuation of Non net operating assts

To calculate non operating assets and liabilities, I assume MFCB own 85% of the balance sheet due to the average of 15% of total equity was attributable to non controlling interest in 2021 and 2022. I minus RM368,000,000 from the total of short term borrowings and long term borrowings of RM669,975,000because it has already been computed in my hydropower valuation. Therefore, the valuation for net non operating assets for MFCB is RM369,349,000

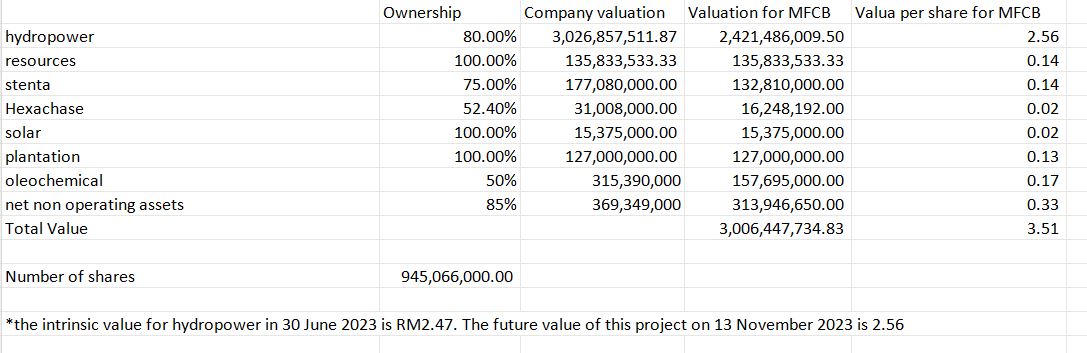

MFCB' intrinsic value worth RM3.51 based on the sum of the parts valuation

Let’ us do the sum of the parts valuation for MFCB. In 1H2023, the number of shares was 945,066,000. Therefore, the intrinsic value per share for MFCB for hydropower, resources, packaging, solar, plantation, oloechemical, net non operating assets are RM2.56, RM0.14, RM0.16, RM0.02, RM0.13, RM0.17, RM0.33 respectively. In conclusion , MFCB is worth RM3.51 based on sum of the parts valuation.

If you like my analysis, please follow my social media: Facebook , Youtube , you can watch my analysis of Mega First Corporation Berhad in a video format on Youtube.

Disclaimer

This information is intended for educational purposes only. It shall not be understood or construed as, financial advice. It is very important to do your own analysis before making any decision

Sources:

1: PWC

2" Annual Reports of MFCB

3: Annual General Meeting

4: Quarterly Reports

5: Company Website

6: Bursa Malaysia

7: Isaham.com

8: Public investment bank analyst reports, Ambank analyst reports, Maybank analyst reports

9: Results briefing

10: Others

Hi, I am Lim Khai Woon. I passed CFA program in 2 years and achieved a distinction for my master degree in Finance, Investment and Risk from University of Kent .I was a senior investment analyst in a family office and a financial analyst in a physical commodity trading firm.

I will be providing an investment course for the participants who want to learn comprehensive fundamental investing. It is a 2 day training that will be conducted over the weekend that costs RM5,000. The course can be conducted in either English or Mandarin, but it will be taught separately. The date is not decided yet. The location will be held in Selangor/ Kuala Lumpur subject to availability of the training rooms . Other locations(e.g. Johor, Penang) can be considered if there are enough students interested to participate in the course.

If you are interested in learning the stock analysis from me , please fill up the google form.

https://docs.google.com/forms/d/19sr1vRPDctEmkN9Sx1bzjSDp6ff_XuypJHp7zJiGLlo/viewform?fbclid=IwAR2lN7hxdi9fYEovDp66h6XEHbDufW7_wJ1Nr-ScsmdH6fvMQ26wJkyTadQ&edit_requested=true

My email address is : investingiscommonsense@gmail.com

I am also providing the service of building the financial models for the companies. If any company is interested, please contact me by my email(investingiscommonsense@gmail.com).

More articles on investment knowledge

Created by investingiscommonsen | Oct 23, 2023

BLee

Hi, Mr KW Lim, I find your article very thorough, except not touching so much on past performance (CAGR over 10 year period and almost twice dividend payout per year). Also not forgetting, the power generation from the 260MW Don Sahong Hydropower (DSH) is by Run-of-river hydroelectricity (ROR) technology is very much different from having a dam which is more capital intensive, less reliable due to single point vs multipoint for ROR, not so efficient in energy distribution as ROR in this case going to be at 5 different locations and a single dam needs a larger storage area.

MFCB is having a good meteoric rise this year. Few days ago, I did a calc for Insas' CAGR, also checked on MFCB over a 10 year period. The results are much better than Insas. Will find time to post the results, maybe over the coming weekend. Meanwhile, maybe you can also do a calc based on your assumption, different from my assumption of dividend reinvestment.

Happy Trading and TradeAtYourOwnRisk.

2024-04-03 13:01